Dynamics Business Central - Inventory Pt. 1 - Inventory Posting

Hi Readers,

We will look at the standard inventory processes in Business Central and other related functions. In future posts, we will explore various setups for specialized inventory scenarios.

Inventory Posting

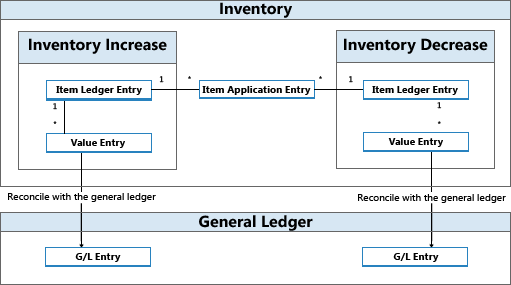

Each inventory posting results in two types of entries : Item ledger entries & Value Entries.

Item Ledger Entries focus on the changes of quantity in inventory whereas value Entries focus on changes in inventory value. A value entry is tied to an item ledger and a single item ledger entry may have one or several value entries tied to it.

The value entries posts to the general ledger to reconcile the inventory ledger to the general ledger. The image below from Microsoft shows the structure:

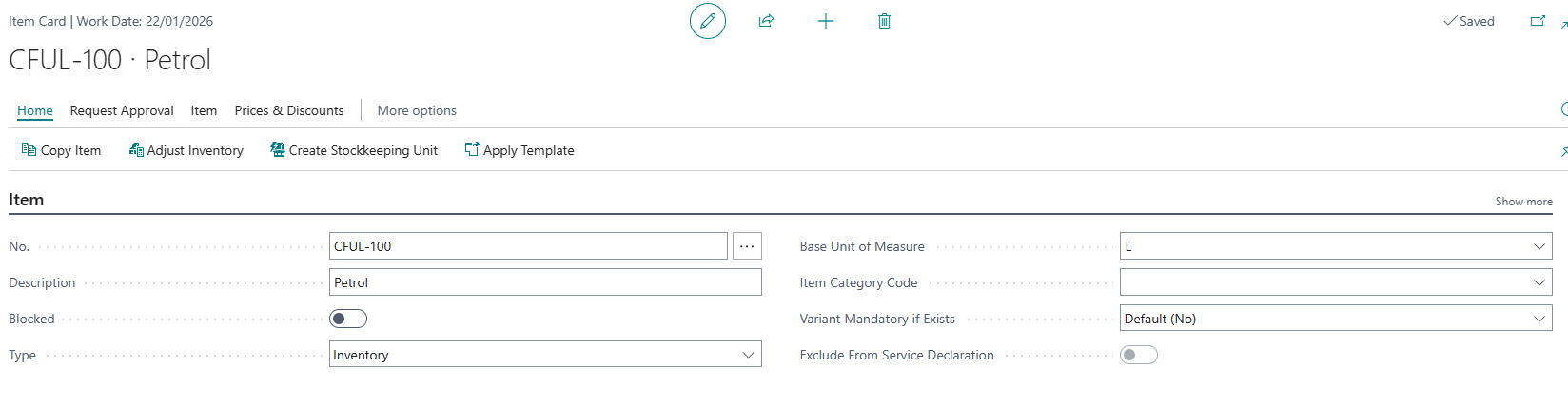

Let explore what happens when an item is received and invoiced. The item is created :

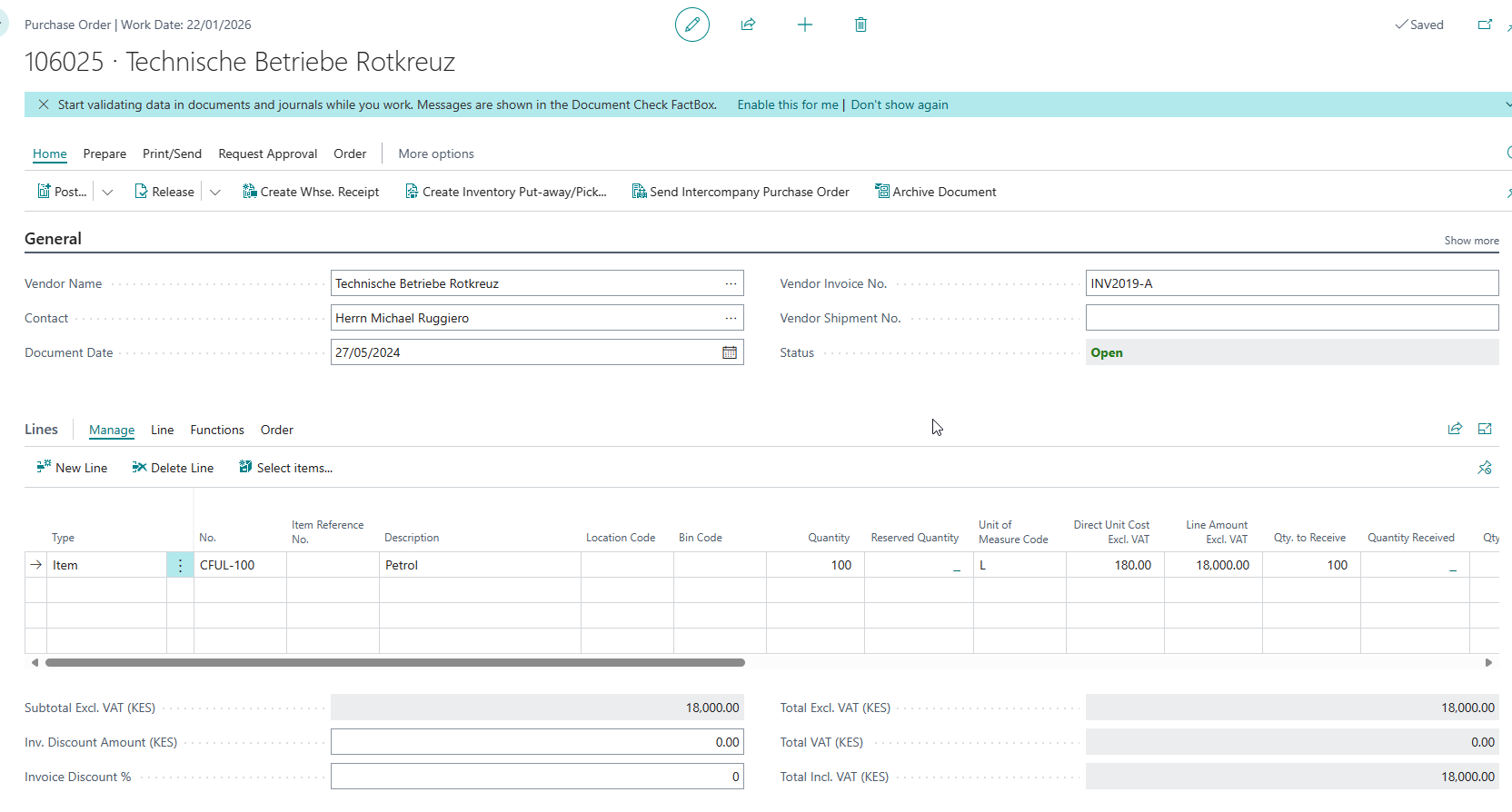

We will create a purchase order for 100 liters :

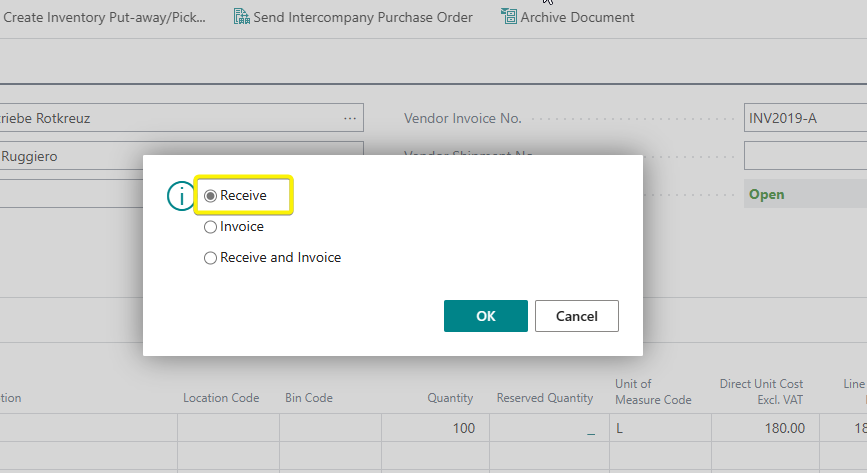

On posting the purchase order, we will only receive without invoicing.

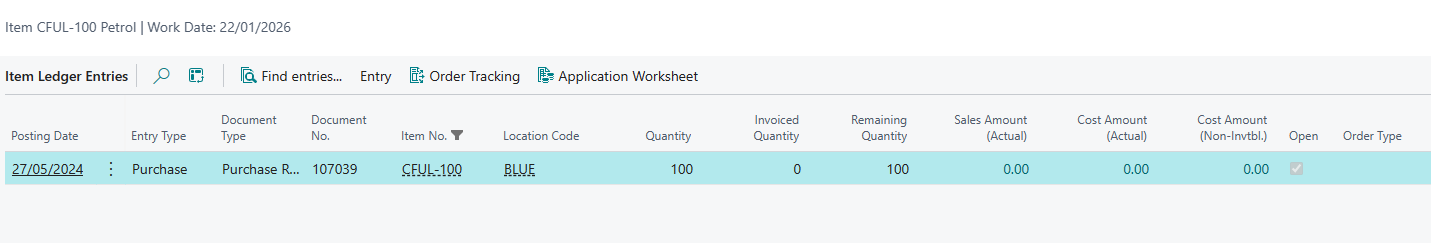

The posting creates a document ( Posted Purchase Receipt) which creates an Item Ledger Entry:

However, you can note that our Cost Amount (Actual) column has 0.00 as the cost despite our item being receipted in stock. Why is this?

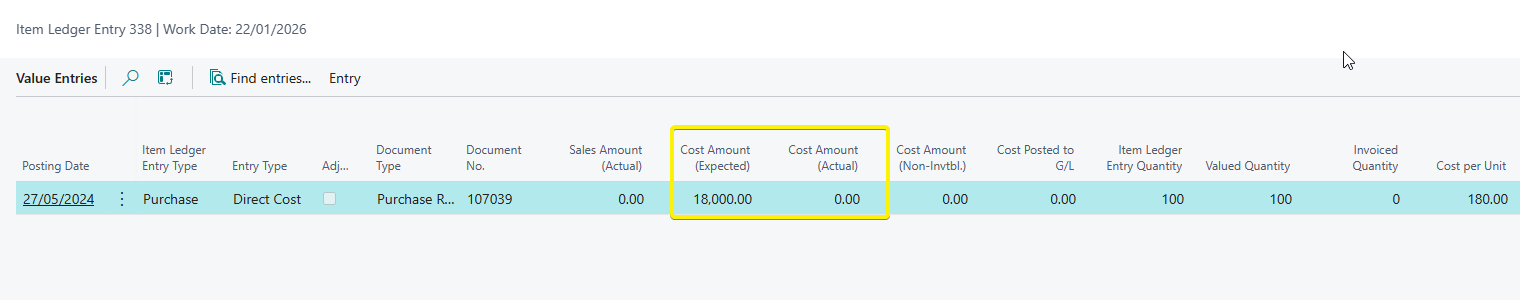

In the value entries related to the item ledger entry, the cost Cost Amount (Actual) is only recorded when a purchase order is invoiced. Therefore, purchase receipts will have no financial effect on our general ledger when an item is received without invoicing.

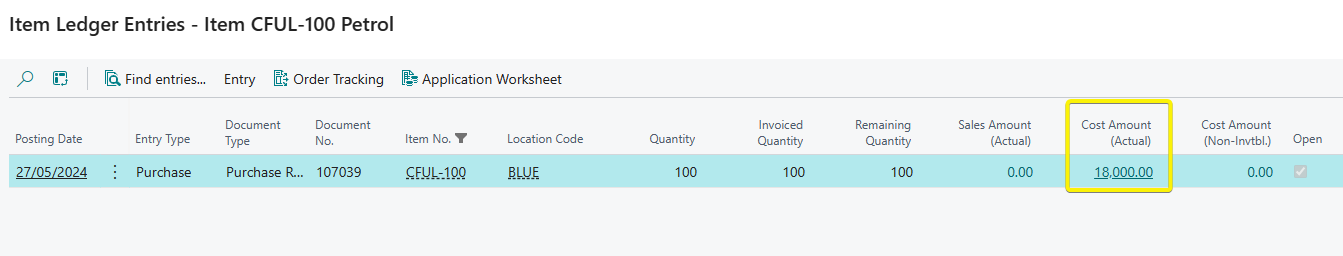

We will invoice the purchase order and create the Posted Purchase Invoice document. We can re-check our item ledger entry again.

You will now note the Cost Amount (Actual) has now been updated with the cost. Why?

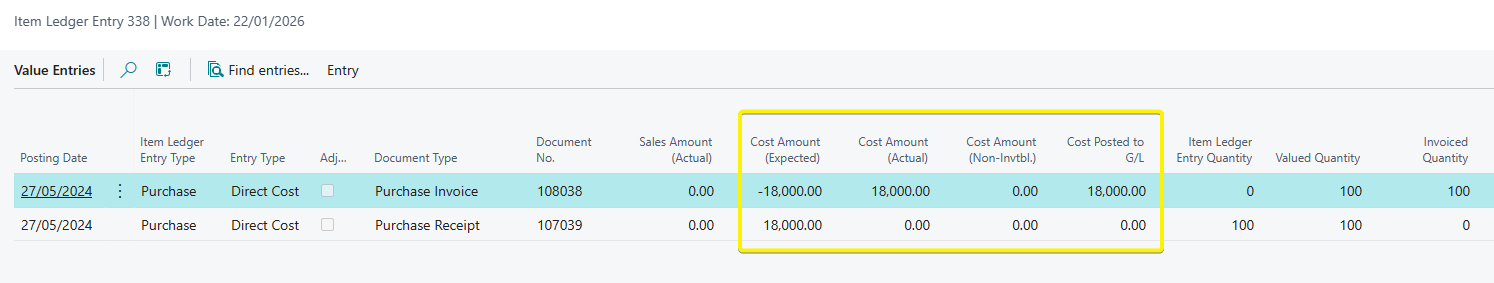

We check our value entries also. An observation can be noted that we have an extra value entry of type Purchase Invoice which does below:

1.It removes out the amount initially recorded in the Cost Amount (Expected) and populates the Cost Amount (Actual) field.

2.It records a value in the field Cost Posted to G/L thus signifying that a financial transaction has now occured

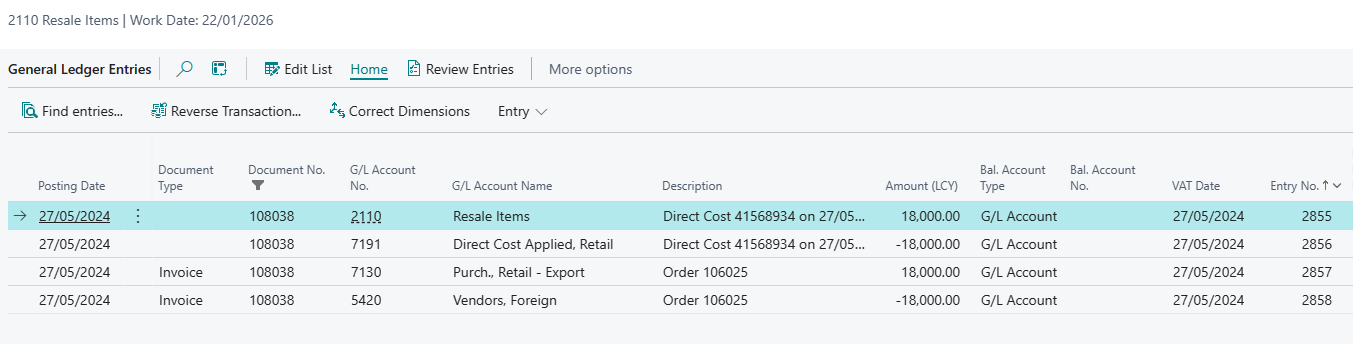

Lets explore which financial entries have been posted:

| Account | Debit | Credit |

| Inventory Account ( Picked from the Inventory Account in the Inventory Posting Setup of the item) | 18,000 | |

| Direct Cost Applied Account (Picked from the Direct Cost Applied Account in the Gen Prod. Posting Setup of the item) | 18,000 | |

| Purchases Account Picked from the Purchases Account in the Gen Prod. Posting Setup of the item) | 18,000 | |

| Accounts Payable ( Picked from the Payables Account in the Vendor Posting Group of the vendor) | 18,000 |

We can note from the image and table above we have separate postings to 4 different accounts. As per normal accounting standards, we should have 2 entries or 3 (if input VAT/ variance is applicable).

So why do we have the direct cost applied / purchase accounts? Lets look at that in part 2.

Part 2 link :Part 2 : Inventory Financial Transactions