Dynamics Business Central - Inventory Pt. 4 - Expected Cost Posting functionality

Hi Readers,

Find the links to Part 1 & 2 below

Part 1 - Pt.1 - Link - Inventory Posting

Part 2 - Pt. 2 - Link - Inventory Financial Transactions

Part 3 Pt 3. Adjust Cost

In our final Part 4, we look at Expected Costing Functionality of Business Central.

In Part 1, i mentioned that if an item is received and not invoiced, there is no financial effect on the general ledger.

However, some organizations usually like to know the financial value of Goods Received but not Invoiced or Goods Shipped but not invoiced in their books if they regularly have differences in timing between receipting and invoicing.

As per Microsoft explanation , Expected costs represent the estimation of, for example, a purchased item's cost that you record before you receive the invoice for the item.

How does Business Central support this?

Expected Cost Posting to G/L Functionality

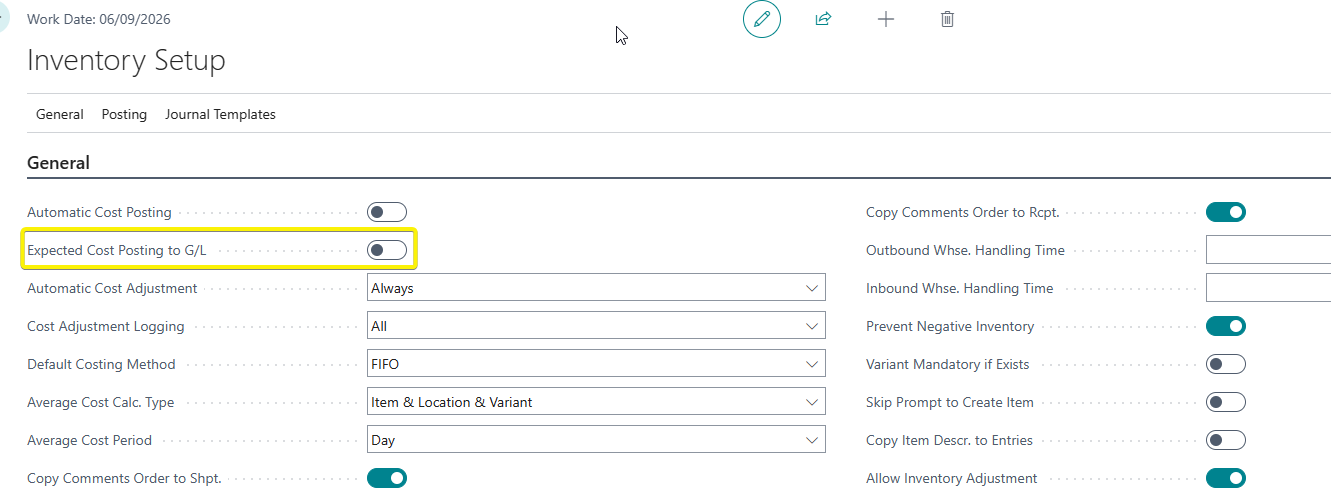

In the inventory setup, there is a setup called Expected Cost Posting to G/L. The setup should be turned on.

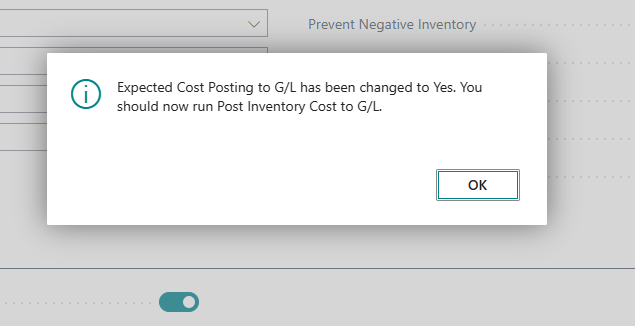

On enabling, it runs checking for any entries to adjust and displays message below.

Lets go through a purchase process with this checkbox enabled.

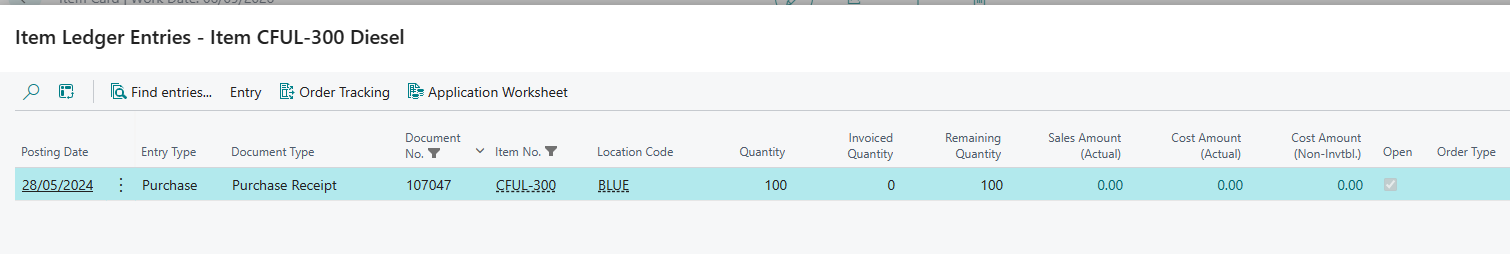

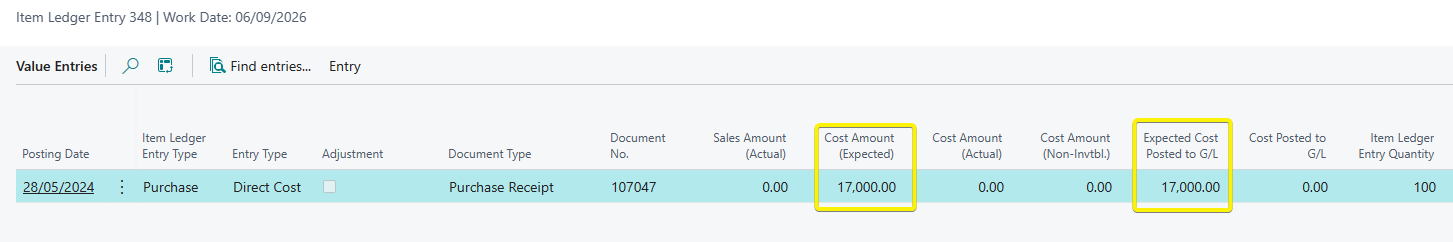

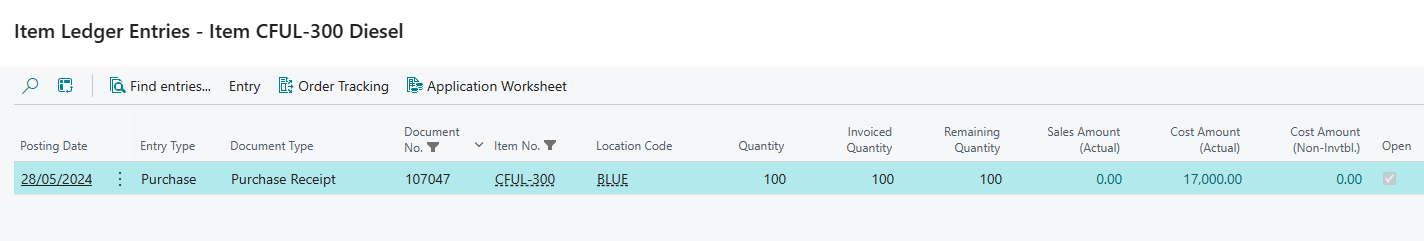

I have created a purchase order for diesel 100 liters at 170 each - 17,000 and done a purchase receipt without invoicing. Below are the item ledger entries, value entries and general ledger entries.

On the value entries above, we can see a field called Expected Cost Posted to G/L. This field shows the expected Cost that has been posted to the G/L.

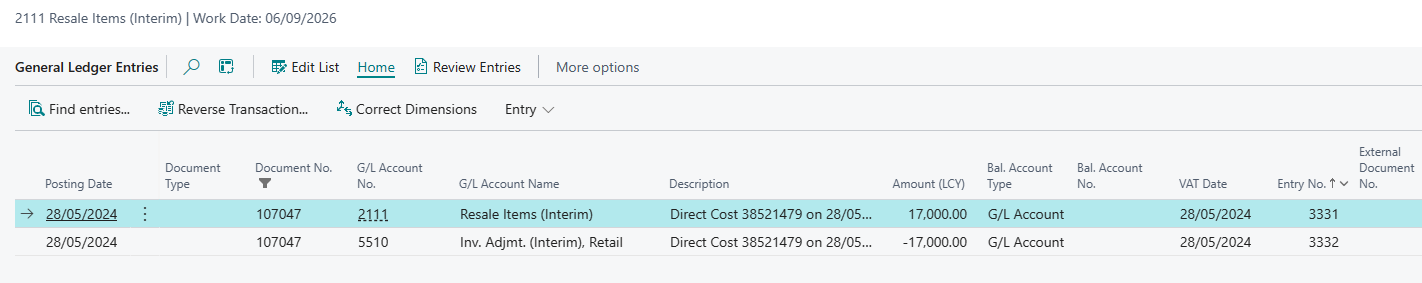

The general ledger entries generated are:

| Account | Debit | Credit |

| Inventory Account (Interim) | 17,000 | |

| Invt. Accrual Acc. (Interim) | 17,000 |

You may ask where the accounts are picked from -

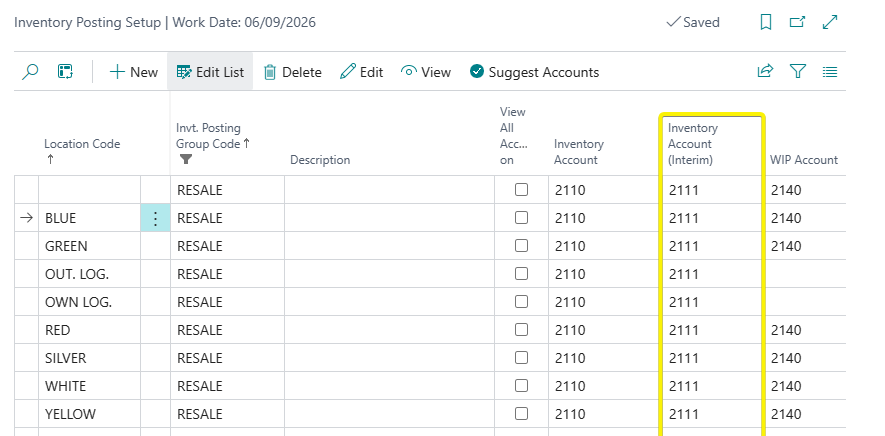

Inventory Account (Interim) from Inventory Posting Setup - Debited

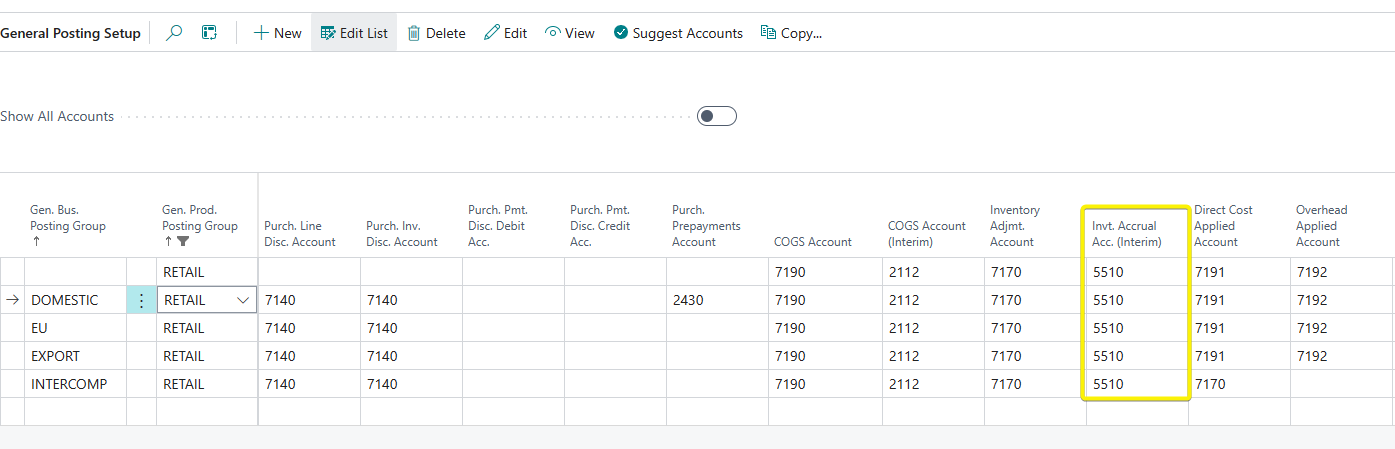

Invt. Accrual Acc. (Interim) from Gen. Posting Setup - Credited

Therefore the amounts in the Inventory Account (Interim) represent the valuation of the goods received but not invoiced.

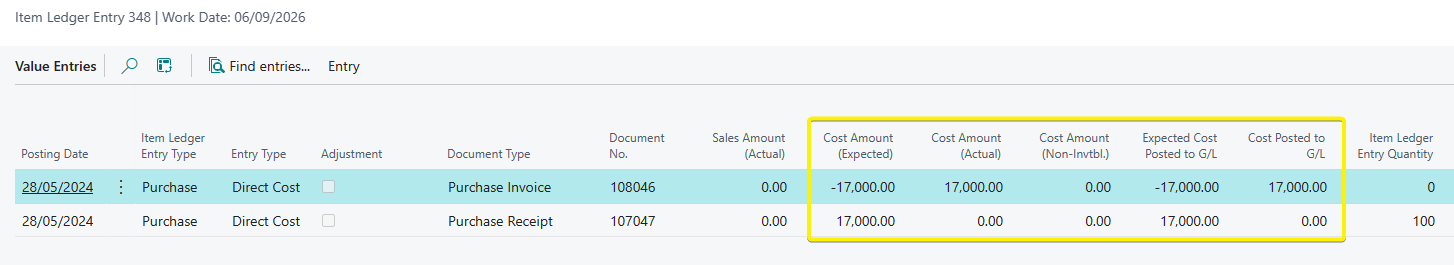

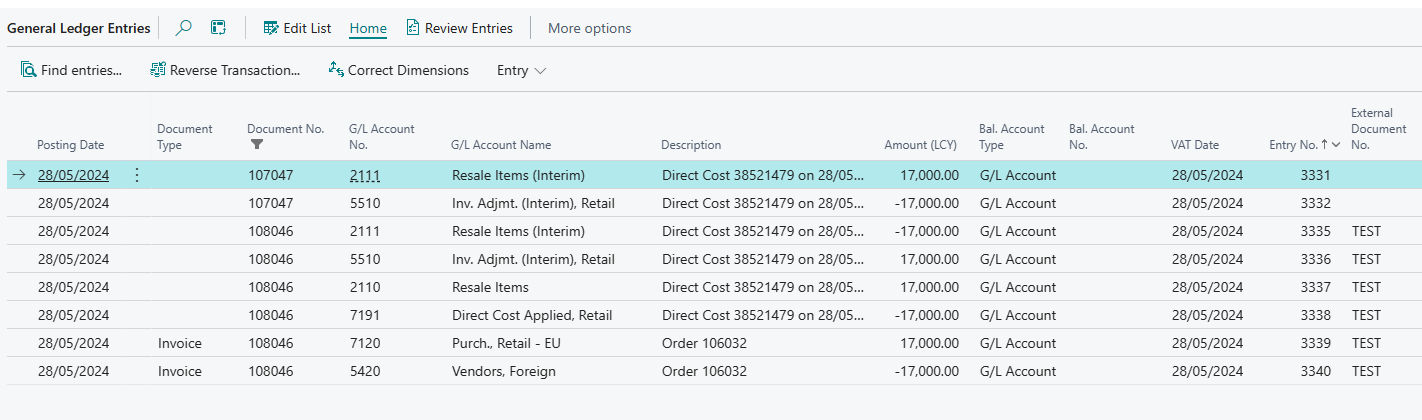

Lets now invoice the purchase order and check what happens. Below are the item ledger entries, value entries and general ledger entries.

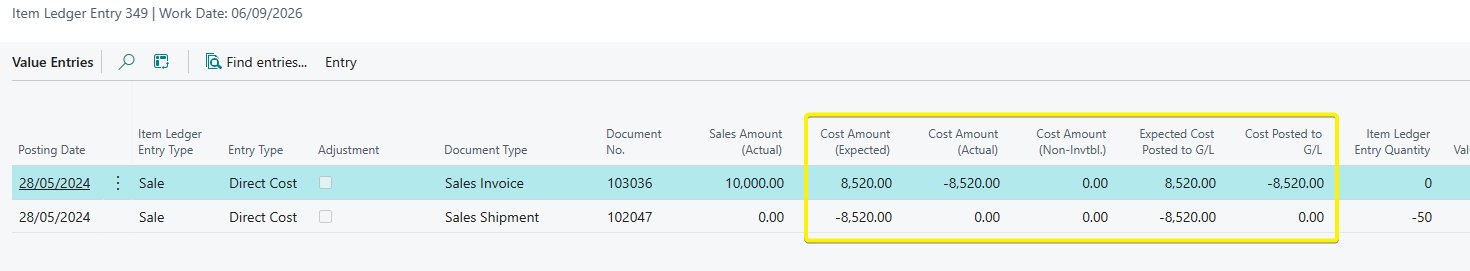

From the above, we can note:

- The Cost Amount (Actual) is updated on the item ledger entries.

- On the value entries, the Cost Amount ( Expected ) & Expected Cost Posted to G/L are reversed. The Cost Amount ( Actual ) and Cost Posted to G/L are recorded.

Which general ledger entries are recorded?

| Account | Debit | Credit |

| Invt. Accrual Acc. (Interim) | 17,000 | |

| Inventory Account (Interim) | 17,000 | |

| Inventory Account | 17,000 | |

| Direct Cost Applied Entries | 17,000 | |

| Purchase Account | 17,000 | |

| Accounts Payable | 17,000 |

We can see that all the expected costs are reversed on invoicing and the normal accounts are now affected.

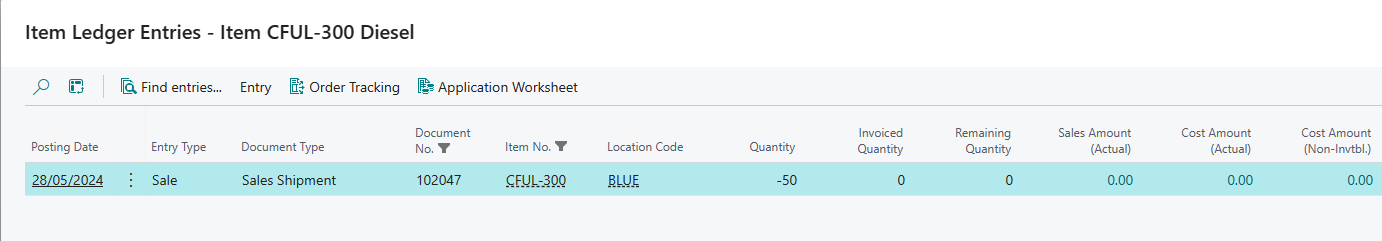

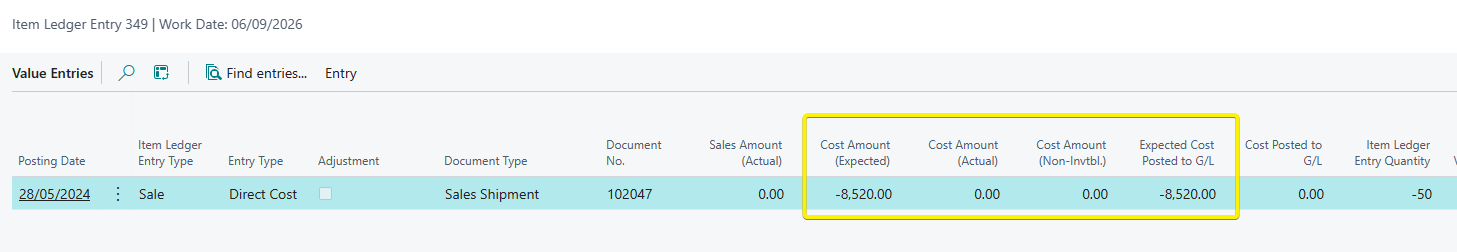

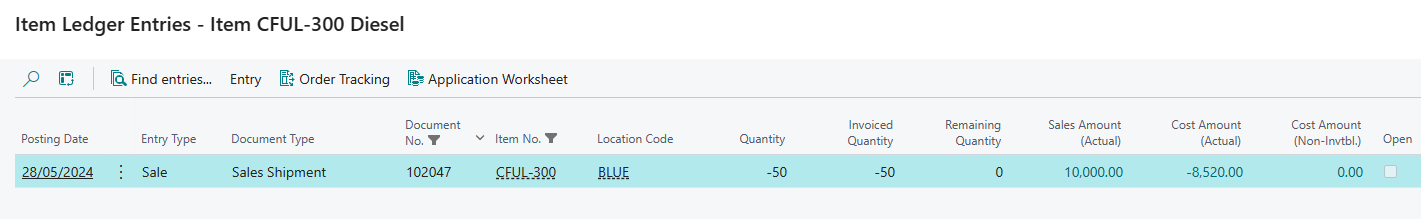

For Sales, the same is expected. I have a sales order of 50 L at 200. The unit cost of the sales order is 170.4 * 200 = 8520.

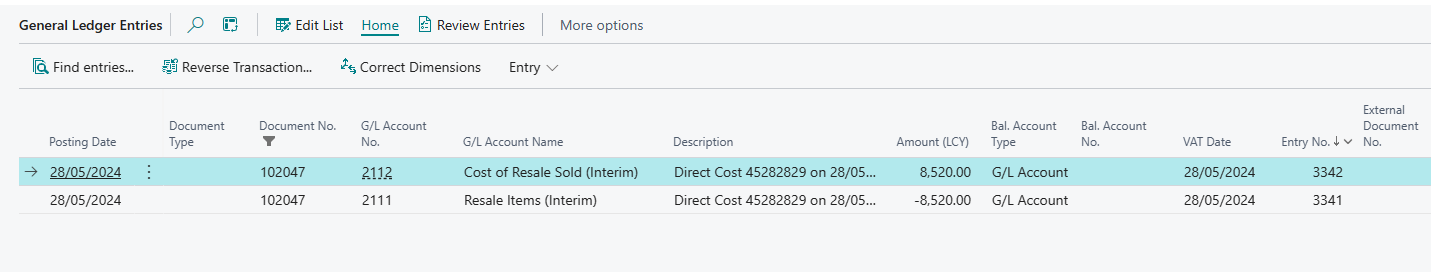

See below entries on shipping only

| Account | Debit | Credit |

| Cost of Goods (Interim) - In the Gen.Posting Setup | 8,520 | |

| Inventory Account (Interim) - In the Inventory .Posting Setup | 8,520 |

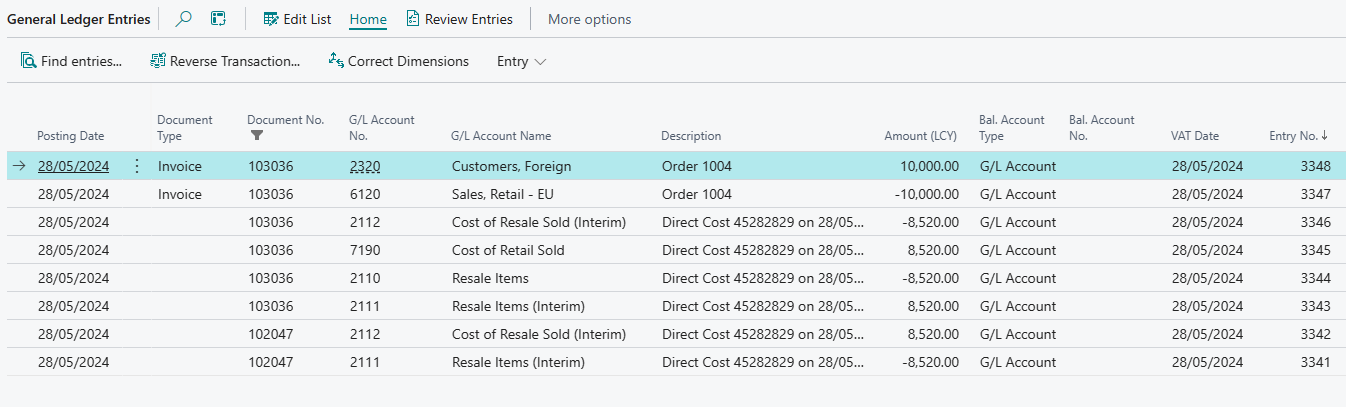

After invoicing the sales order:

| Account | Debit | Credit |

| Inventory Account (Interim) | 8,520 | |

| Cost of Goods (Interim) | 8,520 | |

| Account Receivable | 10,000 | |

| Sales Revenue | 10,000 | |

| Cost of Goods Sold | 8.520 | |

| Inventory Account | 8,520 |

Similar to purchases, all the expected sales costs are reversed on completion of invoicing.

This wraps up the inventory series. We will be covering Revaluation, Non-Inventory and how you can use the setups for various inventory management scenarios in future posts.

Any feedback is welcome on the series.

Thanks