Manufacturing Postings Pt. 1 - Financial Postings without Variance

Hi Readers,

Today's post will examine the impact of manufacturing postings on our financials.

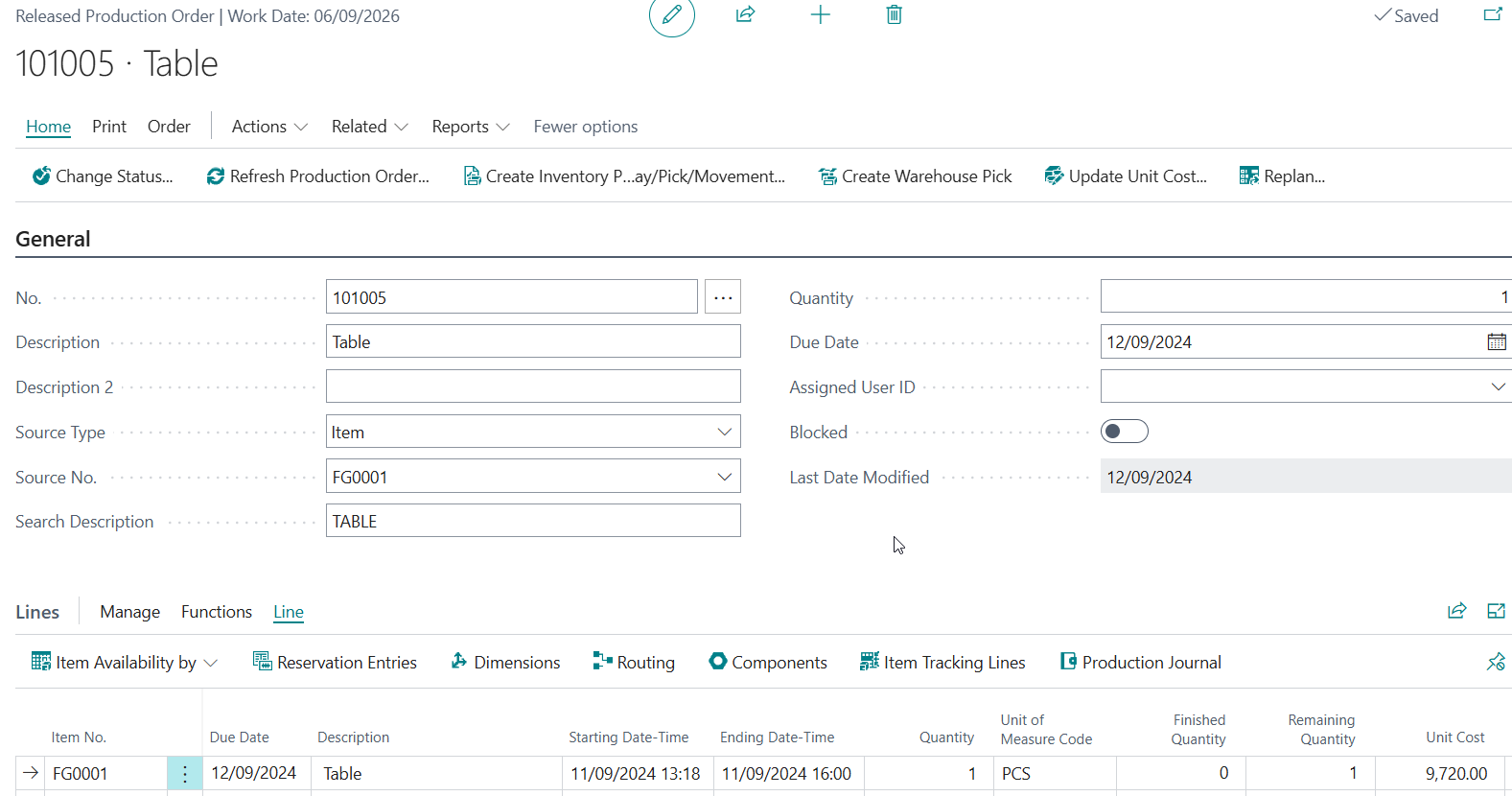

My finished item will be a table.

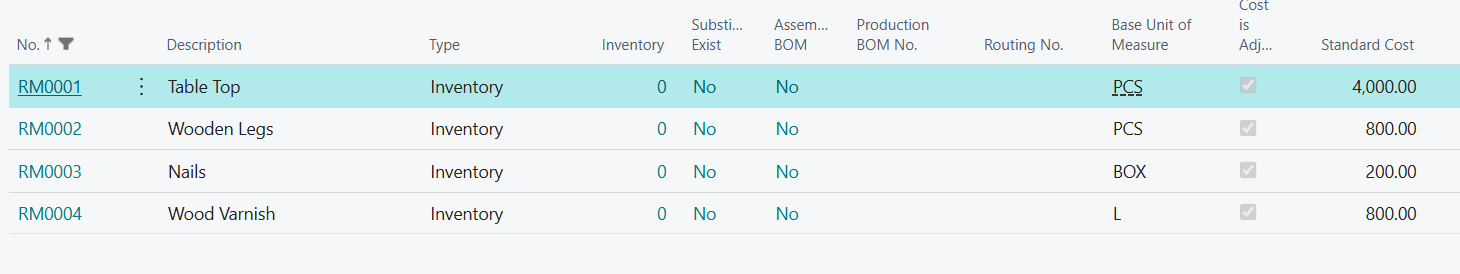

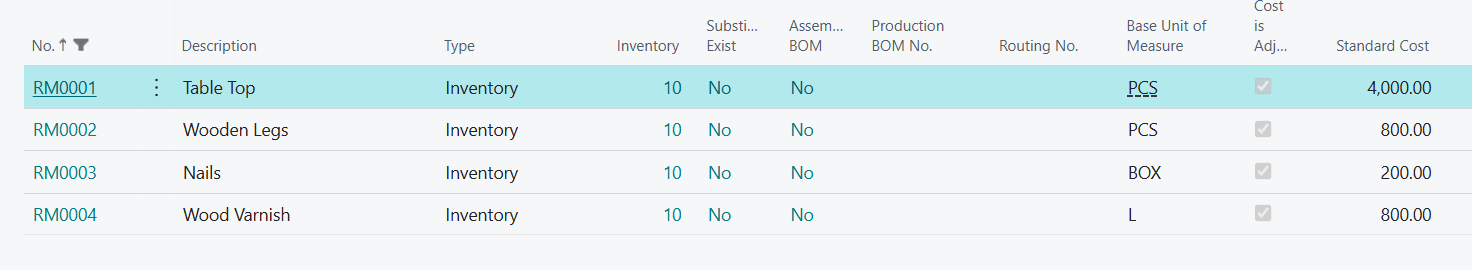

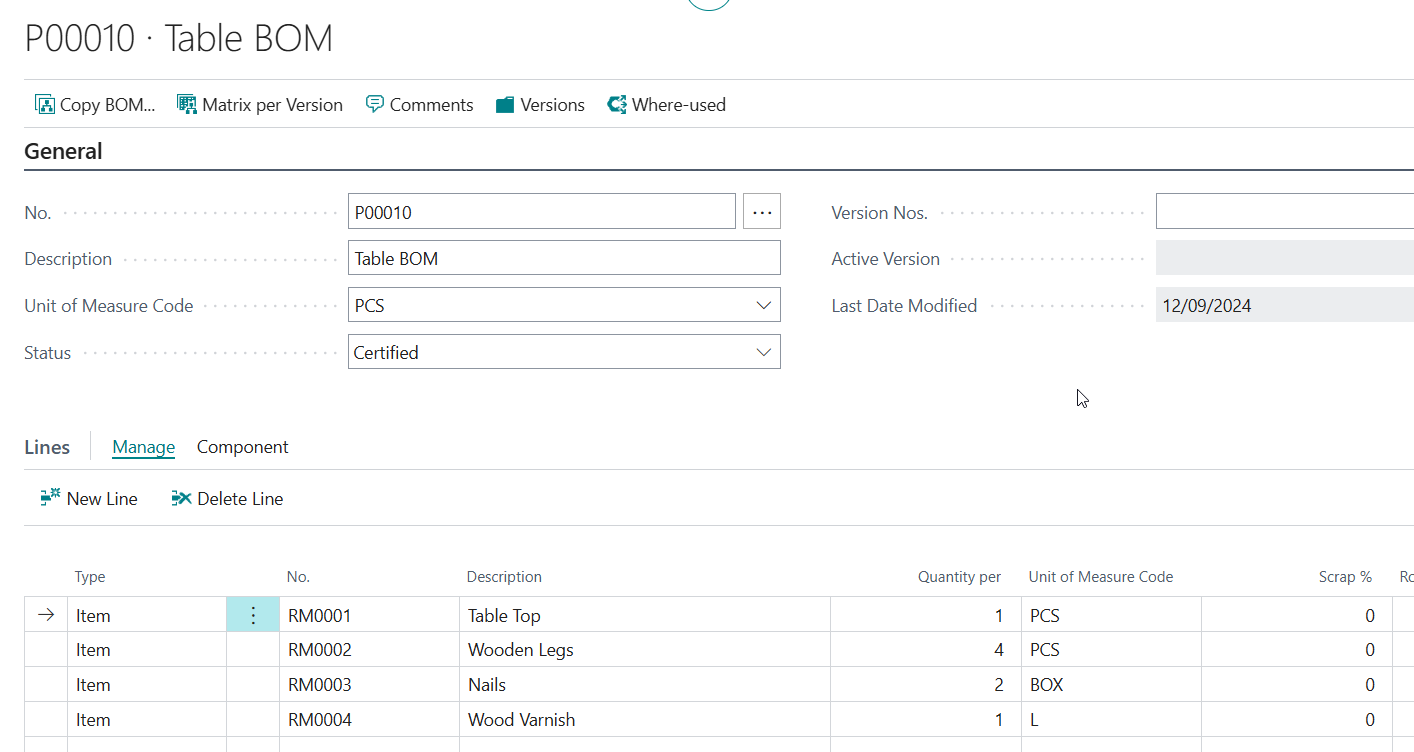

The raw materials to be utilized are as follows.

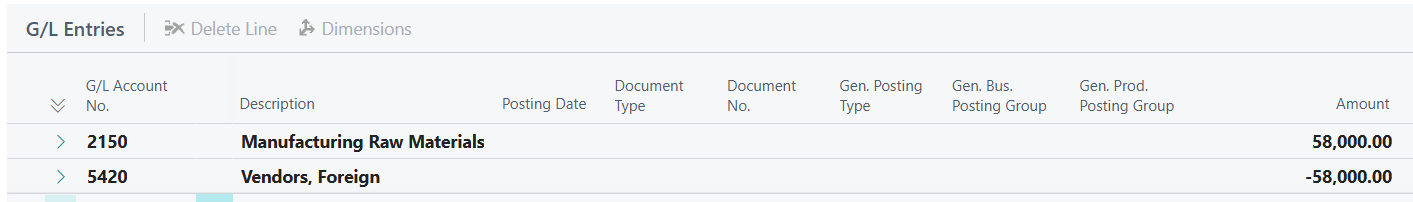

A purchase of 10 units each will be made.

The GL Accounts will be affected as follows by the purchase ( Debit Inventory, Credit Vendors).

The raw materials are now stocked.

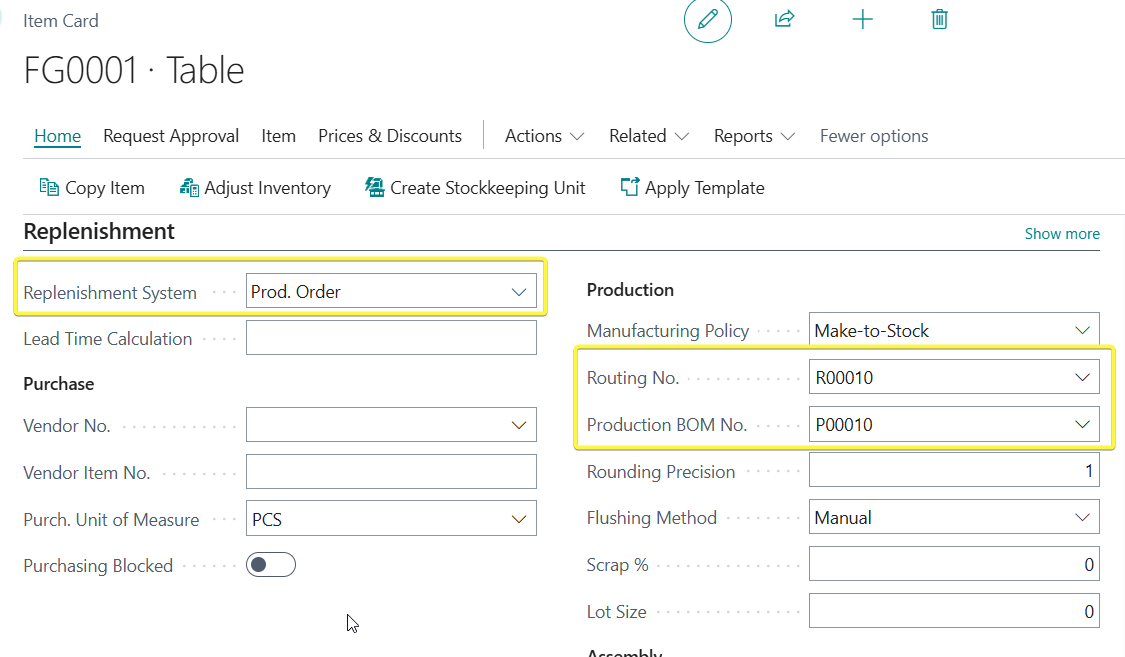

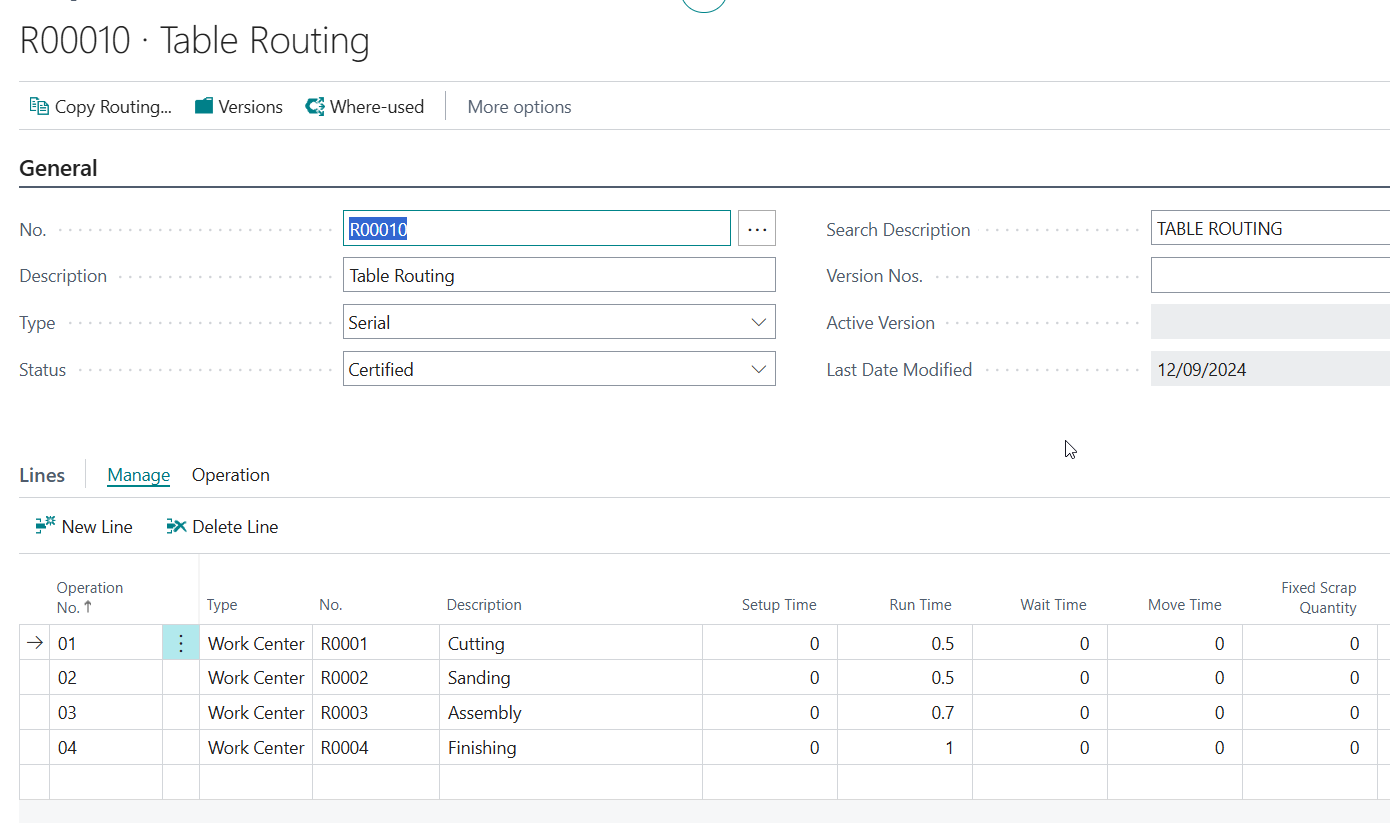

I also have a BOM and Routing for my Table Finished Item.

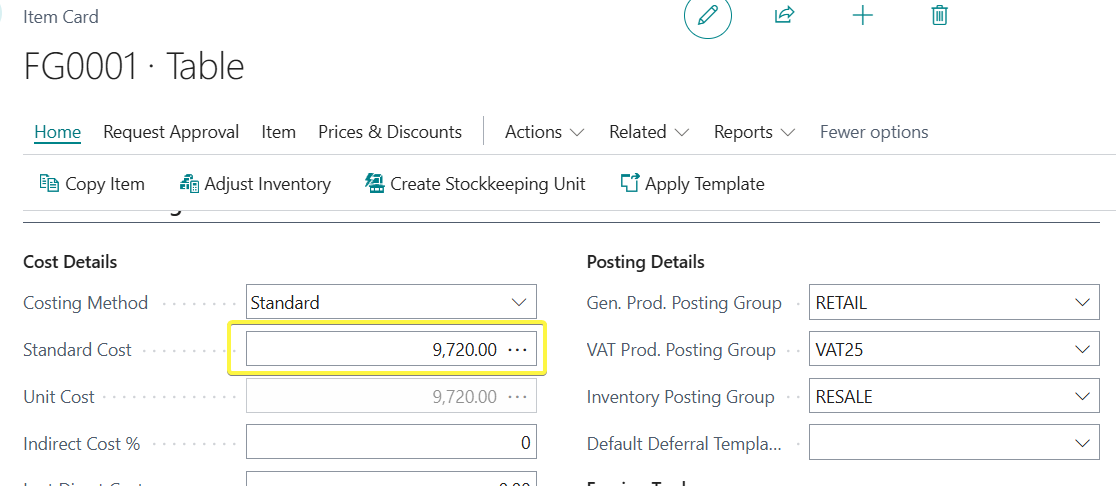

The standard cost of producing the finished item has to be calculcated. On the item card click on Related >> Bill of Materials >> Production >> Calc. Production Std. Cost >> All Levels

The system will update the standard cost of producing one table ( total routing cost + total materials cost) on the standard cost field of the table.

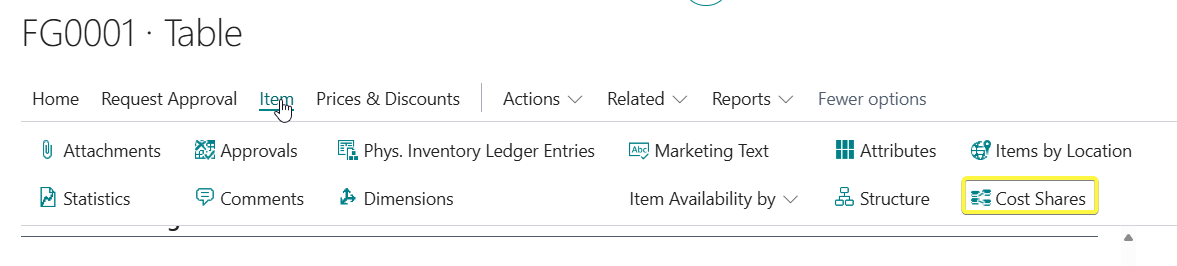

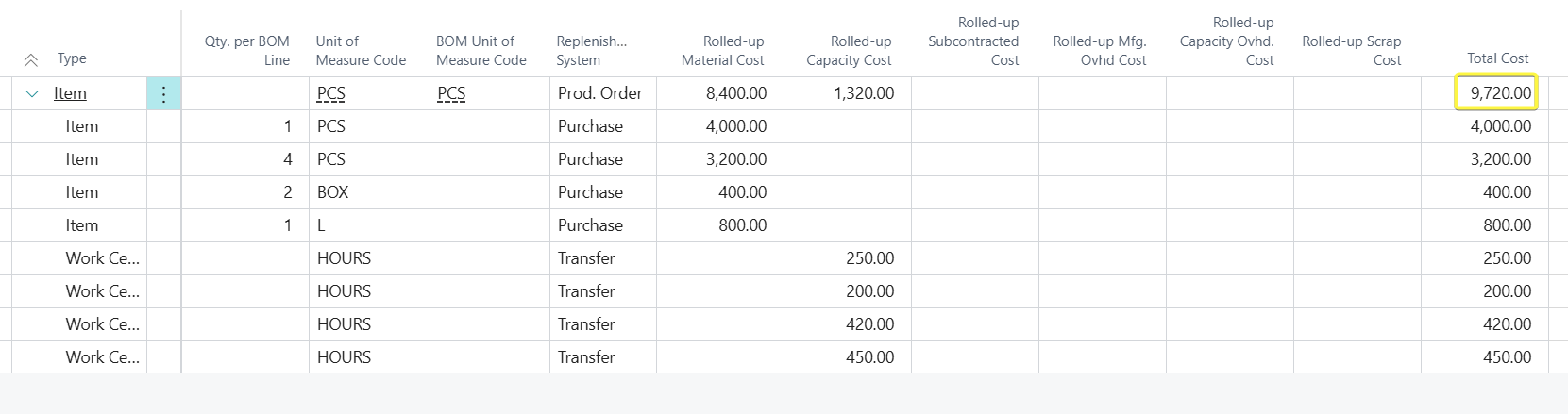

If you wish to see the breakdown of the cost, click on Item >> Cost Shares

Now lets produce our item. Creating a released prod order.

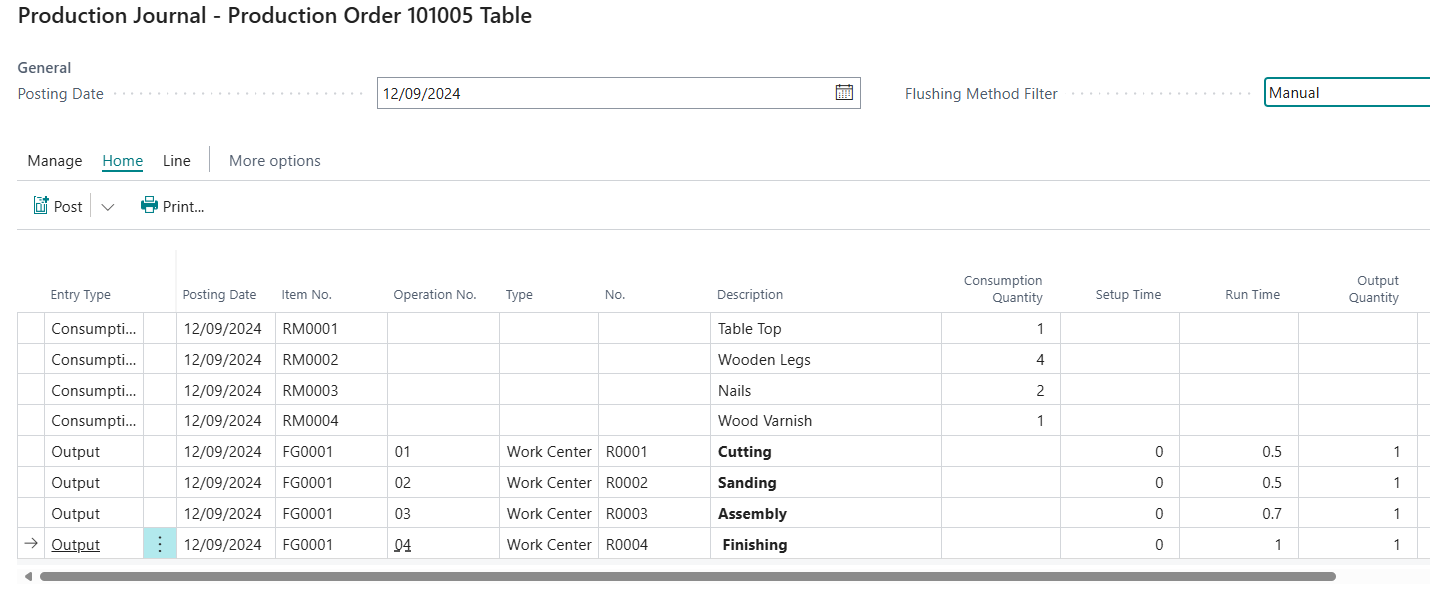

Next step is to open the production journal and fill in the actual. We will have various scenarios:

A. There are no variances - The standard item qty and routing is the same as the actual.

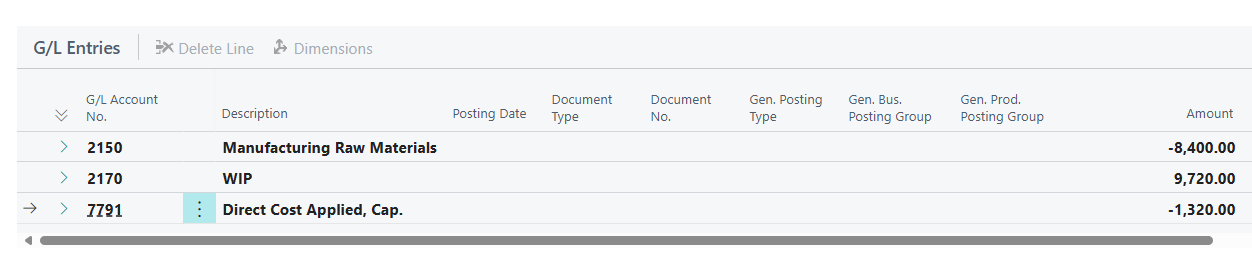

Lets see which accounts are affected.

Lets go over what has happened.

| Type | Qty | Cost | Total | GL Account | Source |

| Material - RM0001 | 1 | 4000 | 4000 | ||

| Material - RM0002 | 4 | 800 | 3200 | ||

| Material - RM0003 | 2 | 200 | 400 | ||

| Material - RM0004 | 1 | 800 | 800 | ||

| Total Material | 8400 | Credit to Inventory Account | Inventory Posting Setup - Inventory Posting Group of the BOM items - Inventory Account | ||

| Cost of routing is from the work center card | |||||

| Work Center - R0001 | 0.5 | 500 | 250 | ||

| Work Center - R0002 | 0.5 | 400 | 200 | ||

| Work Center - R0003 | 0.7 | 600 | 420 | ||

| Work Center - R0004 | 1 | 450 | 450 | ||

| Total Routing | 1320 | Credit to Direct Cost Applied | General Posting Setup - Gen. Prod Posting Group of the routing - Direct Cost Applied Acc | ||

| 9720 | Debit to WIP | Inventory Posting Setup - Inventory Posting Group of the BOM items - WIP Account |

We can now change the status of the production from Released to Finished and see what happens.

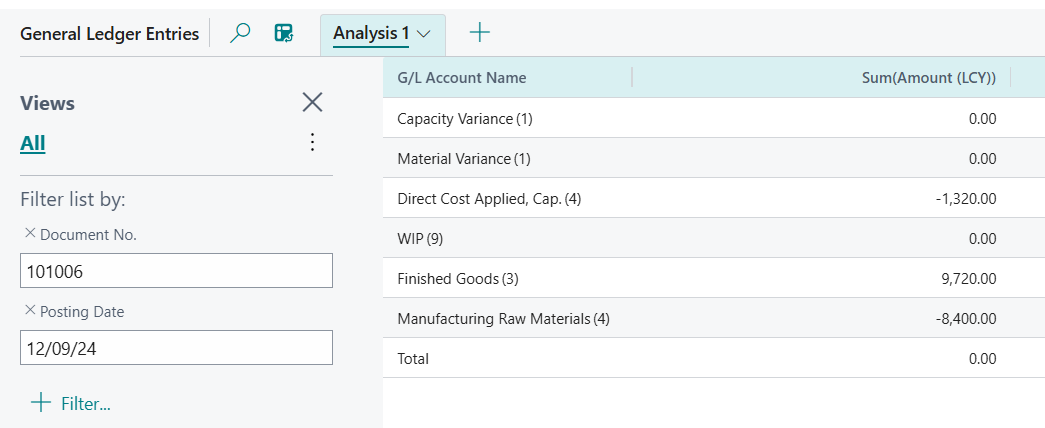

An analysis is done by the document number of the finished production order.

Our 9,720 value is now sitting in Finished Goods so what happened?

| GL Account | Debit | Credit | Source |

| Finished Goods | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| WIP | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account |

From the transactions above we can note that the amount is transferred from our WIP to the inventory account of the finished item.

In a summarised format the full manufacturing posting would be :

| GL Account | Debit | Credit | Source |

On posting the production journal |

|||

| WIP | 9,720 | ||

| Raw Material Inventory | 8,400 | ||

| Direct Cost Applied | 1,320 | ||

On changing status of the production order to finished. |

|||

| Finished Goods Inventory Account | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| WIP | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account | |

We may ask ourself what is the purpose of crediting the Direct Cost Applied for our routing costs.

This is done to decrease the balance in the relevant expense since those costs are now being capitalized into the production process.

To explain, the cost of 1,320 is capitalized 'inside' of 9,720 in the Finished Goods Inventory Account after leaving the WIP account.

When the workers are paid by the business , we will have : Debit to Direct Salary Expenses & Credit to Bank / Salary Payable.

When the item is sold we will have : Debit to COGS of 9,720 & Credit to Finished Goods Inventory Account of 9,720.

At this point, we have two duplicate debit expenses in our income statement - Direct Salary Expenses and the '1320' routing cost component inside COGs.

Therefore, the credit of -1,320 to Direct Cost Applied is used to negate the Direct Salary Expenses debit of same amount 1320 to leave the debit '1320' routing cost component inside COGs.

In Part 2, we look at variances and how they affect our books.