Manufacturing Postings Pt. 2- Financial Postings with Variance

Hi Readers,

In Pt. 2 , we look at how variances affect our books

Link to Pt.2 Link to Pt. 1

B. Using excess amount of material / routing

Lets assume that in a production run for the table , the varnish required an extra liter. Therefore another hour was spent in Finishing.

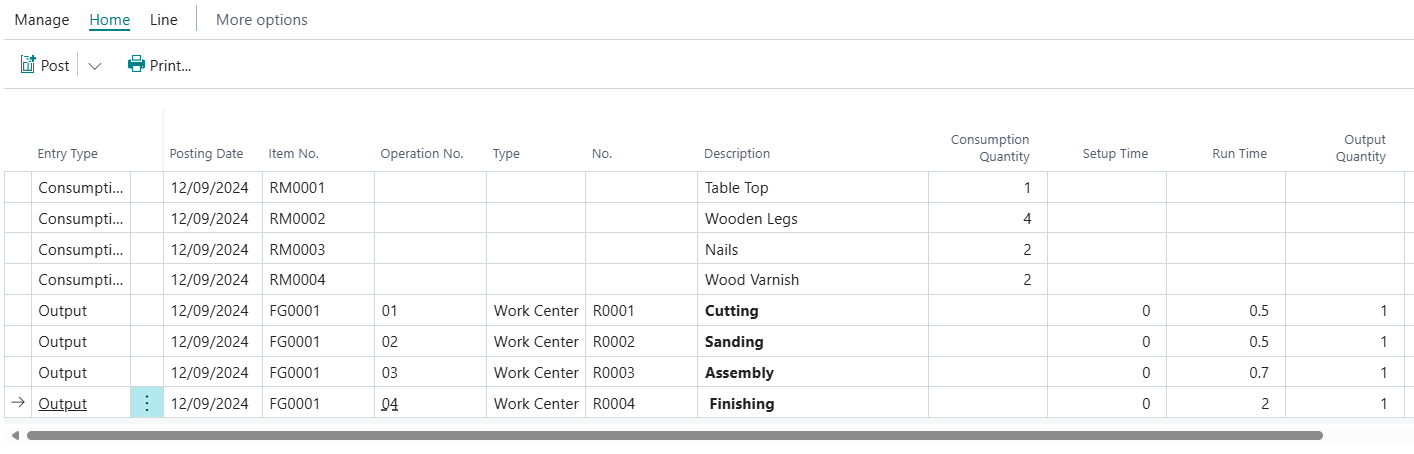

Our production journal will be as below.

Lets see which accounts are affected.

| Type | Qty | Cost | Total | GL Account | Source |

| Material - RM0001 | 1 | 4000 | 4000 | ||

| Material - RM0002 | 4 | 800 | 3200 | ||

| Material - RM0003 | 2 | 200 | 400 | ||

| Material - RM0004 | 2 | 800 | 1600 | ||

| Total Material | 9200 | Credit to Inventory Account | Inventory Posting Setup - Inventory Posting Group of the BOM items - Inventory Account | ||

| Cost of routing is from the work center card | |||||

| Work Center - R0001 | 0.5 | 500 | 250 | ||

| Work Center - R0002 | 0.5 | 400 | 200 | ||

| Work Center - R0003 | 0.7 | 600 | 420 | ||

| Work Center - R0004 | 2 | 450 | 900 | ||

| Total Routing | 1770 | Credit to Direct Cost Applied | General Posting Setup - Gen. Prod Posting Group of the routing - Direct Cost Applied Acc | ||

| 10970 | Debit to WIP | Inventory Posting Setup - Inventory Posting Group of the BOM items - WIP Account |

We can now change the status of the production from Released to Finished and see what happens.

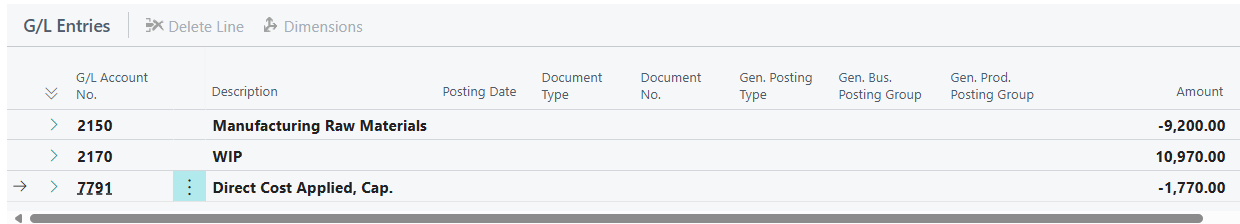

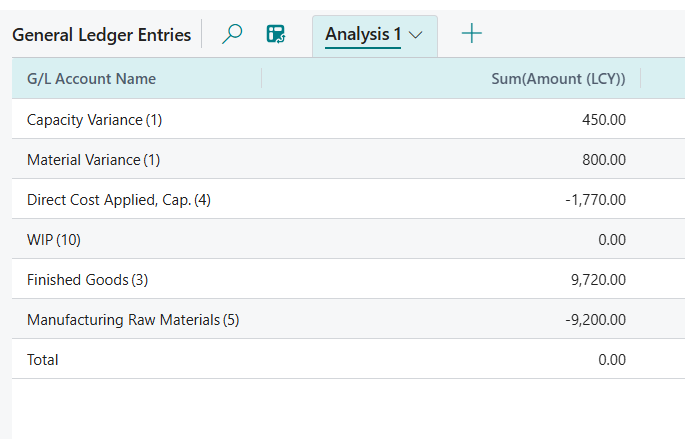

An analysis is done by the document number of the finished production order.

The transactions would be summarised as below

| GL Account | Debit | Credit | Source |

On posting the production journal |

|||

| WIP | 10,970 | ||

| Raw Material Inventory | 9,200 | ||

| Direct Cost Applied | 1,770 | ||

On changing status of the production order to finished. |

|||

| Finished Goods Inventory Account | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| Material Variance | 800 | Inventory Posting Setup - Inventory Posting Group of the produced item - Material Variance Account | |

| Capacity Variance | 450 | Inventory Posting Setup - Inventory Posting Group of the produced item - Capacity Variance Account | |

| WIP | 10,970 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account | |

When changing status from released to finished, the system checks the standard cost of the finished good ( remember when we calculated the std cost and checked the cost shares) - 9,720.

Upon checking it will always post the standard cost only in the Finished Goods Inventory Account. The difference between the WIP and standard cost of the item are transferred to relevant variance accounts in the income statement accounts.

C. Using less amount of material / routing

Lets assume that in a production run for the table , the amount spent in Finishing was 30 minutes (0.5).

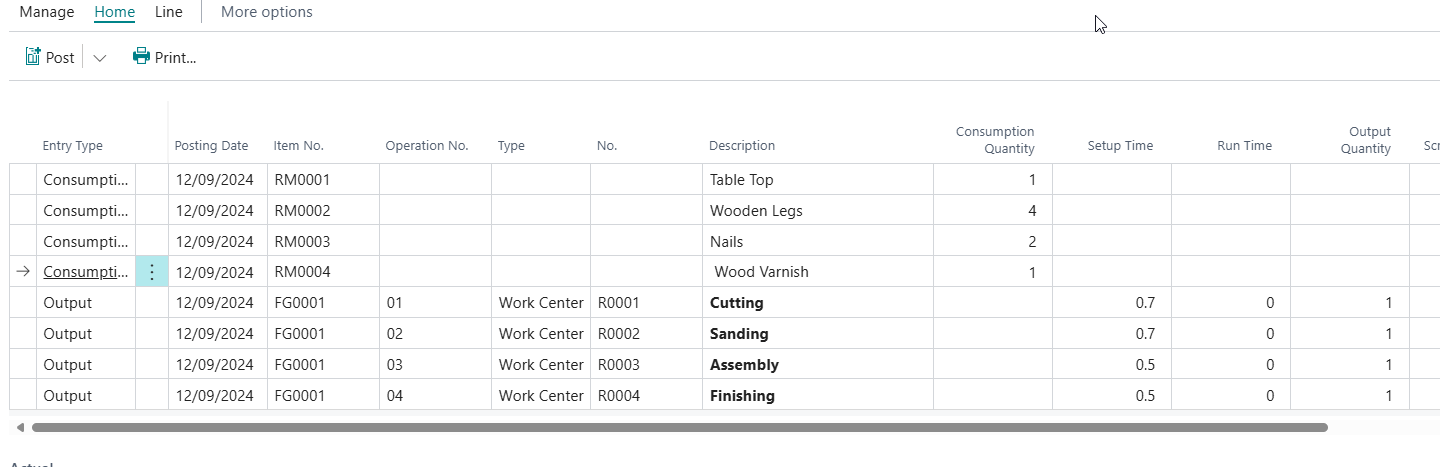

Our production journal will be as below.

Lets see which accounts are affected.

| Type | Qty | Cost | Total | GL Account | Source |

| Material - RM0001 | 1 | 4000 | 4000 | ||

| Material - RM0002 | 4 | 800 | 3200 | ||

| Material - RM0003 | 2 | 200 | 400 | ||

| Material - RM0004 | 1 | 800 | 800 | ||

| Total Material | 8400 | Credit to Inventory Account | Inventory Posting Setup - Inventory Posting Group of the BOM items - Inventory Account | ||

| Cost of routing is from the work center card | |||||

| Work Center - R0001 | 0.5 | 500 | 250 | ||

| Work Center - R0002 | 0.5 | 400 | 200 | ||

| Work Center - R0003 | 0.7 | 600 | 420 | ||

| Work Center - R0004 | 0.5 | 450 | 225 | ||

| Total Routing | 1095 | Credit to Direct Cost Applied | General Posting Setup - Gen. Prod Posting Group of the item - Direct Cost Applied Acc | ||

| 9495 | Debit to WIP | Inventory Posting Setup - Inventory Posting Group of the BOM items - WIP Account |

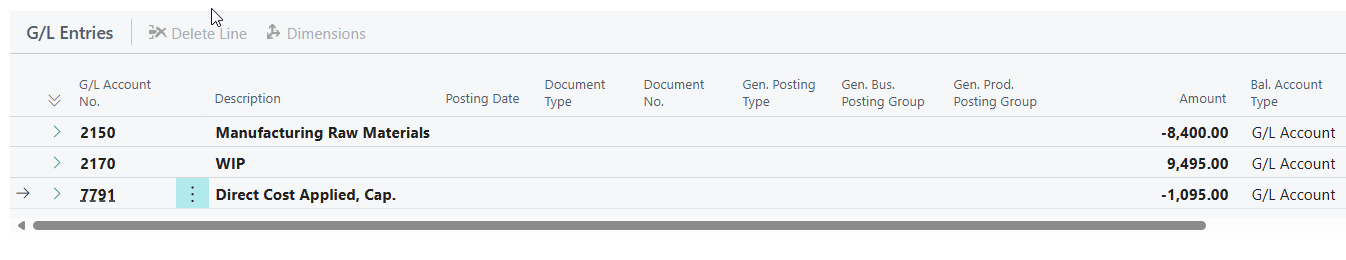

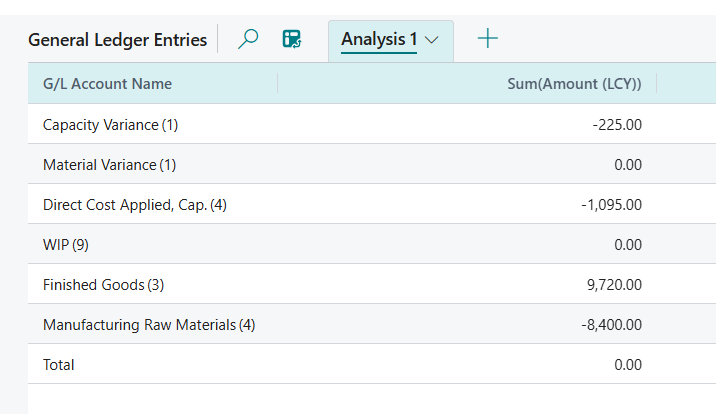

We can now change the status of the production from Released to Finished and see what happens.

An analysis is done by the document number of the finished production order.

The transactions would be summarised as below

| GL Account | Debit | Credit | Source |

On posting the production journal |

|||

| WIP | 9,495 | ||

| Raw Material Inventory | 8,400 | ||

| Direct Cost Applied | 1,095 | ||

On changing status of the production order to finished. |

|||

| Finished Goods Inventory Account | 9,720 | Inventory Posting Setup - Inventory Posting Group of the produced item - Inventory Account | |

| Capacity Variance | 225 | Inventory Posting Setup - Inventory Posting Group of the produced item - Capacity Variance Account | |

| WIP | 9,495 | Inventory Posting Setup - Inventory Posting Group of the produced item - WIP Account | |

When changing status from released to finished, the system also checks the standard cost of the finished good ( remember when we calculated the std cost and checked the cost shares) - 9,720.

Upon checking it will always post the standard cost only in the Finished Goods Inventory Account - even if the WIP amount is lower. The difference between the WIP and standard cost of the item are transferred to relevant variance accounts as credits in the income statement accounts.

That concludes our Part 2 Post. In Part 3, we look at overheads.