Transactional Data Migration Pt. 3 : Trial Balance

Hi Readers,

In the previous 2 post (Transaction Data Migration Pt. 1 & Transaction Data Migration Pt. 2 ) we looked at migrating the sub-ledger accounts.

In this post, we look at migrating the trial balance.

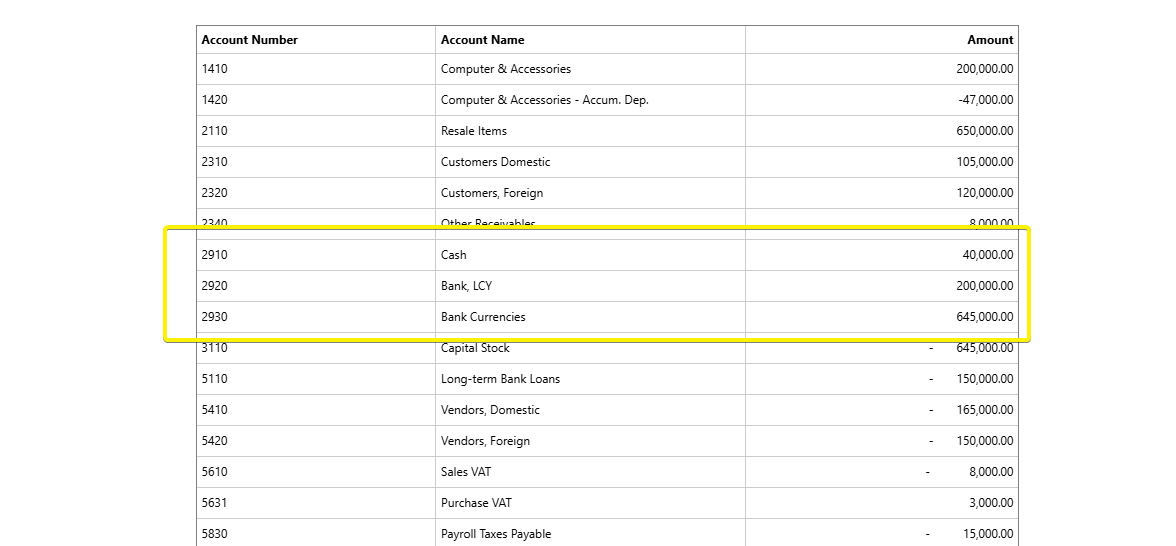

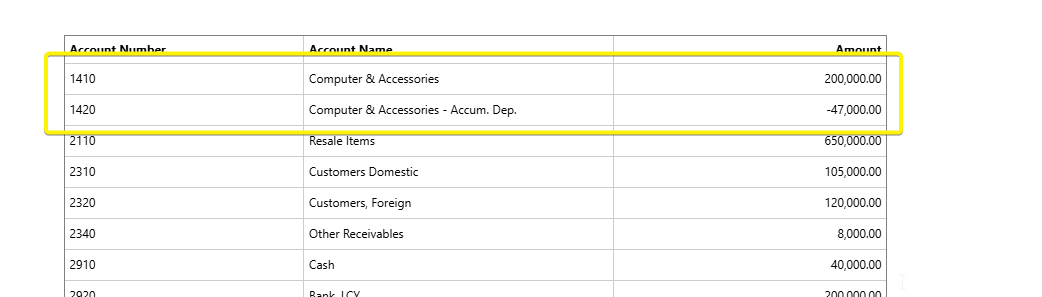

The Trial balance data has been provided as below.

| Account Number | Account Name | Amount |

| 1410 | Computer & Accessories | 200,000.00 |

| 1420 | Computer & Accessories - Accum. Dep. | -47,000.00 |

| 2110 | Resale Items | 650,000.00 |

| 2310 | Customers Domestic | 105,000.00 |

| 2320 | Customers, Foreign | 120,000.00 |

| 2340 | Other Receivables | 8,000.00 |

| 2910 | Cash | 40,000.00 |

| 2920 | Bank, LCY | 200,000.00 |

| 2930 | Bank Currencies | 645,000.00 |

| 3110 | Capital Stock | - 645,000.00 |

| 5110 | Long-term Bank Loans | - 150,000.00 |

| 5410 | Vendors, Domestic | - 165,000.00 |

| 5420 | Vendors, Foreign | - 150,000.00 |

| 5610 | Sales VAT | - 8,000.00 |

| 5631 | Purchase VAT | 3,000.00 |

| 5830 | Payroll Taxes Payable | - 15,000.00 |

| 5850 | Employees Payable | - 320,000.00 |

| 6110 | Sales, Retail - Dom. | - 600,000.00 |

| 8130 | Repairs and Maintenance | 5,000.00 |

| 8210 | Office Supplies | 2,000.00 |

| 8530 | Repairs and Maintenance | 4,000.00 |

| 8710 | Wages | 30,000.00 |

| 8720 | Salaries | 40,000.00 |

| 8820 | Depreciation, Equipment | 15,000.00 |

| 8830 | Depreciation, Vehicles | 8,000.00 |

| 8840 | Gains and Losses | - 2,000.00 |

| 8910 | Other Costs of Operations | 10,000.00 |

| 9110 | Interest on Bank Balances | - 10,000.00 |

| 9220 | Interest on Bank Loans | 7,000.00 |

| 9510 | Corporate Tax | 20,000.00 |

Before uploading the TB on the general journal, we have to make several checks:

Check 1 : Confirm the TB is balancing

The debits and credits should be balancing.

Check 2 : The receivables sub-ledger amount should tally with the amount in TB provided.

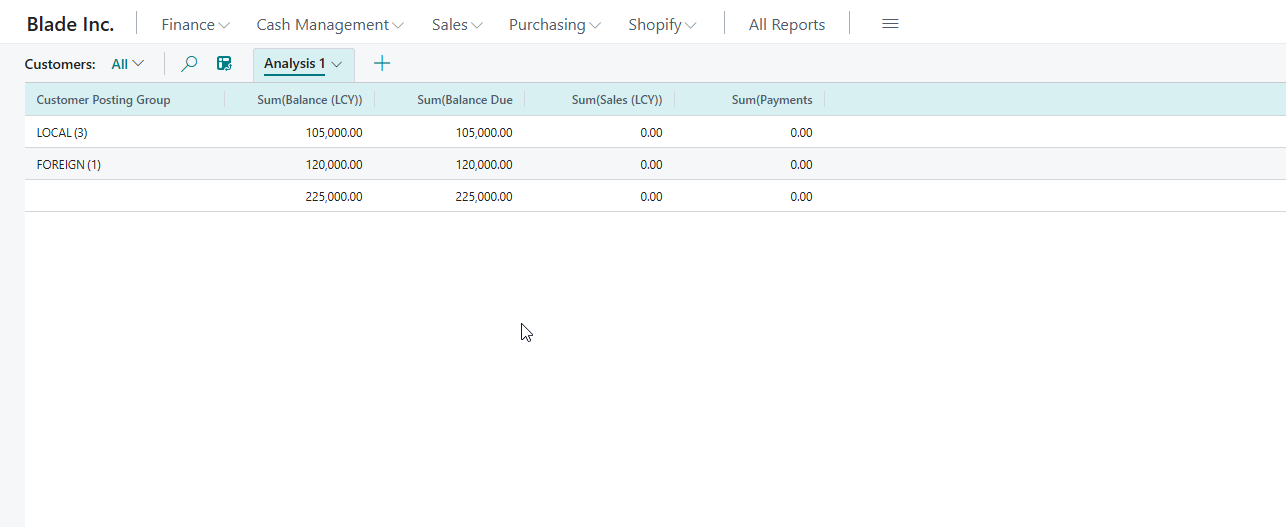

I will use the analyze feature on the customer list to group the customer balance by customer posting group.

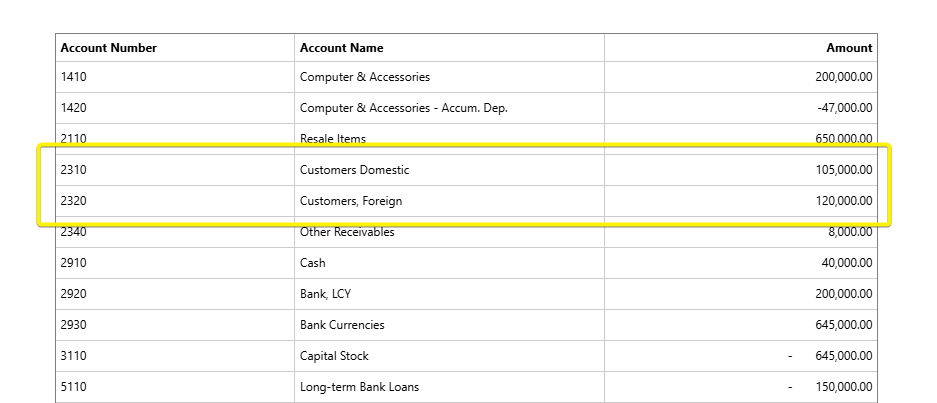

The figure will be counterchecked against the accounts specified in the customer posting group as seen below.

Check 3 : The payables sub-ledger amount should tally with the amount in the TB provided.

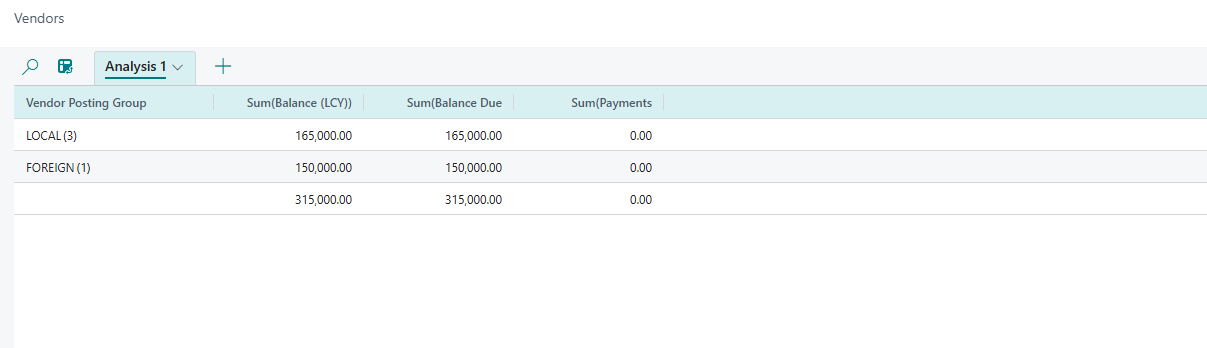

The vendors list is analyzed and grouped by the vendor posting group.

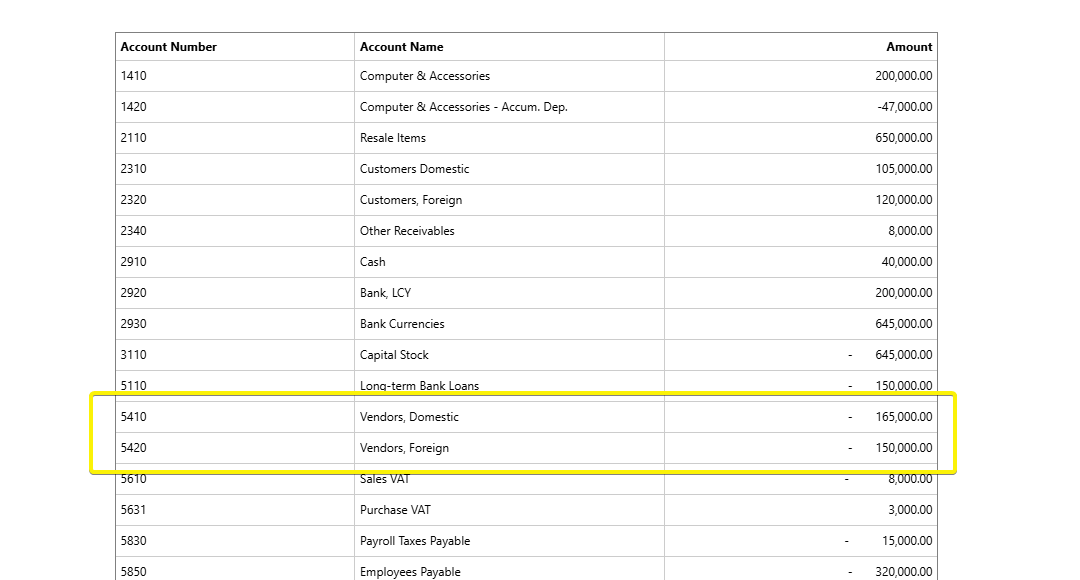

The figure will be counterchecked against the accounts specified in the vendor posting groups as seen below.

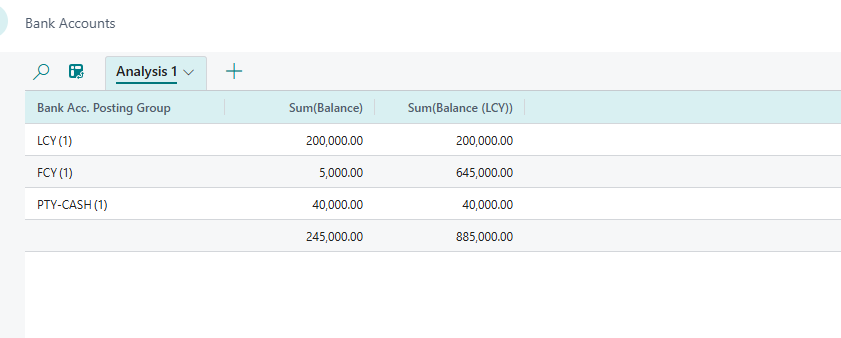

Check 4 : The bank account sub-ledger amount tally with the amount in the TB provided.

The bank account list is analyzed and grouped by the bank account posting group. We use the Balance (LCY) field.

The figure will be counterchecked against the accounts specified in the bank account posting groups as seen below.

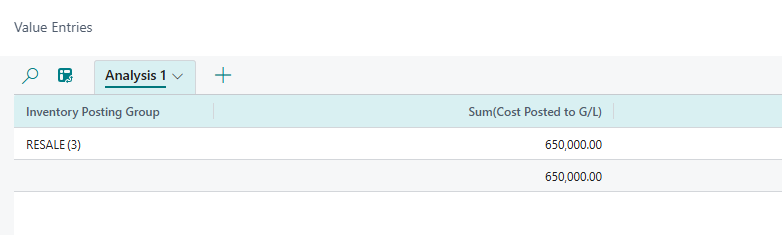

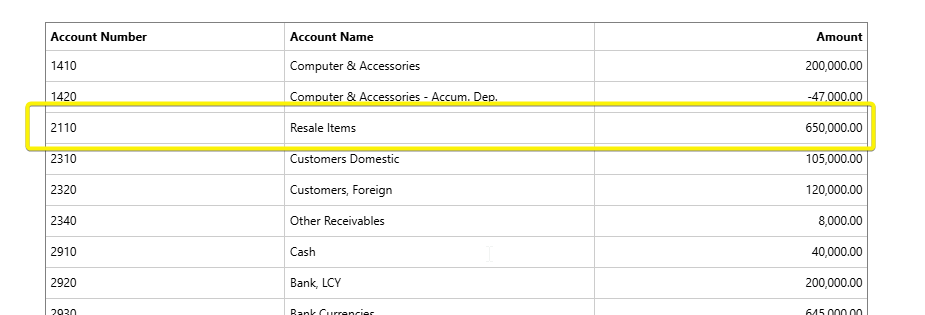

Check 4 : The item sub-ledger amount tally with the amount in the TB provided.

The value entries are analyzed and grouped by the inventory posting group. We use the Cost Posted to G/L field.

The figure will be counterchecked against the accounts specified in the bank account posting groups as seen below.

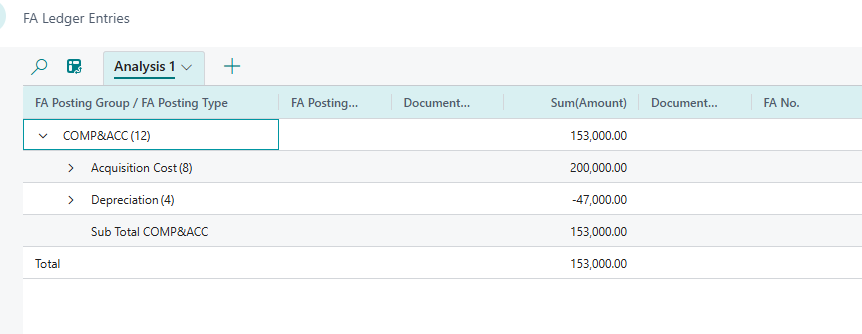

Check 5 : The fixed sub-ledger amount tally with the amount in the TB provided.

The fixed asset entries are analyzed and grouped by the FA Posting Group and FA Posting Type.

The figure will be counterchecked against the accounts specified in the fixed asset posting groups as seen below.

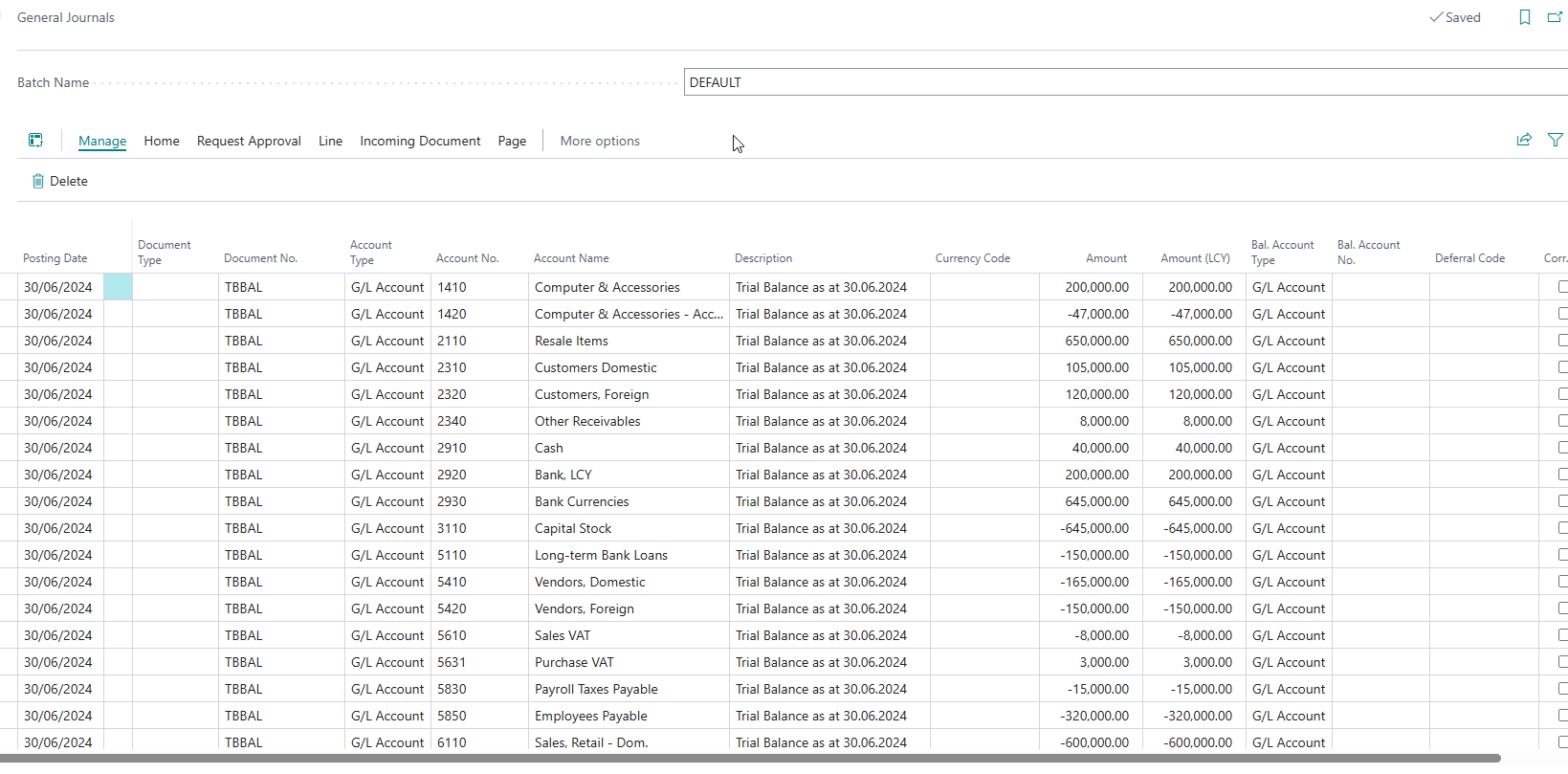

Once all the checks have passed, you can load the journal with the TB and post.

That would mark the end of the transactional data migration.