Manufacturing Postings Pt. 3- Financial Postings with Overheads

Hi Readers,

In this part we look at overheads in Business Central.

You can access Pt.1 here - Link to Pt.1 and Part.2 here - Link to Pt. 2

Overheads includes all costs that help keep the business running - whether or not they are related to manufacturing e.g Marketing expenses help promote the business and sell products but aren’t linked to manufacturing, Rent for office space (not factory space) because it supports the business but isn’t tied to manufacturing activities.

Indirect Costs are a subset of overheads that specifically support the production process but aren’t tied to a specific product. e.g the salary of a maintenance worker who keeps machines running, but their salary is not directly tied to making the product as a direct cost.

Once the cost accountants have identified the overhead costs, they can find a way to calculate an overhead rate.

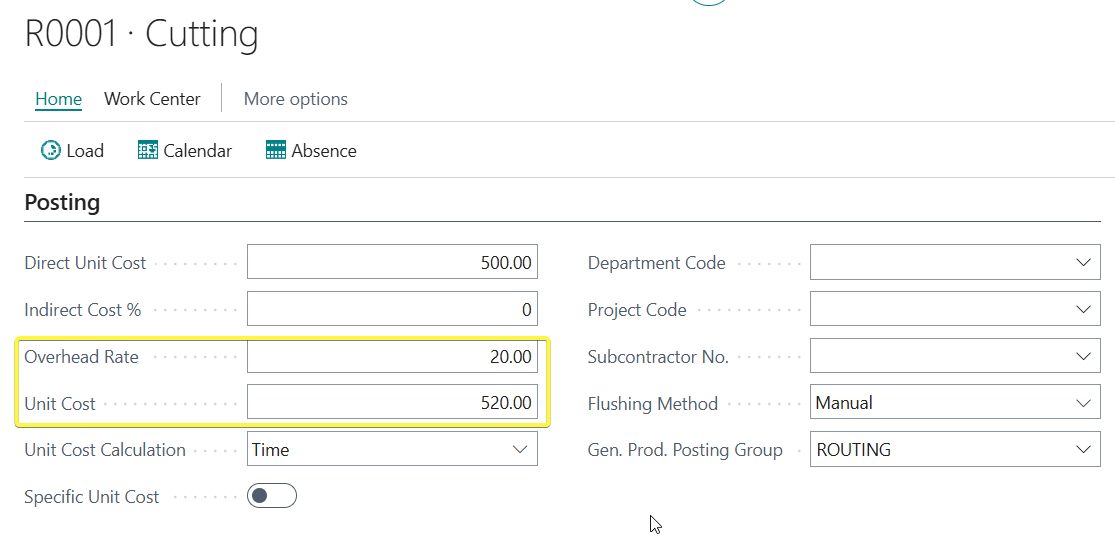

For our case we can say we have an overhead rate of 20 per hour per work center. For large organizations, they may be different because some work center may consume more power, water factory space etc than others.

In the work center card, add the Overhead rate in the field shown below.

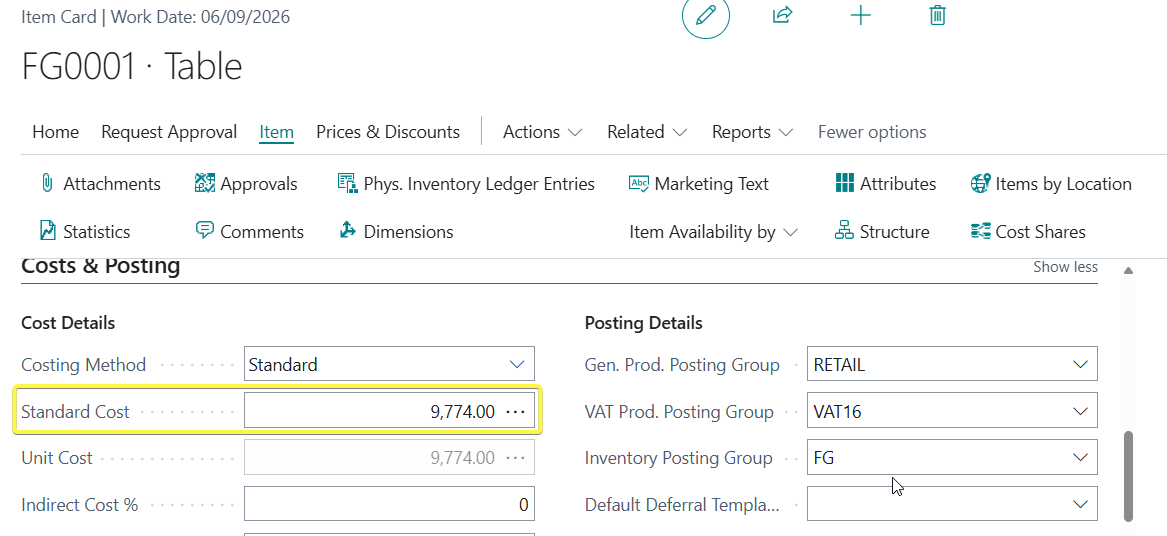

Because the cost of the routing will increase we have to re-calculate our product standard cost.

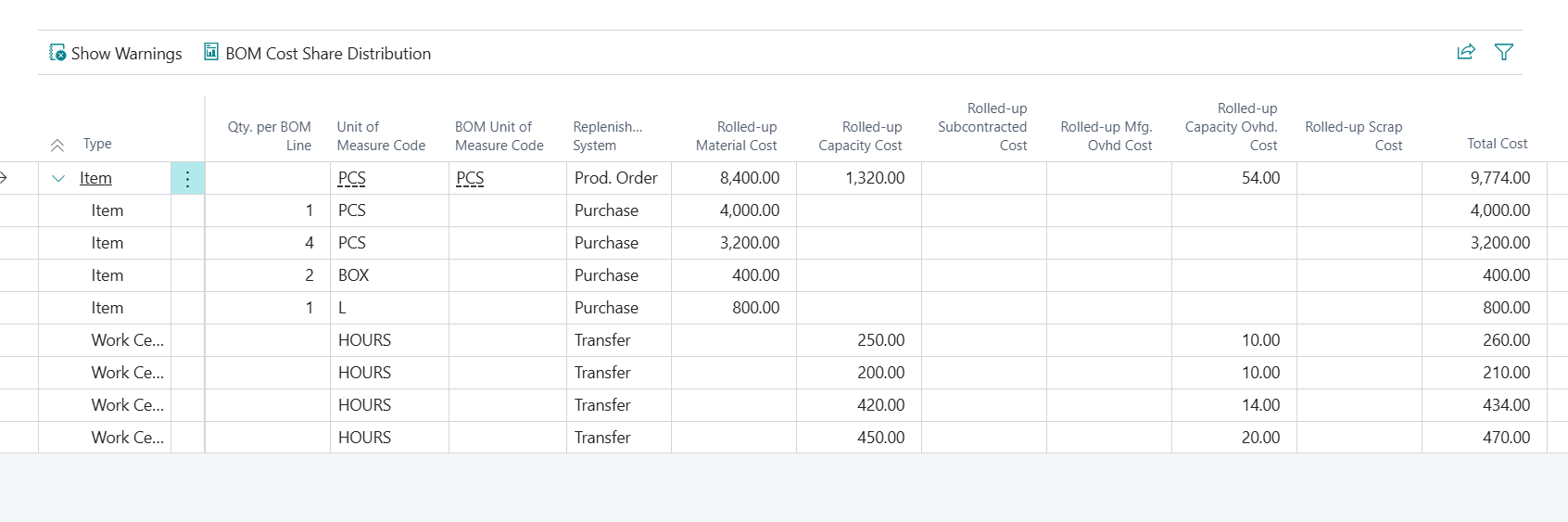

Our table finished good now has a standard cost of 9,774 (9,720 + 54). The 20 overhead rate is also multiplied by the number of routing hours hence why we dont have 80 (20 * 4) but 54 (20 * 0.5 + 20 * 0.5 + 20 * 0.7 + 20 * 1).

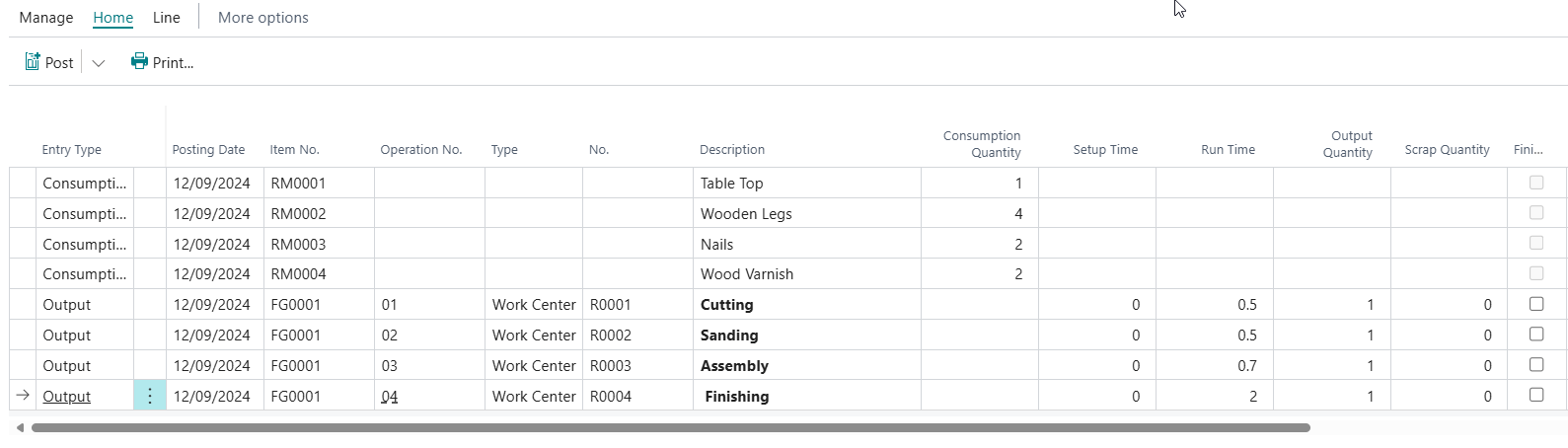

So now lets produce with excess consumption.

Lets see which accounts are affected.

| Type | Qty | Cost | Total | GL Account | Source |

| Material - RM0001 | 1 | 4000 | 4000 | ||

| Material - RM0002 | 4 | 800 | 3200 | ||

| Material - RM0003 | 2 | 200 | 400 | ||

| Material - RM0004 | 2 | 800 | 1600 | ||

| Total Material | 9200 | Credit to Inventory Account | Inventory Posting Setup - Inventory Posting Group of the BOM items - Inventory Account | ||

| Cost of routing is from the work center card | |||||

| Work Center - R0001 | 0.5 | 500 | 250 | ||

| Work Center - R0002 | 0.5 | 400 | 200 | ||

| Work Center - R0003 | 0.7 | 600 | 420 | ||

| Work Center - R0004 | 2 | 450 | 900 | ||

| Total Routing | 1770 | Credit to Direct Cost Applied | General Posting Setup - Gen. Prod Posting Group of the routing - Direct Cost Applied Acc | ||

| Cost of overhead is from the work center card | |||||

| Work Center - R0001 | 0.5 | 20 | 10 | ||

| Work Center - R0002 | 0.5 | 20 | 10 | ||

| Work Center - R0003 | 0.7 | 20 | 14 | ||

| Work Center - R0004 | 2 | 20 | 40 | ||

| Total Routing | 74 | Credit to Overhead Applied | General Posting Setup - Gen. Prod Posting Group of the routing - Overhead Applied Acc |

We can now change the status of the production from Released to Finished and see what happens.

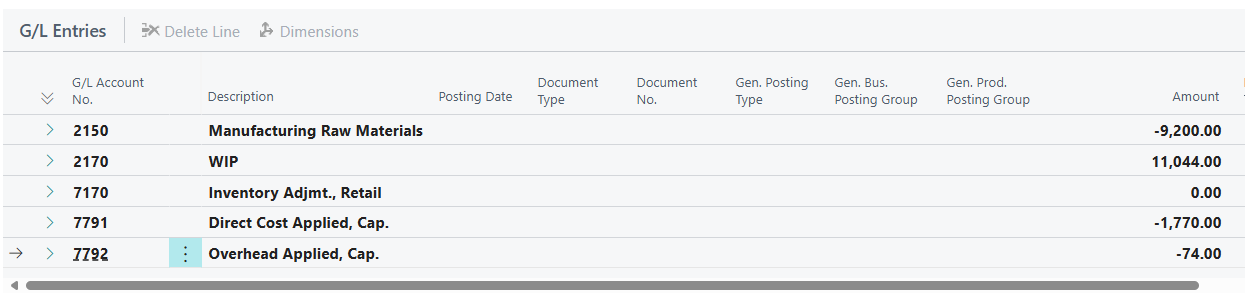

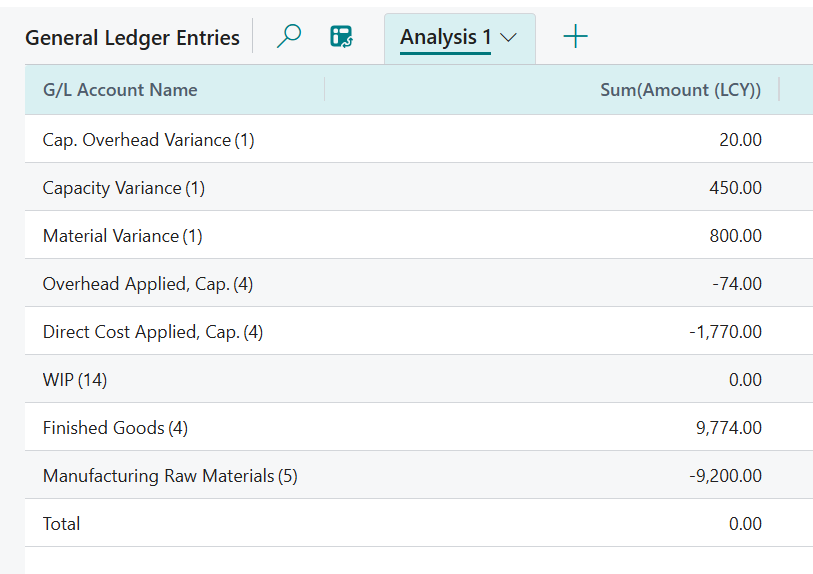

An analysis is done by the document number of the finished production order.

The transactions would be summarised as below

| GL Account | Debit | Credit | Source |

On posting the production journal |

|||

| WIP | 11.044 | ||

| Raw Material Inventory | 9,200 | ||

| Direct Cost Applied | 1,770 | ||

| Overhead Applied, Capacity | 74 | ||

On changing status of the production order to finished. |

|||

| Finished Goods Inventory Account | 9,774 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| Material Variance | 800 | Inventory Posting Setup - Inventory Posting Group of the produced item - Material Variance Account | |

| Capacity Variance | 450 | Inventory Posting Setup - Inventory Posting Group of the produced item - Capacity Variance Account | |

| Capacity Overhead Variance | 20 | Inventory Posting Setup - Inventory Posting Group of the produced item - Capacity Overhead Variance Account | |

| WIP | 11.044 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account | |

When changing status from released to finished, the system checks the standard cost of the finished good ( remember when we calculated the std cost and checked the cost shares) - 9,774.

Upon checking it will always post the standard cost only in the Finished Goods Inventory Account. The difference between the WIP and standard cost of the item are transferred to relevant variance accounts in the income statement accounts.

Our capacity overhead variance is 20 because we had 2 hours in Work Center - R0004 which has a standard production time of 1 hour (extra 1 hour * 20 is the overhead variance).

If no variance is available, no variance accounts will be posted to.

If less is consumed in production, the variances posting would be in the credit side.

The credit treatment of the Overhead Applied, Capacity is similar to Direct Cost Applied, Labour - to negate the expenses e.g rent, water, salary, power that have been capitalized as part of the finished item standard cost and will drop to the income statement as COGs.

NB

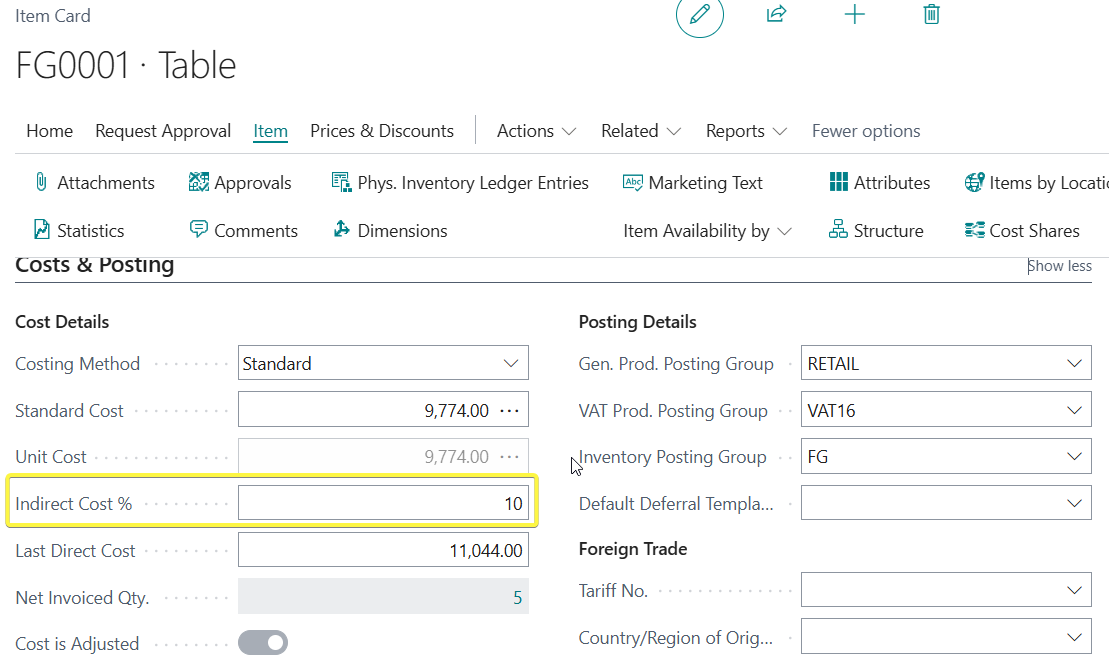

The system also offers another option to register the overhead as an Indirect Cost % on the item card of the finished good. I will add 10% for testing purposes and remove the overheads on the routing.

Recalculate my standard cost.

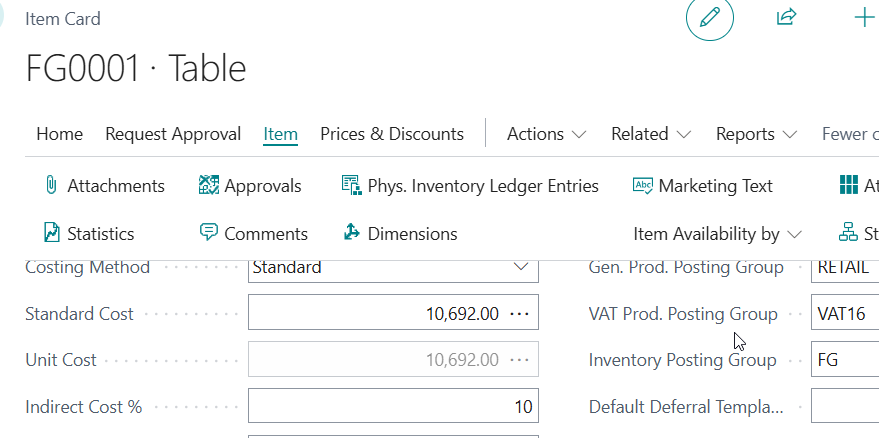

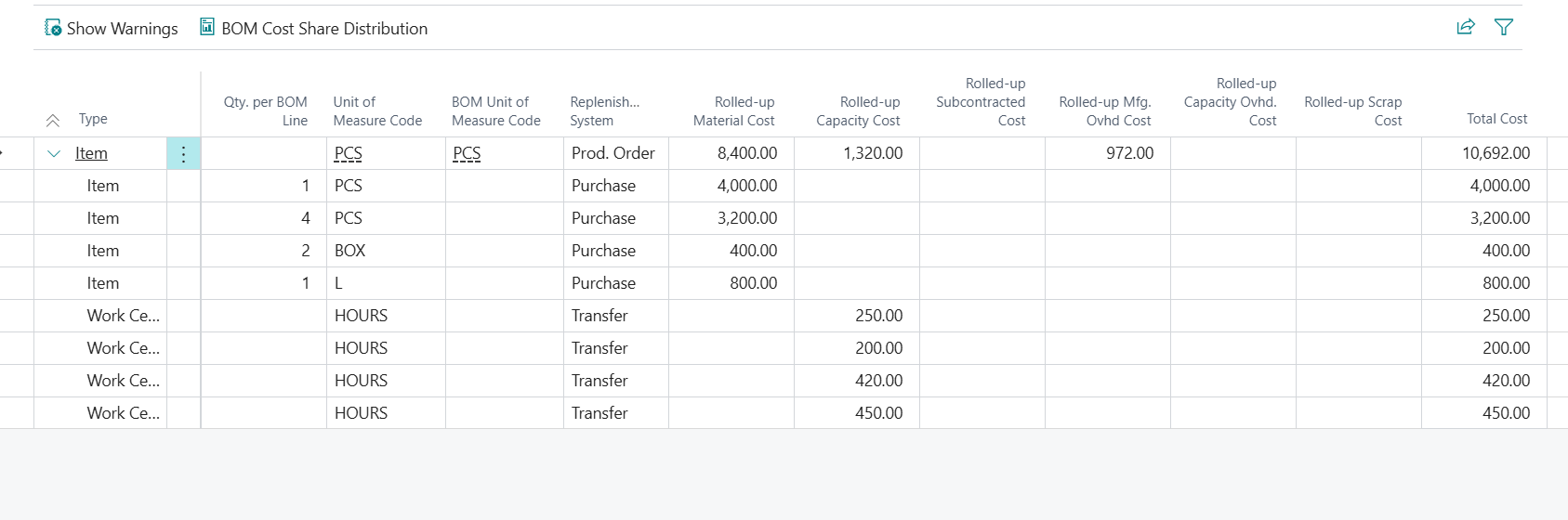

My new standard cost is 9720 + 972 ( 9720 * 10%) = 10,692

Lets produce.

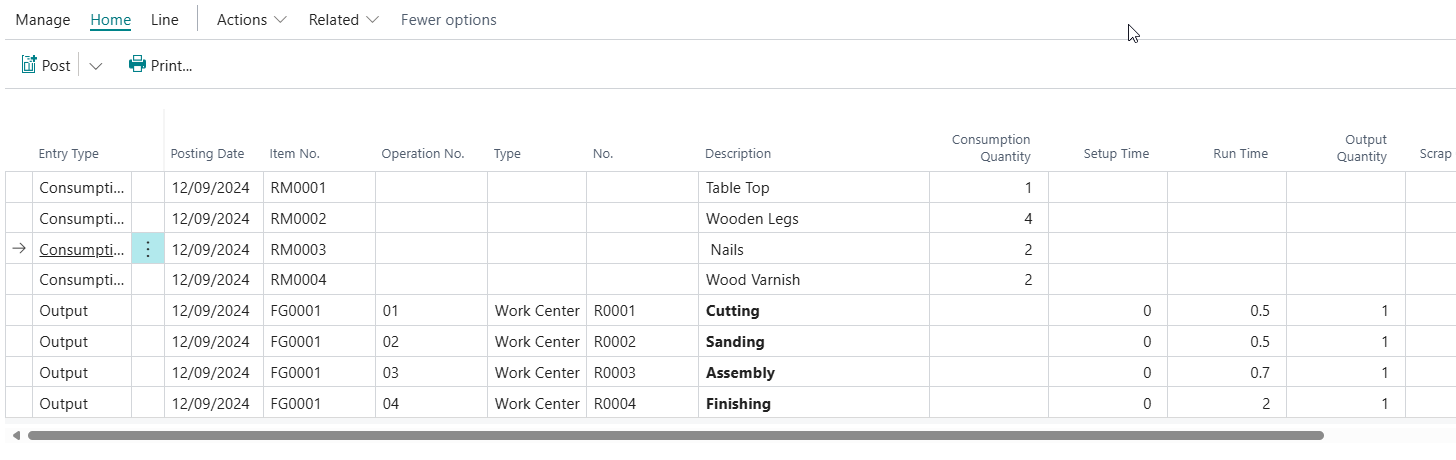

Lets see which accounts are affected.

| Type | Qty | Cost | Total | GL Account | Source |

| Material - RM0001 | 1 | 4000 | 4000 | ||

| Material - RM0002 | 4 | 800 | 3200 | ||

| Material - RM0003 | 2 | 200 | 400 | ||

| Material - RM0004 | 2 | 800 | 1600 | ||

| Total Material | 9200 | Credit to Inventory Account | Inventory Posting Setup - Inventory Posting Group of the BOM items - Inventory Account | ||

| Cost of routing is from the work center card | |||||

| Work Center - R0001 | 0.5 | 500 | 250 | ||

| Work Center - R0002 | 0.5 | 400 | 200 | ||

| Work Center - R0003 | 0.7 | 600 | 420 | ||

| Work Center - R0004 | 2 | 450 | 900 | ||

| Total Routing | 1770 | Credit to Direct Cost Applied | General Posting Setup - Gen. Prod Posting Group of the routing - Direct Cost Applied Acc |

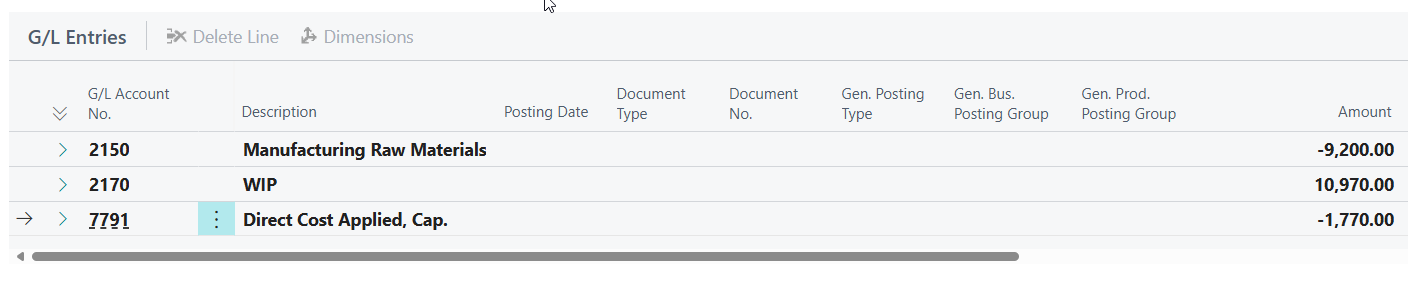

We can now change the status of the production from Released to Finished and see what happens.

An analysis is done by the document number of the finished production order.

The transactions would be summarised as below

| GL Account | Debit | Credit | Source |

On posting the production journal |

|||

| WIP | 10,970 | ||

| Raw Material Inventory | 9,200 | ||

| Direct Cost Applied | 1,770 | ||

On changing status of the production order to finished. |

|||

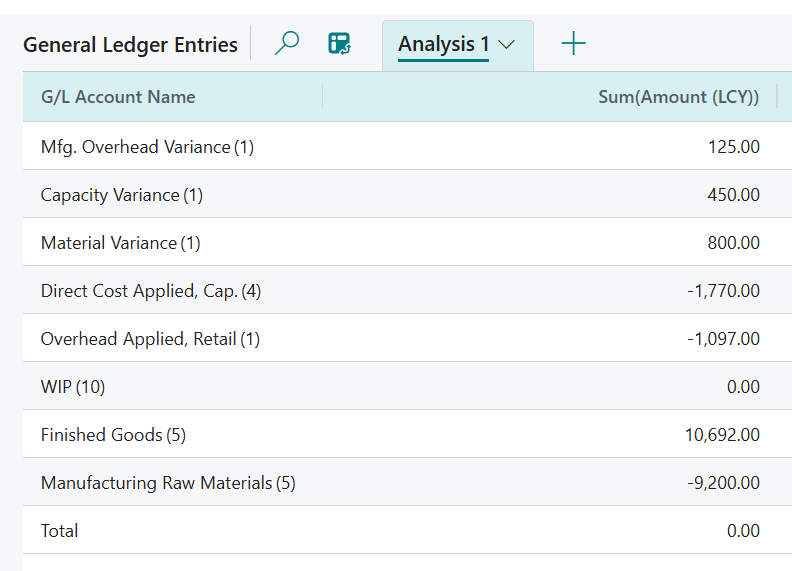

| Finished Goods Inventory Account | 10,692 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| Material Variance | 800 | Inventory Posting Setup - Inventory Posting Group of the produced item - Material Variance Account | |

| Capacity Variance | 450 | Inventory Posting Setup - Inventory Posting Group of the produced item - Capacity Variance Account | |

| Manufacturing Overhead Variance | 125 | Inventory Posting Setup - Inventory Posting Group of the produced item - Manufacturing Overhead Variance Account | |

| WIP | 10,970 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account | |

| Overhead Applied , Retail | 1,097 | General Posting Setup - Gen. Prod Posting Group of the produced item - Overhead Applied Acc | |

A manufacturing overhead variance will be posted which will be be (Material variance + Capacity variance) Indirect Cost % = (800 + 450) * 10% = 125

Overhead Applied Retails is 10% of the total WIP ( actual direct production cost) - 10,970 * 10% = 1097

The credit treatment of the Overhead Applied, Mfg Overhead is similar to Direct Cost Applied, Labour - to negate the expenses e.g rent, water, salary, power that have been capitalized as part of the finished item standard cost and will drop to the income statement as COGs.

Thats marks the end of overheads. In the final post we look at subcontracting.