Dynamics Business Central - Inventory Pt. 2 - Inventory Financial Transactions

Hi Readers,

Link to Part 1 - Pt. 1 - Inventory Posting

In the previous post, we looked at the process of posting inventory, its effect on item ledger entries and on the value entries. This blog post looks at the financial entries caused by the invoicing.

We observed two accounts : Direct Cost Applied Account & Purchase Account which are used by Business central in the purchase process but are not part of normal accounting postings.

Microsoft has not provided any official documentation on why this has been done that way but several forums and subject matter expert have given two reasons why the 2 accounts are used.

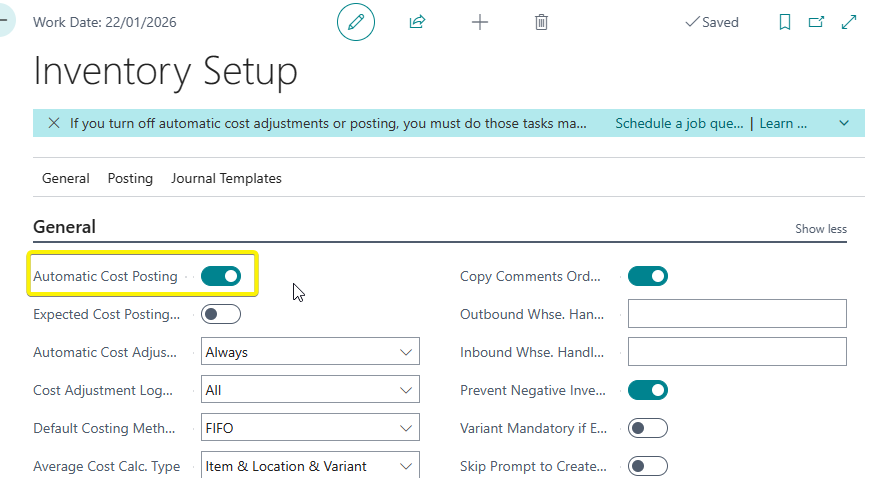

Reason 1 : To accomodate for automatic posting setup

In the inventory setup, we have a checkbox for Automatic Cost Posting

Lets turn it off , raise another PO for 100 liter and invoice.

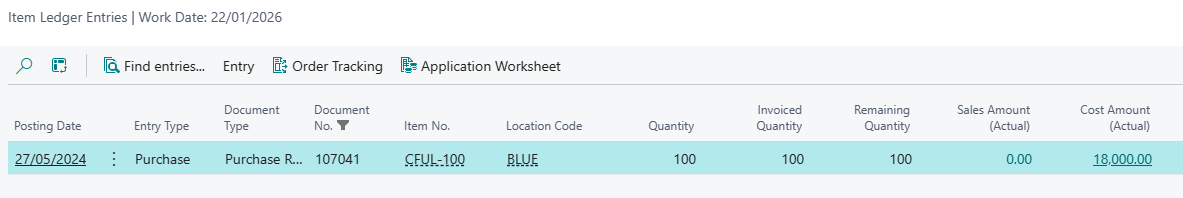

See the item ledger entry and value entry

NB: If while posting , you use the Receive & Invoice together, the value entries will only post a single entry of type Purchase Invoice explaining why i dont have 2 entries of Document Type Purchase Receipt and Purchase Invoice as seen in my previous posting in Pt. 1

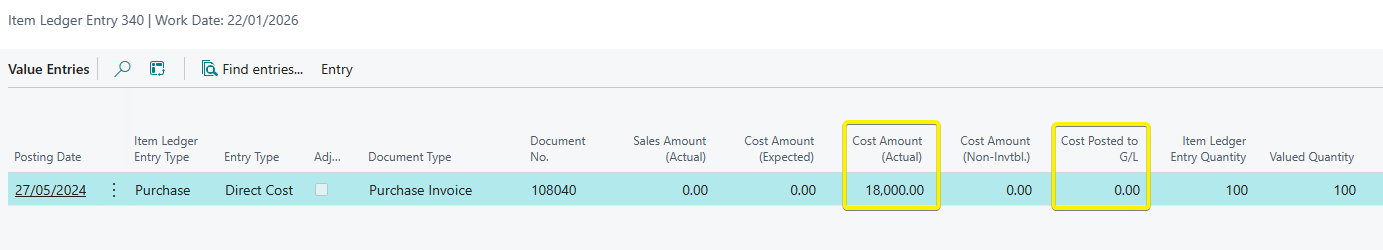

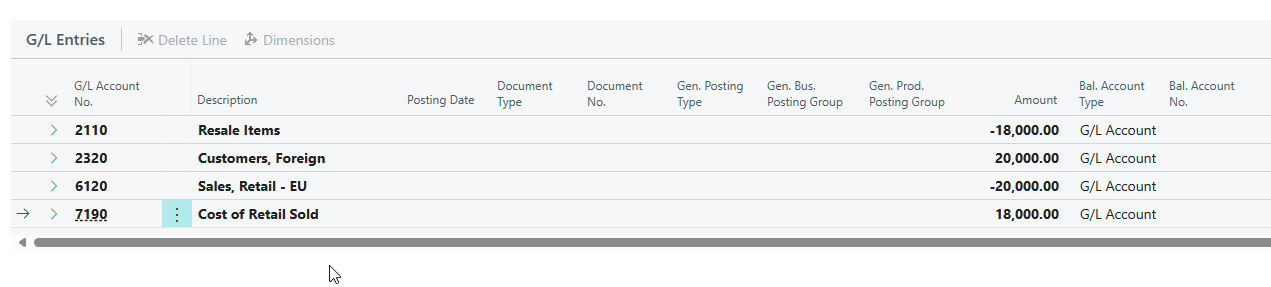

The G/L entries are below:

Now looking at our entries above we can note two things:

1.Our Cost Amount (Actual) field in the value entries is populated but the Cost Posted to G/L is still zero

2. In my general ledger, i only have 2 entries posted. The entry recognizes the payable due however does not debit our inventory asset account.

| Account | Debit | Credit |

| Purchases Account Picked from the Purchases Account in the Gen Prod. Posting Setup of the item) | 18,000 | |

| Accounts Payable ( Picked from the Payables Account in the Vendor Posting Group of the vendor) | 18,000 |

Why does this happen?

This is becuase when the when the user has activates this Automatic Cost Posting button in the Inventory setup, the system automatically posts to the general ledger every time the user invoices the PO.

However, in my case, the setting was turned off. Therefore, 4 entries were not posted but only 2.

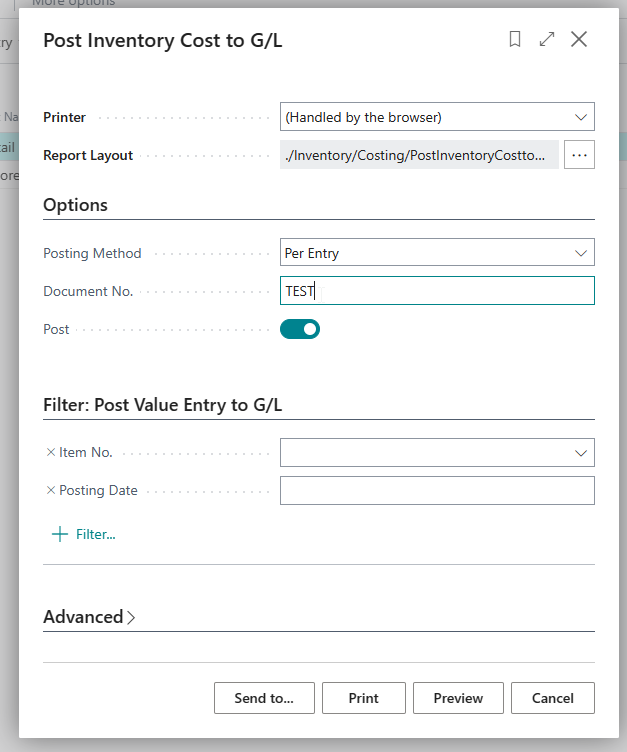

So , how do we get the remaining 2 transactions in the general ledger. Microsoft has a report called Post Inventory Cost to G/L. I have opened the report, selected Posting Method - Per Entry and turned on the Post checkbox as seen below.

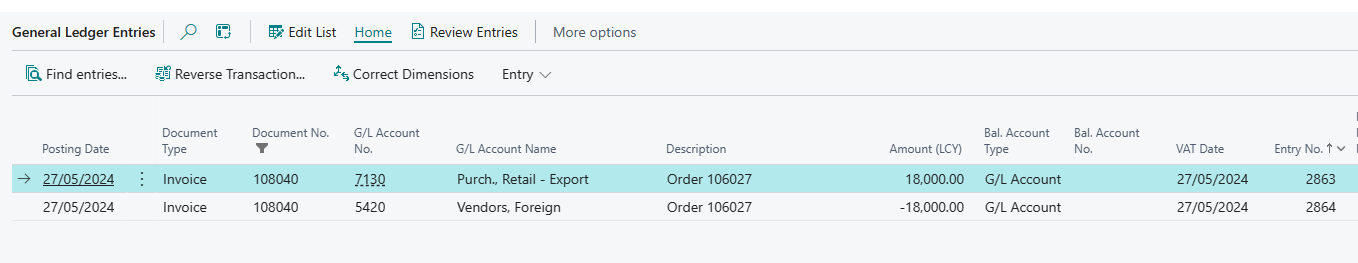

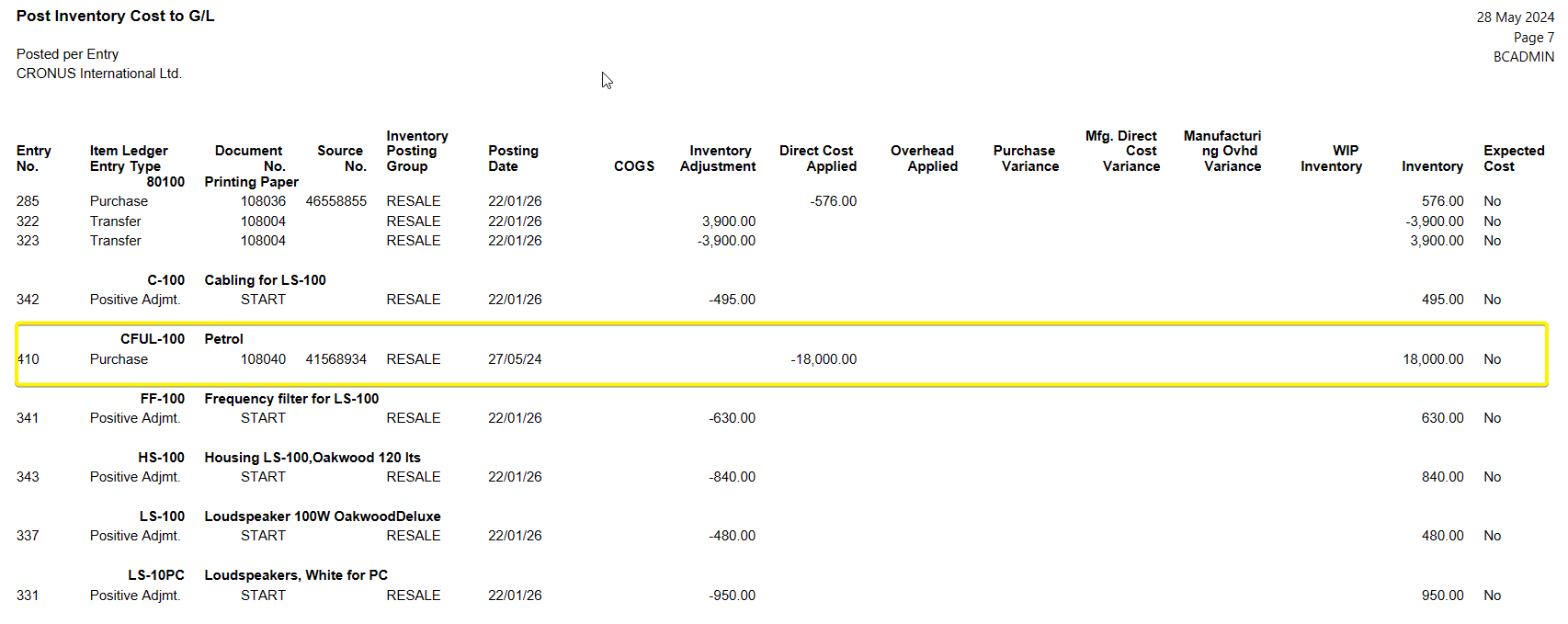

When the user runs this batch report, the program creates G/L entries on the basis of value entries.

An output is given once the reports finishes running showing adjustment that have been made

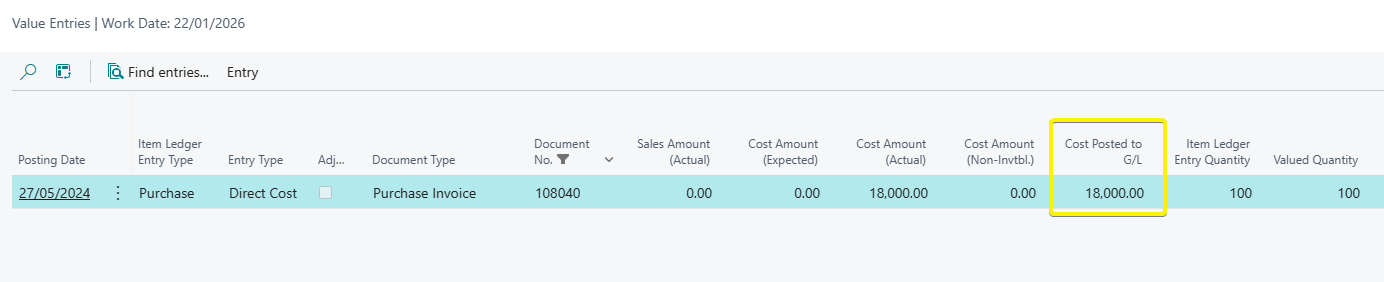

Lets check our ledger and value entries now

We can note that:

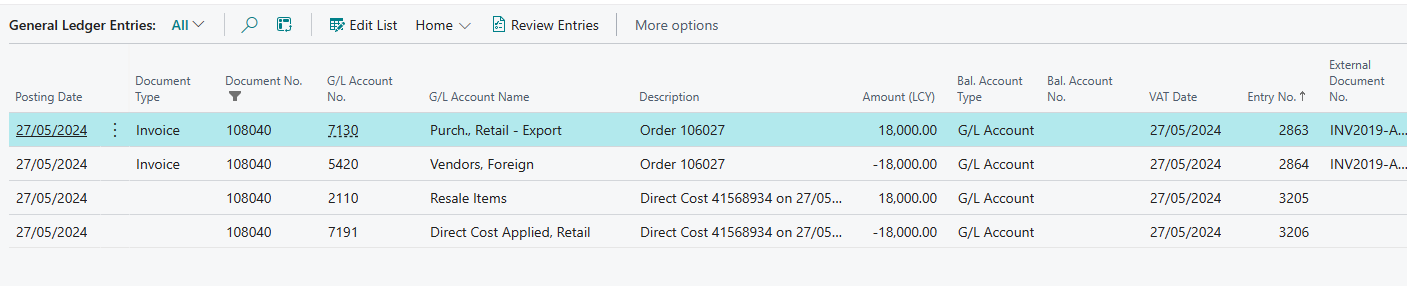

1.Two additional entries have been added to our general ledger

| Account | Debit | Credit |

| Inventory Account | 18,000 | |

| Direct Cost Applied Account | 18,000 |

2. Our Cost Posted to G/L is now populated in the value entries signifying the transaction's financials have been fully posted to the G/L.

General consensus is that we have the two accounts : Direct Cost Applied and Purchases Account to support the ability to turn off automatic cost posting to the G/L in the inventory setup.

Why do we need to turn off automatic posting - we may ask? Lets look at the sales side of it

| Account | Debit | Credit |

| With Automatic Cost Posting Turned On - Assuming 100L sold at 200 each and no VAT | ||

| Account Receivable | 20,000 | |

| Sales Revenue | 20,000 | |

| Cost of Goods Sold | 18,000 | |

| Inventory Account | 18,000 | |

| With Automatic Cost Posting Turned Off - Assuming 100L sold at 200 each and no VAT | ||

| Account Receivable | 20,000 | |

| Sales Revenue | 20,000 | |

| After running Post Cost Report | ||

| Cost of Goods Sold | 18,000 | |

| Inventory Account | 18,000 | |

Assume you work in a retail industry with hundreds of transactions every day or an wholesaler with several sales documents with several line running up to 50 lines. On posting, the system 'locks' and prevents any other user from posting an invoice until it is done posting to the G/L thus affecting the time taken to complete a transaction. On turning the setting off, only the receivable and sales revenue are recognized and stock deducted from the system.

The Post Cost Inventory report is usually automated using job queues to run outside business hours every day to reconcile the inventory ledger and the general ledger for all postings done during the day.

Reason 2 : To provide for a COGs schedule.

Some expert further explain that the Direct Cost Applied and Purchases Account are added to support the need of having a COGs schedule as below

Beginning Inventory XXX.XX

Add: Purchases XXX.XX

--------------

Total Goods Available XXX.XX

Less Ending Inventory (XXX.XX)

---------------

Cost of Goods Sold XXX.XX

The Purchases Account can be used to build the above structure using account schedules.

The above raises further questions - how do we handle the two accounts in our books in the case of purchases. There exist two schools of thought on this.

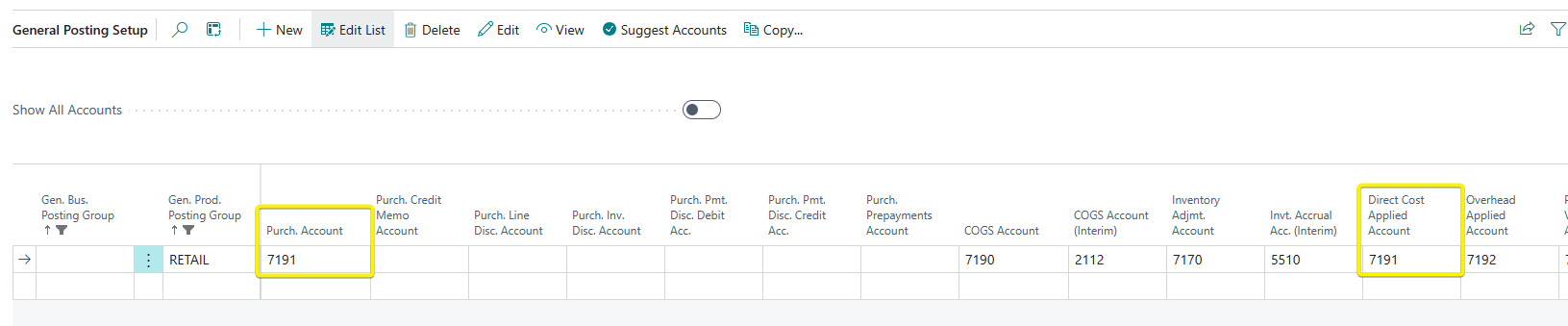

School of thought 1 : Maintain a similar account for Purchases/Direct Cost Applied Account

In this school of thought, it is agreed that a single account should be created called Purchase/ Direct Cost. The net effect of the account would be zero after full purchase invoicing.

| Account | Debit | Credit |

| Purchases Account ( Same Account as Direct Applied Account) | 18,000 | |

| Accounts Payable ( Picked from the Payables Account in the Vendor Posting Group of the vendor) | 18,000 | |

| Inventory Account | 18,000 | |

| Direct Cost Applied Account ( Same Account as Purchase Account) | 18,000 |

As seen above, the account would have zero after the full transaction cycle is complete leaving the payable and the account payable Setup done as below

School of thought 2 : Maintain different accounts for Purchases/Direct Cost Applied Account

In this school of thought, it is argued that maintained the different account would be important for reporting e.g creating a COGs schedule, doing purchase budget vs purchase actual comparison. They prefer to net off at the account schedule level.

This wraps off the costing bit. Next question we could ask is how does the system keep the costing accurate if we make several purchases, adjustments and sales to ensures our COGs and valuations are okay. We look at that in part 3

Link to Part 3 - Pt. 3 - Adjust Cost Functionality