Dynamics Business Central - Inventory Pt. 3 - Adjust Cost Functionality

Hi Readers,

Find the links to Part 1 & 2 below

Part 1 - Pt.1 - Link - Inventory Posting

Part 2 - Pt. 2 - Link - Inventory Financial Transactions

In this part, we look at how the system ensures costing is accurate as different purchases may have different prices. How does the system ensure the COGs is okay? This also applies to other system functions such as revaluations, manufacturing and so on.

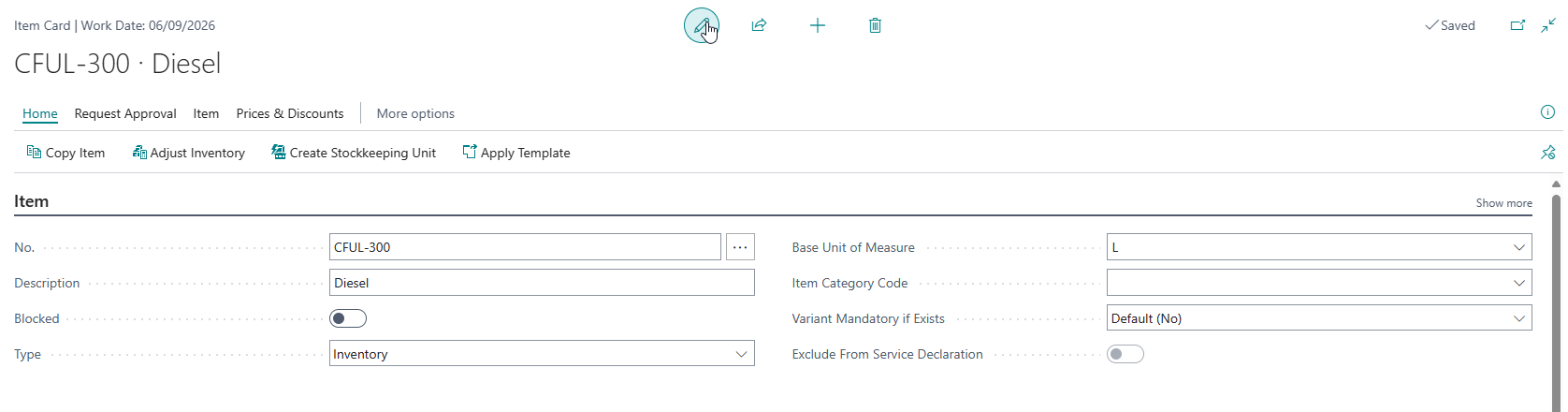

I have created a new item for this part 3.

A purchase and sales is processed as below.

| Date | Transaction - Off System | Transaction - On System |

| 01/05/24 | Order made to a vendor for 300 liters at 160 each - 48,000 | Purchase raised and invoiced to vendor creating an item ledger entry of Entry Type - Purchase |

| 09/05/24 | Sold 100 liters to a customer at 200 each - 20,000 |

Sales order raised to customer creating an item ledger entry of Entry Type - Sale. The system populates the Cost Amount (Actual) as 16,000 , which is the unit cost bought of 160 * 100 = 16,000. The stock left is 200 liters |

The following additional transactions happen:

| Date | Transaction - Off System | Transaction - On System |

| 14/05/24 | Vendor increases price per liter to 170 after price review by regulatory body. | N/A |

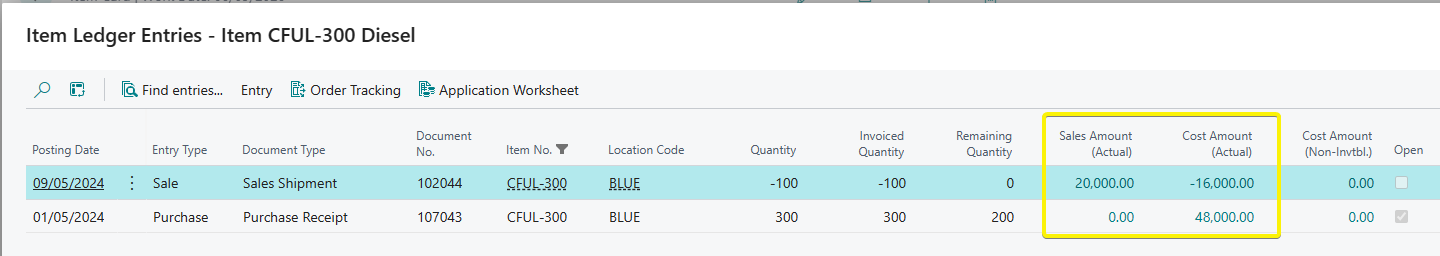

| 16/05/24 | Order made to the vendor for 300 liters at 170 each - 51,000 |

Purchase order raised |

| 17/05/24 | The diesel is received on site. Finance team agrees with vendor not to invoice this time because another order will be made in the next week. |

Purchase order received 300 liters but not invoiced. Our stock is now 500 liters We have no cost in our purchase receipt because we have not invoiced as per our lesson in Pt.1 |

We have no cost in our purchase receipt because we have not invoiced as per our lesson in Pt.1

The following additional transactions happen:

| Date | Transaction - Off System | Transaction - On System |

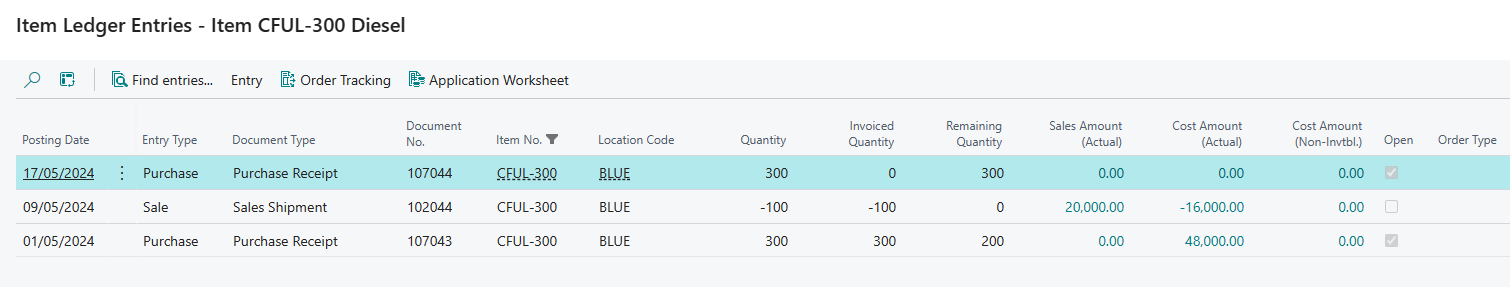

| 18/05/24 | Customer makes an order for 400 liters at 200 each |

Sales order raised to customer creating an item ledger entry of Entry Type - Sale. The system populates the Cost Amount (Actual) as 66,400. 66,400 gives us a unit cost of 166. The stock left is 100 liters |

So why do we have a unit cost of 166 despite the fact that we bought at 160 and 170. The unit cost is affected by the purchases so we calculate below to demonstrate.

| Date | Calculation |

| 01/05/24 |

Stock purchased : 300 Stock count is 300 at 160 = 48,000 |

| 09/05/24 |

Stock sold : 100 at unit cost of 160 = 16,000 Stock count left after sale is 200 |

| 17/05/24 |

Stock purchased : 300 - Stock count is 500 System calculates unit cost as : Initial stock count/valuation : 200 * 160 = 32,000 New stock count/ valuation : 300 * 170 = 51,000 Total valuation = 83,000 Total stock = 500 New unit cost = 83,000 / 500 = 166 |

| 18/05/24 |

Stock sold : 400 at unit cost of 166 = 66,400 Stock count left after sale is 100 at a unit cost of 166. |

Above demonstrated one of the abilities of Business Central to make adjustments that forward cost changes from cost sources e.g purchases to cost recipients e.g sales, according to an item’s costing method, to provide correct inventory valuation.

For this demonstration , I used the Average costing method. The system will make similar adjustments to accomodate FIFO, LIFO, Standard and Specific costing methods to ensure costs are accurate.

Lets make another scenario.

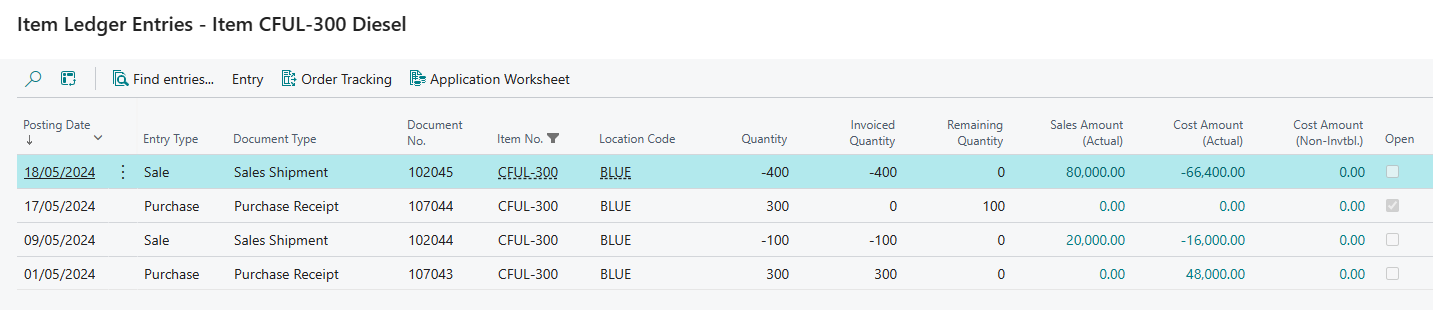

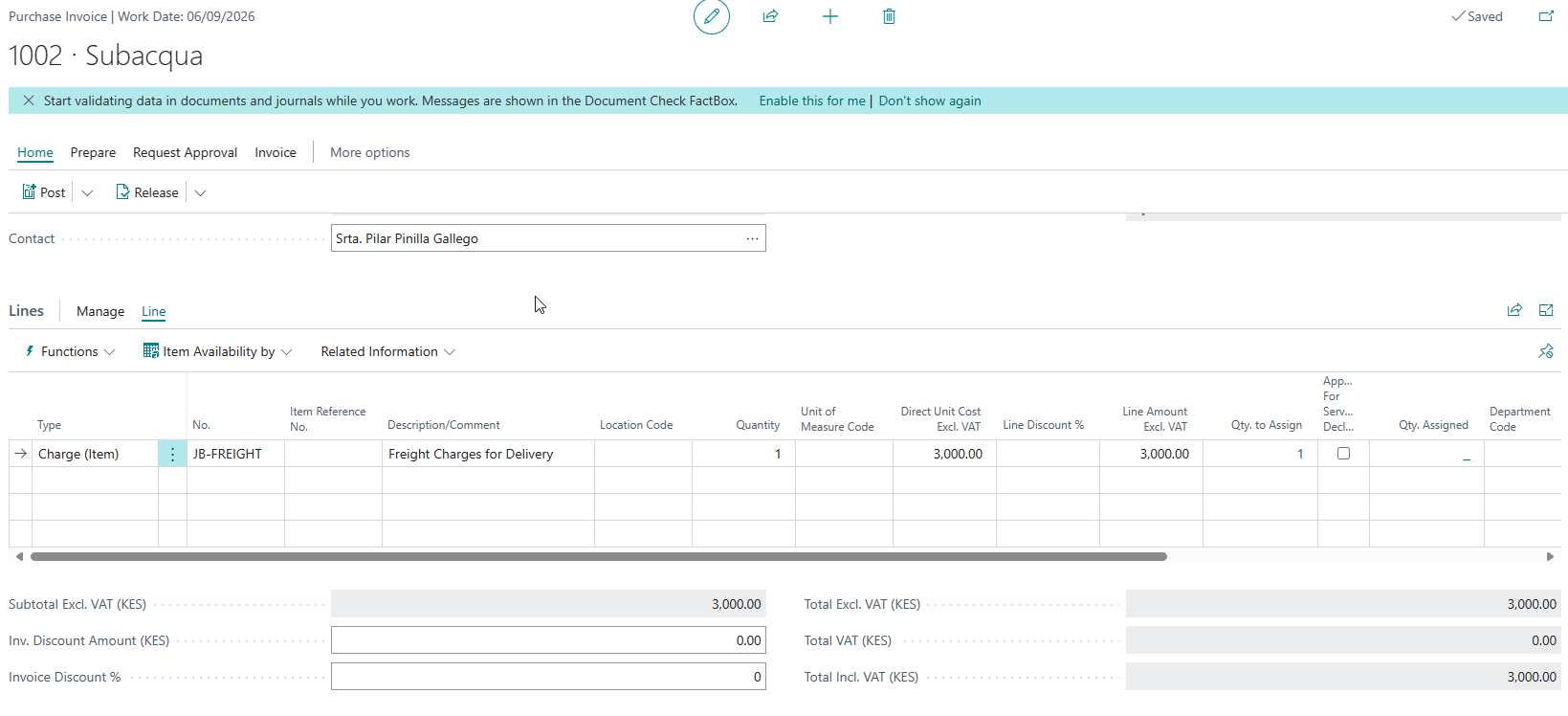

The senior accountant at the firm discovers that the good received on 17/05/24 were done by a different logistics provider than the vendor who offers free delivery. The logistics provider charged 3,000 for delivery.

The senior accountant decides to charge the logistics amount to that purchase receipt to update the direct cost of the purchase.

A purchase invoice is raised with an item charge, assigned to the purchase receipt and posted.

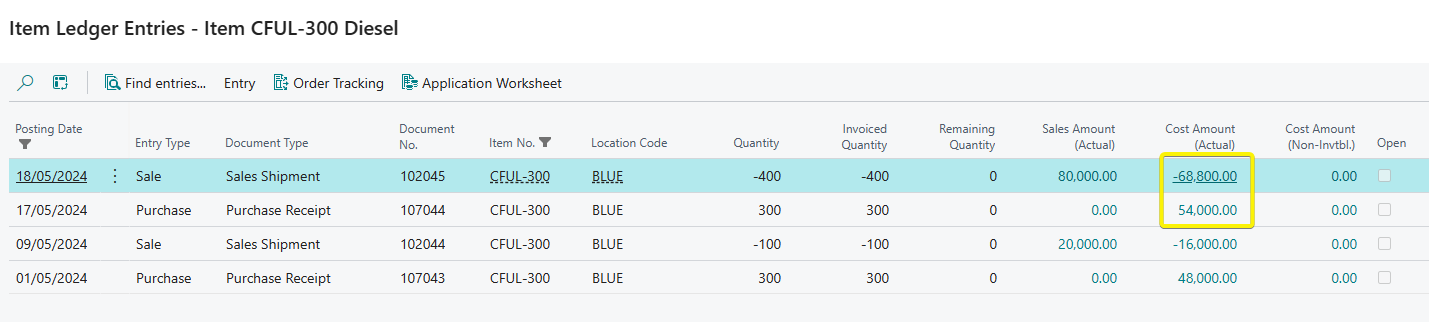

Lets see the difference in costing now on the entries

From the image above, we can see our costs have increased after the item charge has been posted.

We can see that our COGs for the sale on 18/05/2024 has also been updated despite the fact that we raised our item charge after the customer has been invoiced. If we check the value entries, we can see the exact adjusting entries.

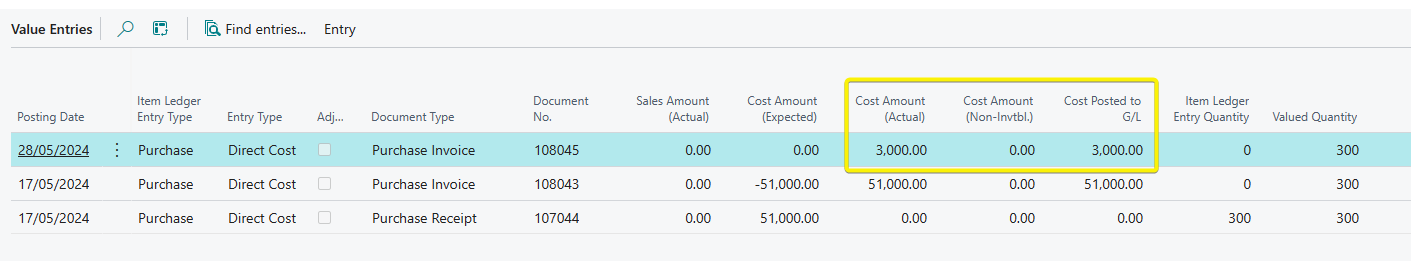

Value entry showing increasing in purchase cost below

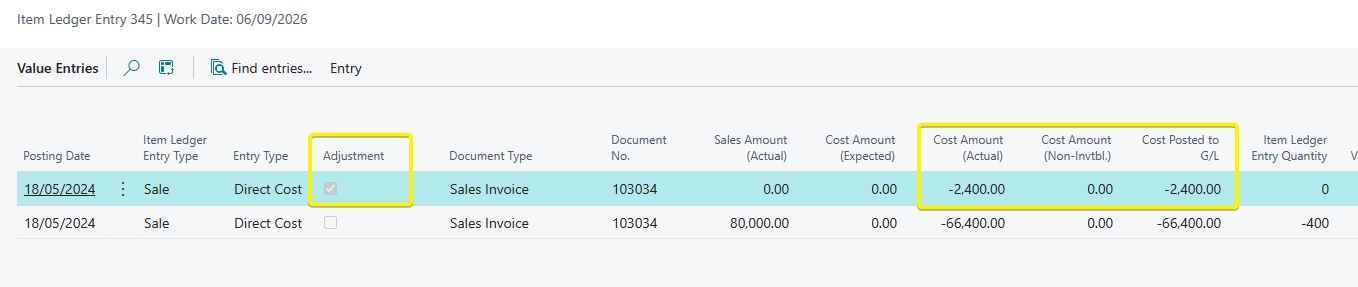

Value entry showing increase in COGs due to adjust

The adjustments ensure that costs are always updated and accurate

Points to Note

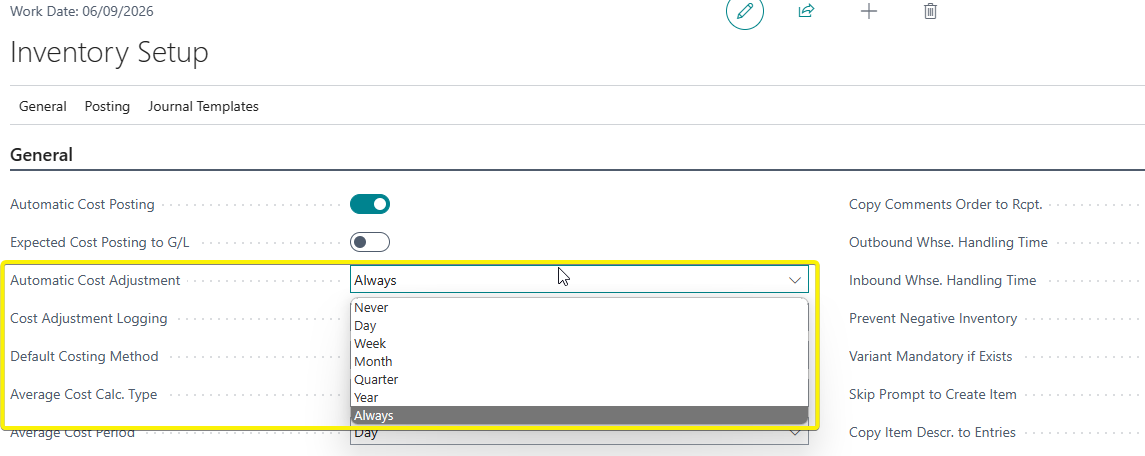

1.Microsoft provides a functionality on the inventory setup to turn off Automatic Adjusting of Costs by setting it to Never. This means that you can manually run the function outside business hours.

Similar to the Post Cost report in Pt.2, adjusting costs can affect posting if the organization has many transactions in a single day and thus can be turned off and ran daily outside business hours.

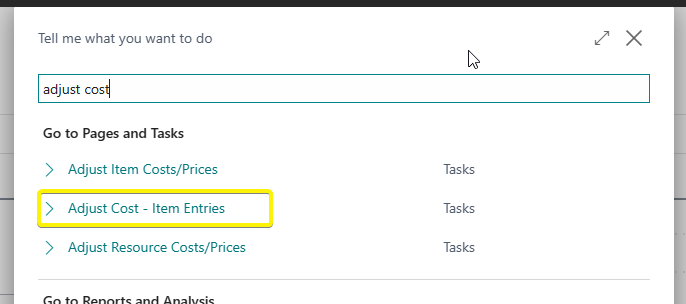

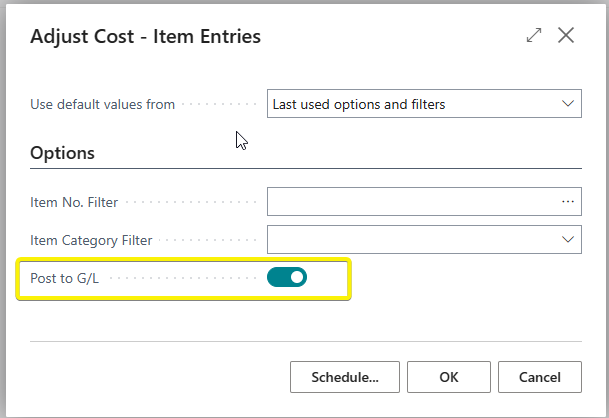

2. If you go the manual route of running the Adjust Cost - Item after hours, you can run the report manually or place it in a job queue.

There are two scenarios:

If Automatic Cost Posting is turned on in the Inventory Setup, the report can make the cost adjustments while also offering an option to post to the general ledger at the same time

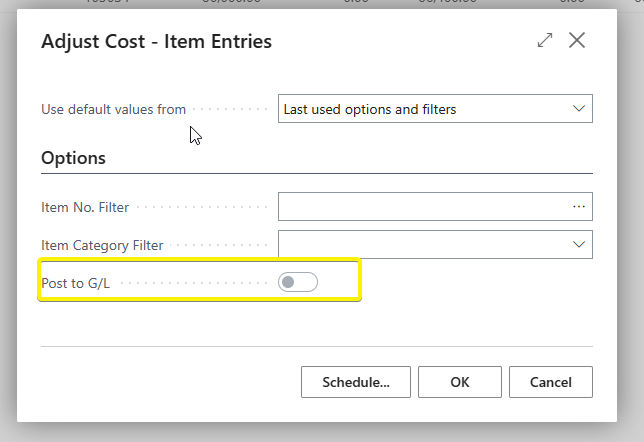

If Automatic Cost Posting is turned off in the Inventory Setup, you will need to run the Adjust Cost - Item Entries first to make all the cost adjustment for the day/period then run the Post Cost Inventory to G/L report to post all adjustments to the general ledger. As shown below, the option to post is non-editable.

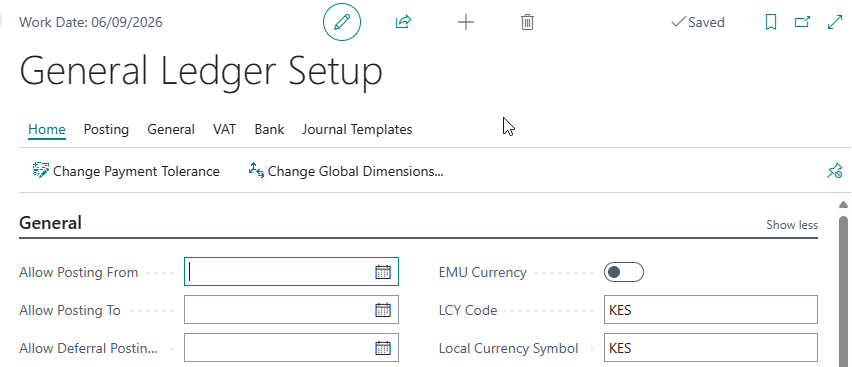

3. If you have closed the month and moved to a new month/year, it is advisable to always change the Allow Posting from to the start of the current month

How does this help? Assume we have a posting that wants to adjust a transaction done with a posting date of April 2024.

When posting the adjusting value entry, the system will check the Allow Posting From field to check the earliest date that it can create the entry.

If the field is blank, it will create the entry with a posting date that matches the original posting date of the document in April.

This would mean that books which were submitted to the management will have changes despite currently being in May 2024.

To prevent this, the Allow Posting From should be the start of the current month. This means the adjusting value entry will be posted using the date 01 May 2024 and be posted in the general ledger on same date.

4. Microsoft released a new feature to manage cost adjustment. You can watch the video on Link - > What's New : Cost Adjustment

In our final Part 4, we look at expected posting.

Link Part 4 -Pt.4 - Expected Posting