Transactional Data Migration Pt. 2 : Fixed Assets & Items

Hi Readers,

In Part 1 ( Transactional Data Migration Pt. 1 ), we covered receivables, payables and bank account balances.

In this post , we will cover migrating item and fixed asset transaction data.

Items

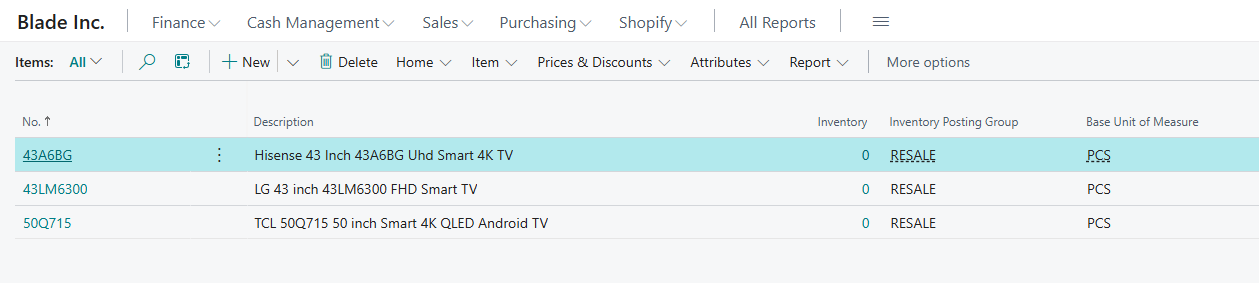

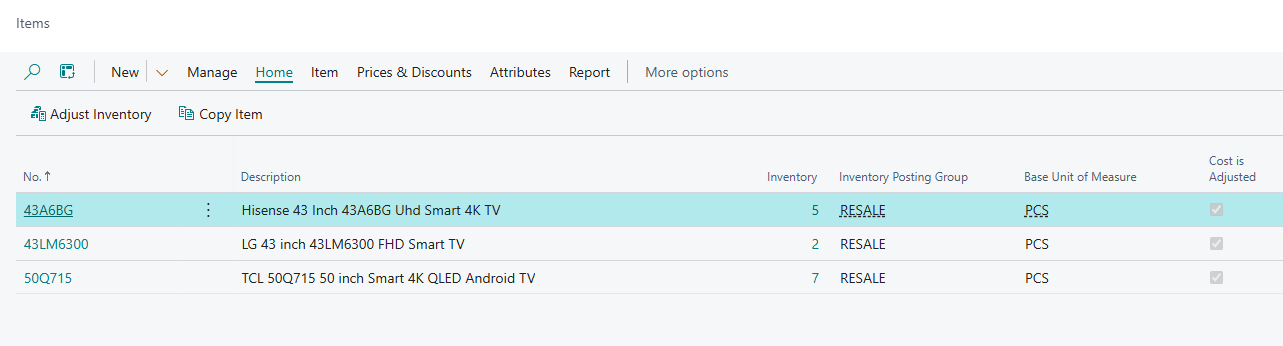

I have the following list of items and inventory posting groups.

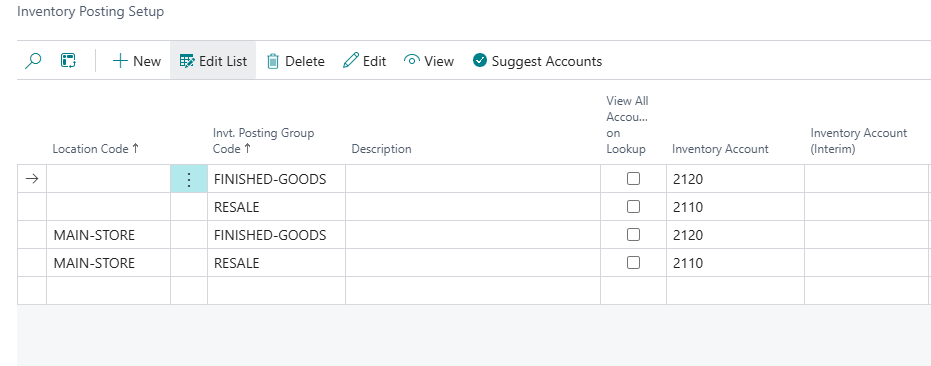

To migrate items, we usually use the item journals and do a positive adjustment. The following accounting entries of the item cost happen on posting.

| Account | Debit | Credit |

| Inventory Account (Inventory Posting Group of the item) | XXX | |

| Inventory Adjustment Account ( Gen. Posting Setup of the Gen. Prod Posting of the item) | XXX |

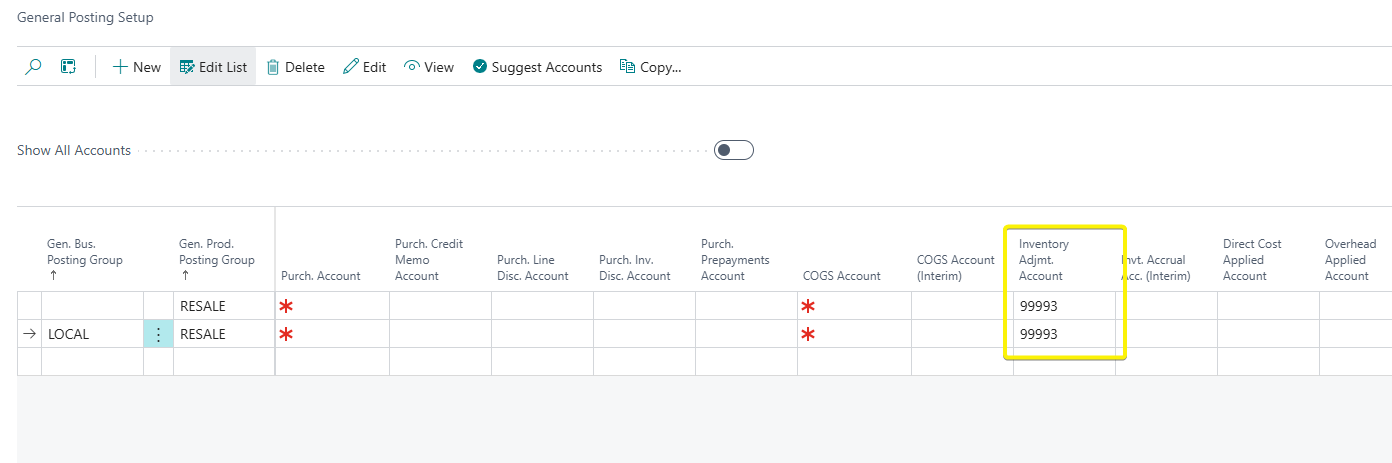

Therefore, we need to make two changes :

1. Change the Inventory Adjustment Account of the items to the Items Migration G/L Account.

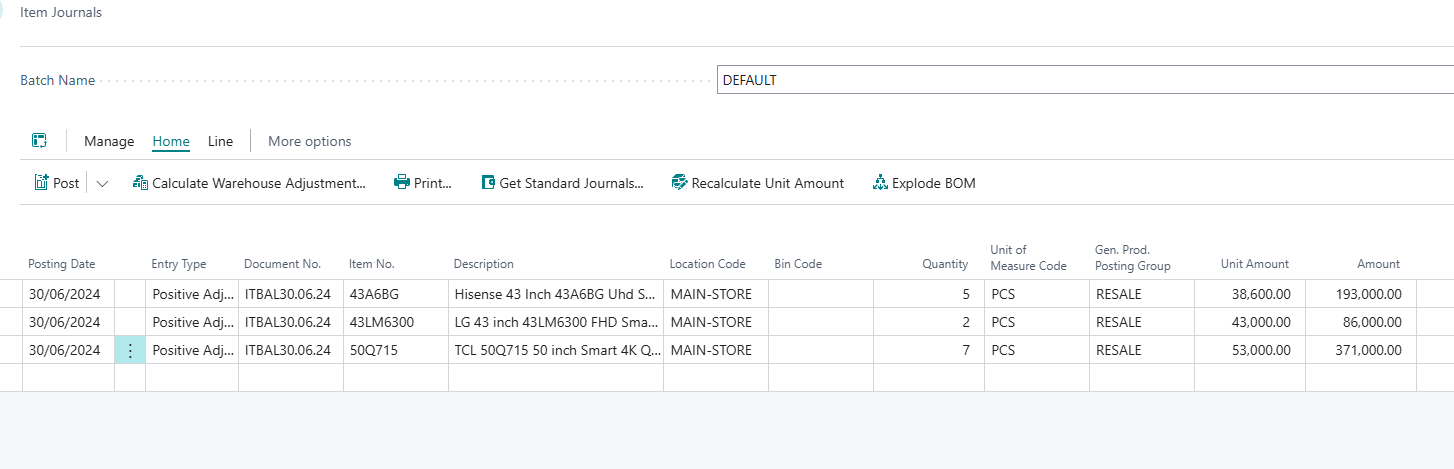

The inventory balances are provided as below.

| Item | Balance | Unit Cost | Total Cost |

| 43A6BG | 5 | 38,600.00 | 193,000.00 |

| 43LM6300 | 2 | 43,000.00 | 86,000.00 |

| 50Q715 | 7 | 53,000.00 | 371,000.00 |

Load your item journal as below.

For items, we will not use a MIGRATION posting group to ensure that our valuation report maintains the original inventiry posting group.

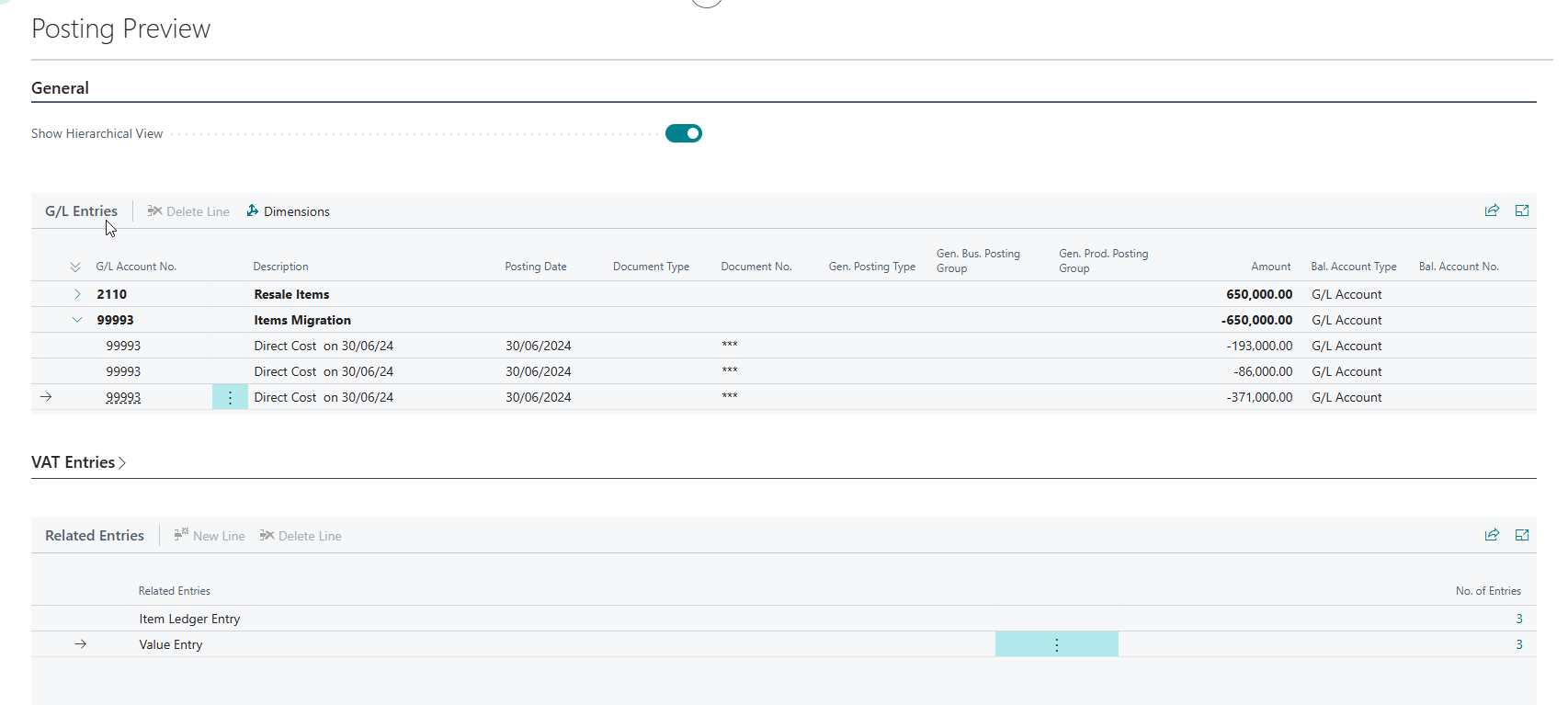

Try and preview post to check the effect on the chart of accounts. ( Ensure your cost adjustments setting are on in the Inventory Setup).

You can post the journal and check item balances.

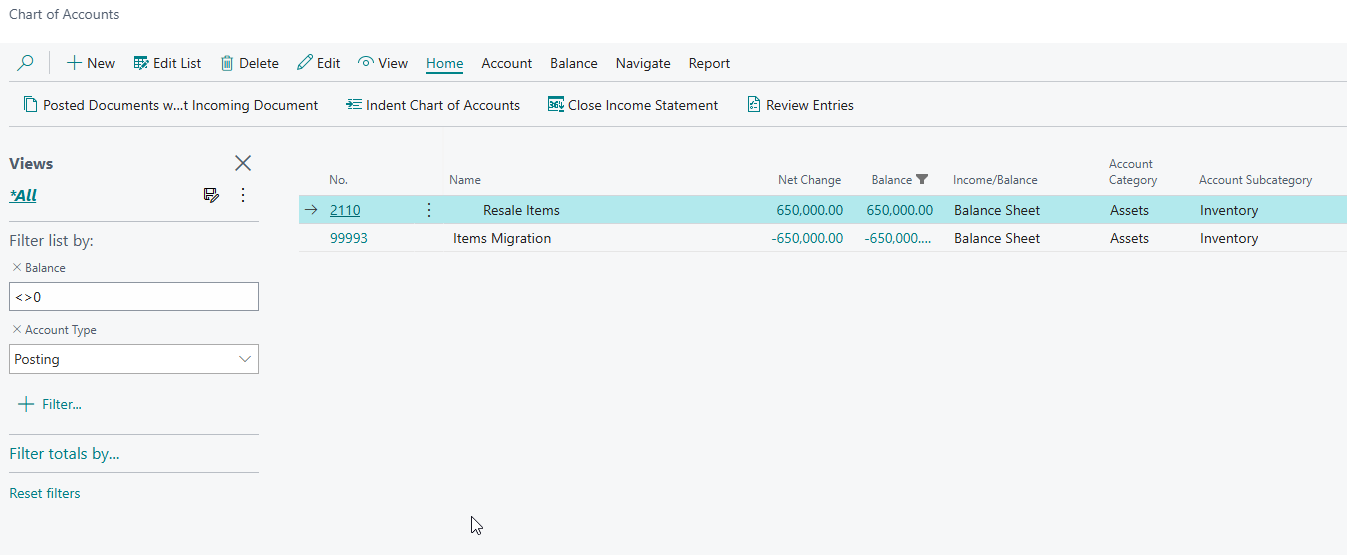

In this case, our chart of accounts now has values.

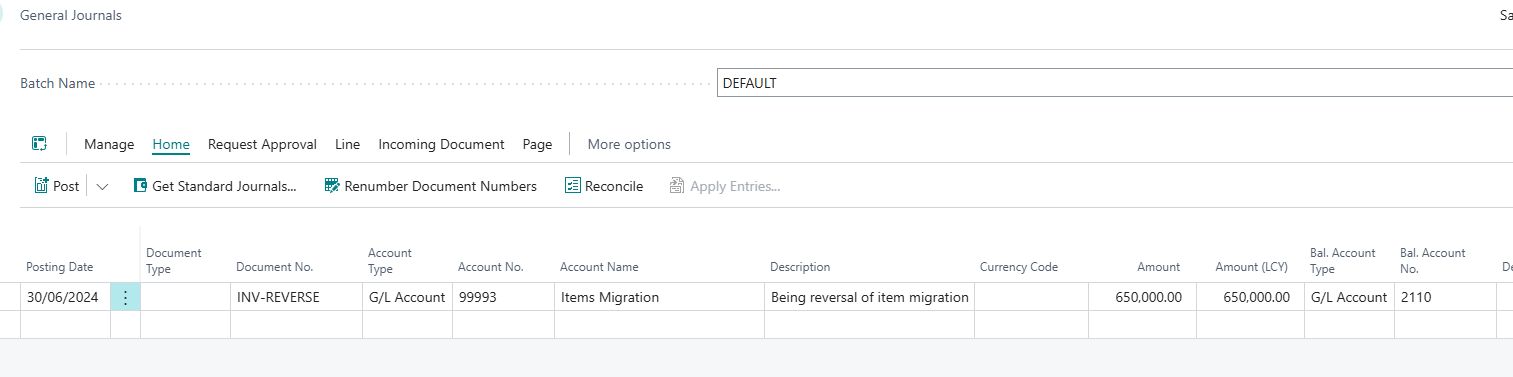

A manual journal entry can be posted to negate the account balances as below and return them to 0 account balances.

| Account | Debit | Credit |

| 99993 | 650,000 | |

| 2110 | 650,000 |

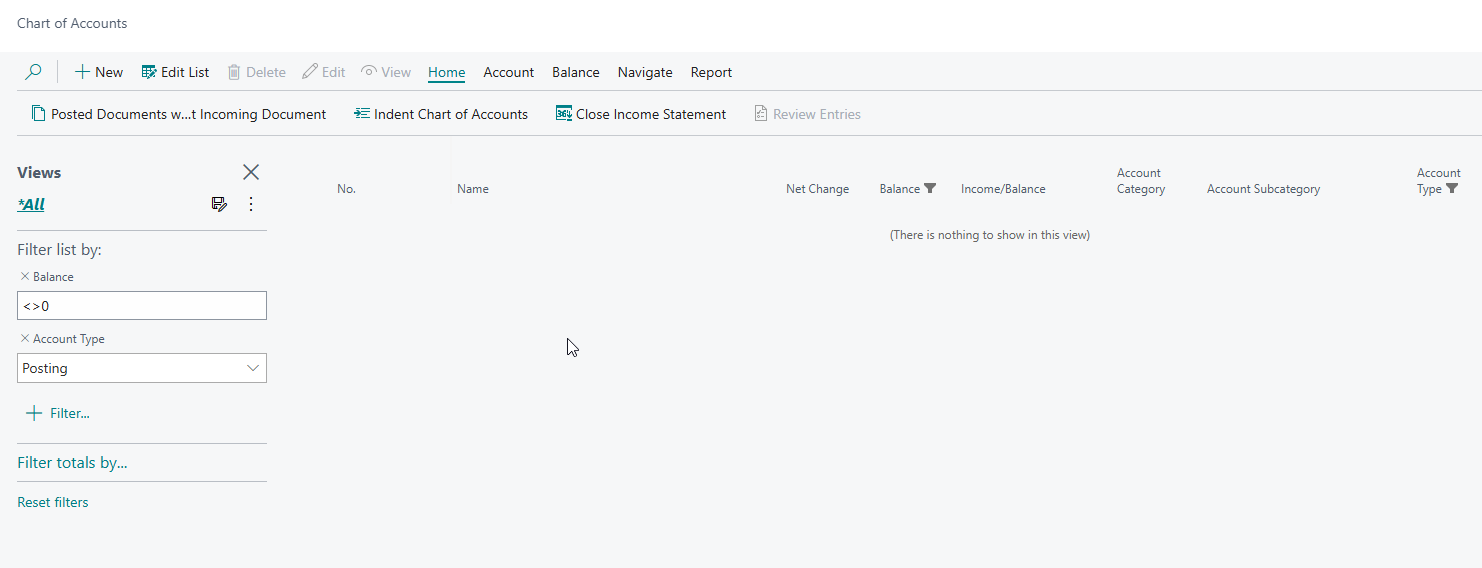

Our chart of accounts should have not transaction balances after posting.

Fixed Assets

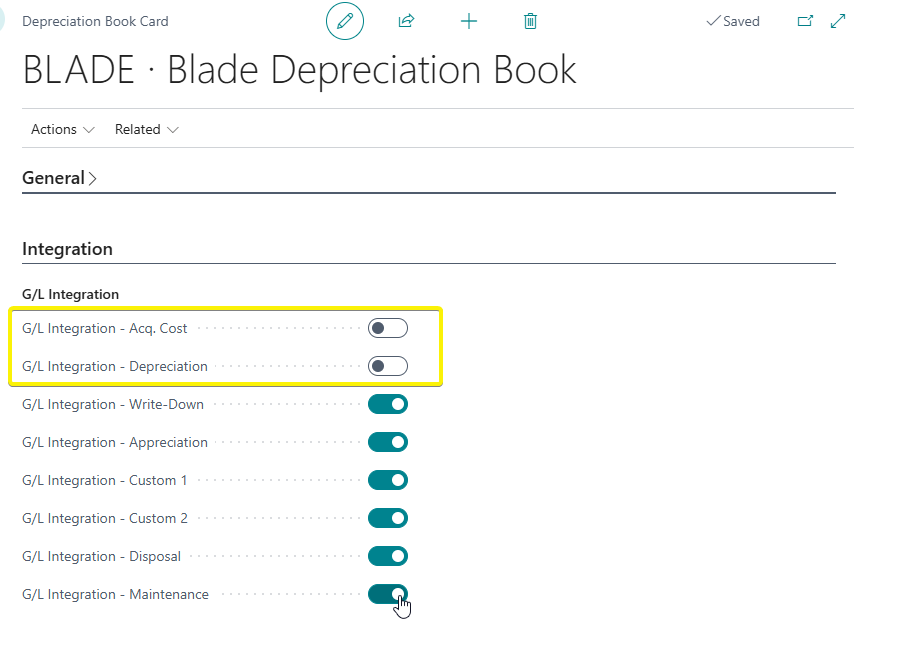

The fixed asset module directly provides us with a functionality to disable integration with the general ledger in the depreciation book.

Switch off the G/L Integration for Acq. Cost & Depreciation as seen above. This will esnure that any uodates we make to the fixed assets will not be posted to the general ledger.

The fixed asset list is as below.

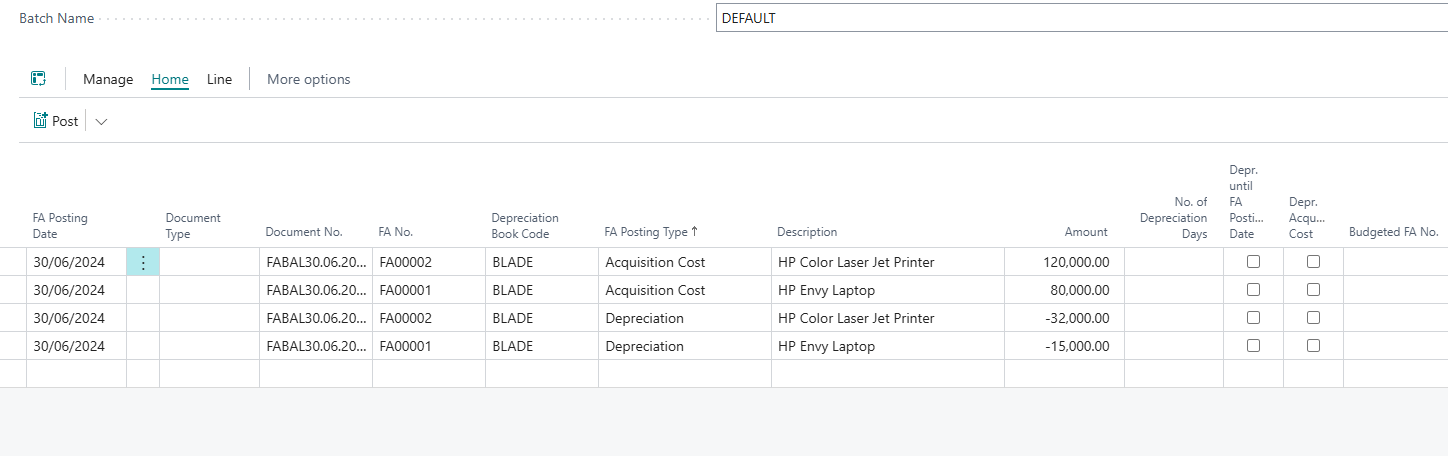

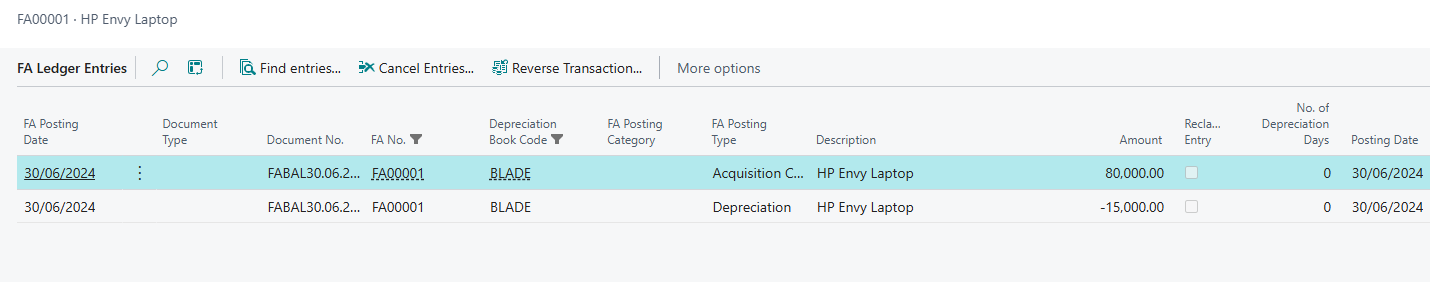

The fixed asset balances are provided as below as at 30.06.24.

| Fixed Asset | Type | Amount |

| FA00001 | Acquisition Cost | 80,000 |

| FA00001 | Depreciation | -15,000 |

| FA00002 | Acquisition Cost | 120,000 |

| FA00002 | Depreciation | -32,000 |

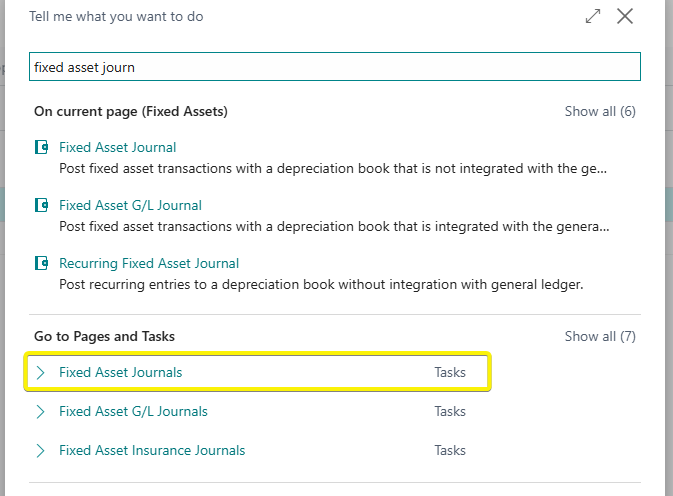

Load your Fixed Asset Journal. ( Do not use Fixed Asset G/L Journals )

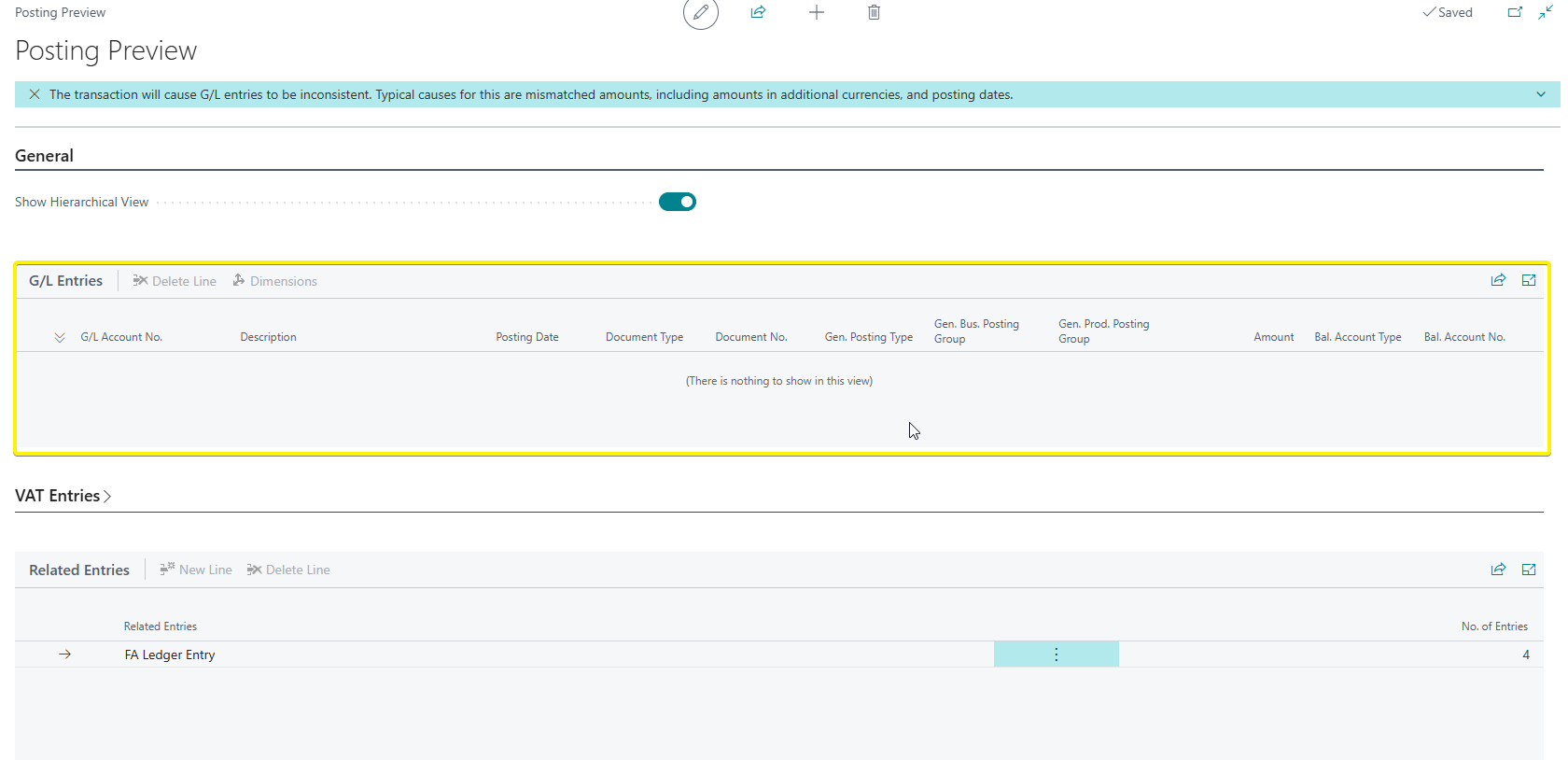

Lets preview post to confirm our chart of accounts is not affected.

Your section on G/L entries Preview should be blank as seen above.

Post the journal.

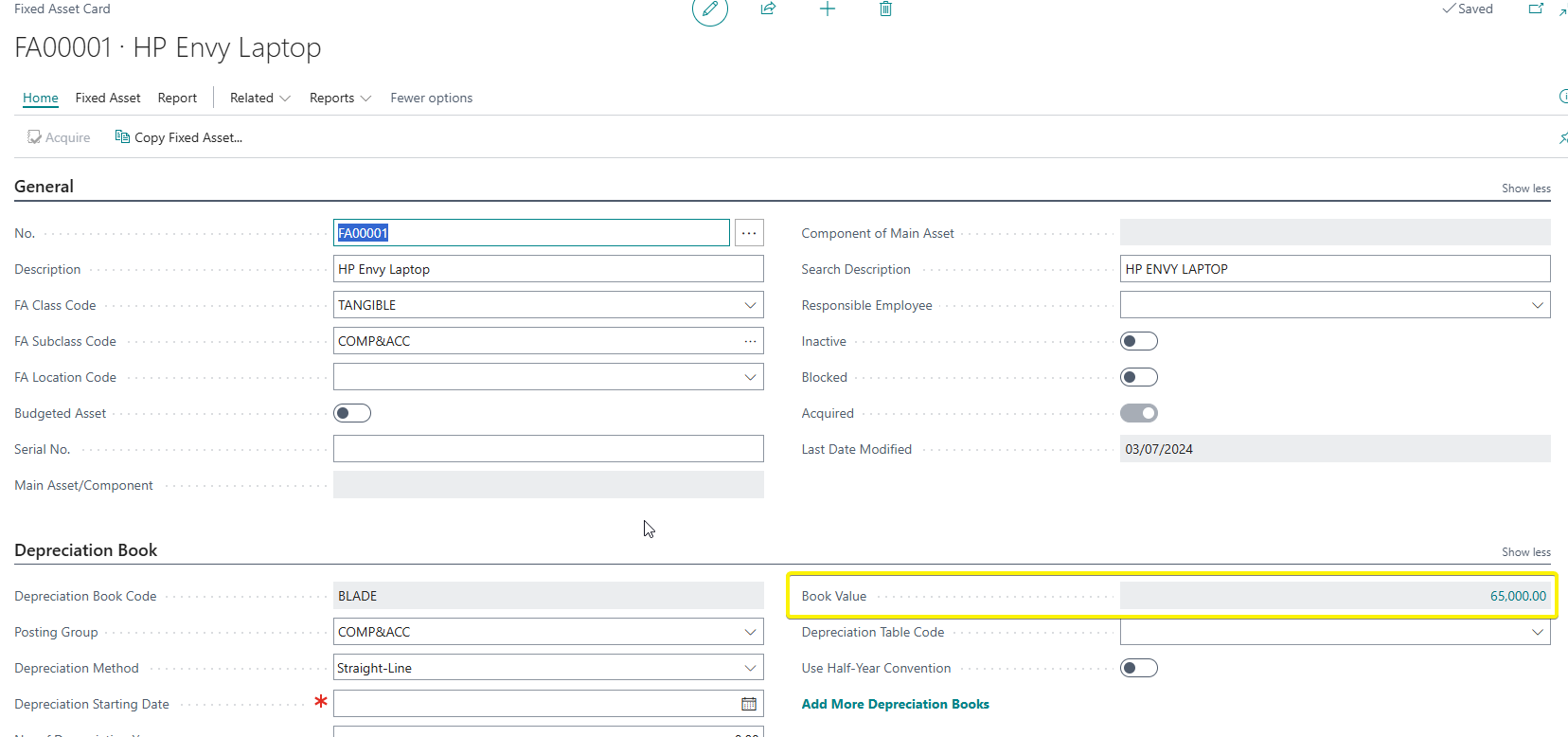

The FA net book values should be updated.

Remember to turn on the G/L Integration in the depreciation book.

That concludes our migration of sub-ledger account.

In Pt.3 (Transactional Data Migration Pt. 3 ) we look at loading the trial balance.