Item Costing Methods

Hi Readers,

In todays post, we will take a detailed look at the item costing methods : FIFO , LIFO, Average, Specific and Standard.

I have created 5 separate items and will use the following transactions for each of them.

| Date | Transaction Type | Transaction Details |

| 01/09/2024 | Purchase | 5 Pieces at cost of 100 |

| 02/09/2024 | Purchase | 3 Pieces at a cost of 110 |

| 04/09/2024 | Sale | 6 pieces at a price of 200 |

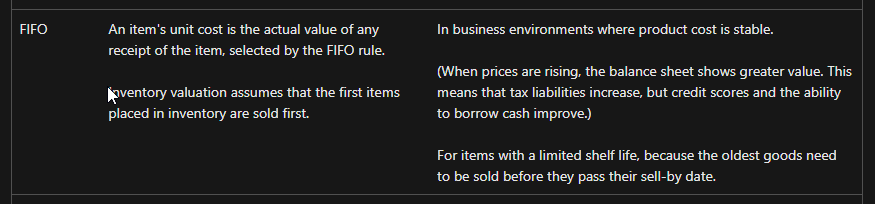

FIFO

From Microsoft website, FIFO description and application is as below:

I will proceed and do the transactions for the items.

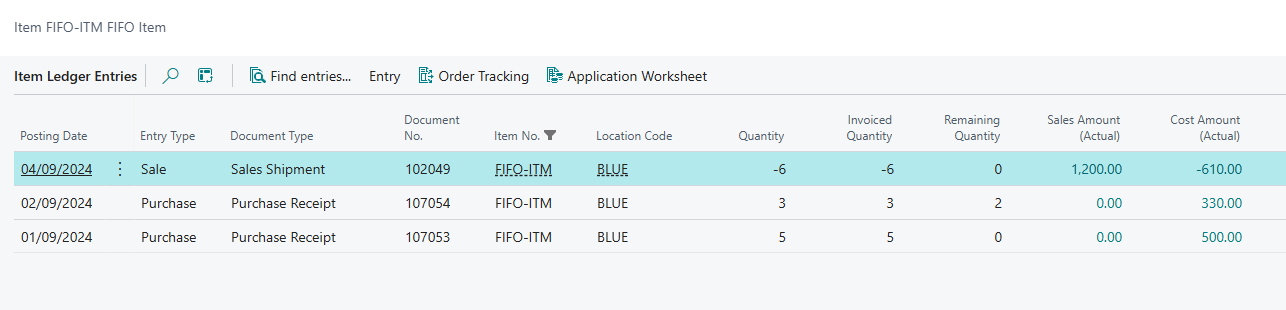

The item ledger entries are as below.

| Date | Transaction Type | Transaction Details | System Entries |

| 01/09/2024 | Purchase | 5 Pieces at cost of 100 |

We will have a purchase receipt item ledger of 5 items with a Cost Amount (Actual) of 500 ( 5 * 100). You will note the remaining qty is zero. Because we sold six unit, the system picked the first available entry and picked 5 of them. |

| 02/09/2024 | Purchase | 3 Pieces at a cost of 110 |

We will have a purchase receipt item ledger of 3 items with a Cost Amount (Actual) of 330 ( 3 * 110). You will note the remaining qty is two. Because we sold six unit, the system picked the first available entry and picked 5 of them, then pick one unit from the next earlier entry. Thus we are left with two units in this entry. |

| 04/09/2024 | Sale | 6 pieces at a price of 200 |

We will have a sale shipment item ledger of 6 items with a Cost Amount (Actual) of 610 calculated as below: 5 units of 100 cost = 500 1 unit of 110 cost = 110 Total cost = 500+110 = 610 Sales cost is 1200.

|

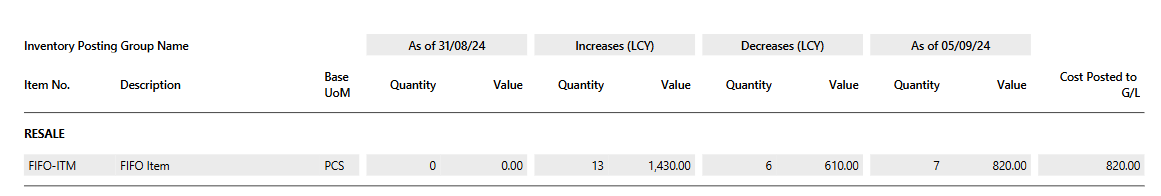

Valuation

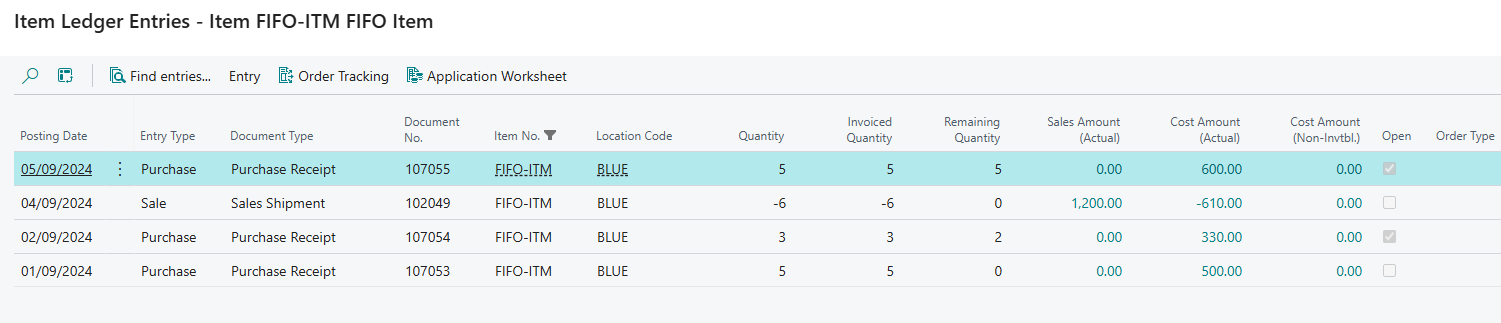

I will add an extra transaction to check how FIFO valuation is done

| Date | Transaction Type | Transaction Details |

| 05/09/2024 | Purchase | 5 Pieces at cost of 120 |

The item ledgers are updated with the newer entry.

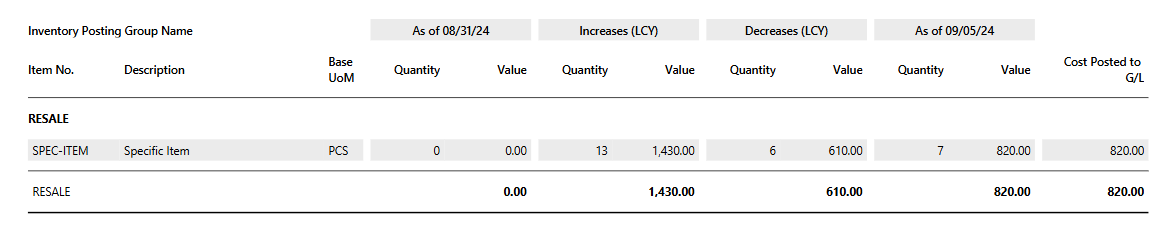

On running the valuation , the total cost is given as 820.

The breakdown is as below:

| Transaction Details |

|

5 units at cost of 120 = 600 2 units at cost of 110 = 220 Total cost = 600 + 220 = 820 |

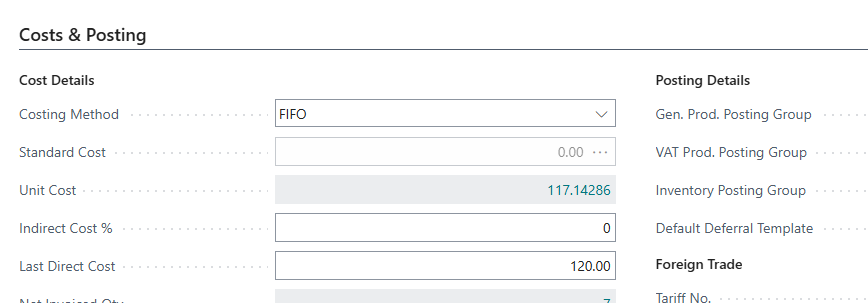

On the item card, the field unit cost has a value of 117.14286. This should be the total cost 820 divided by 7 units to give you that figure.

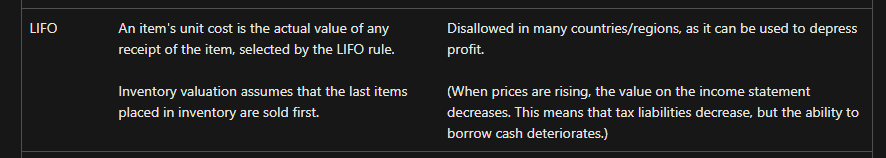

LIFO

From Microsoft website, LIFO description and application is as below:

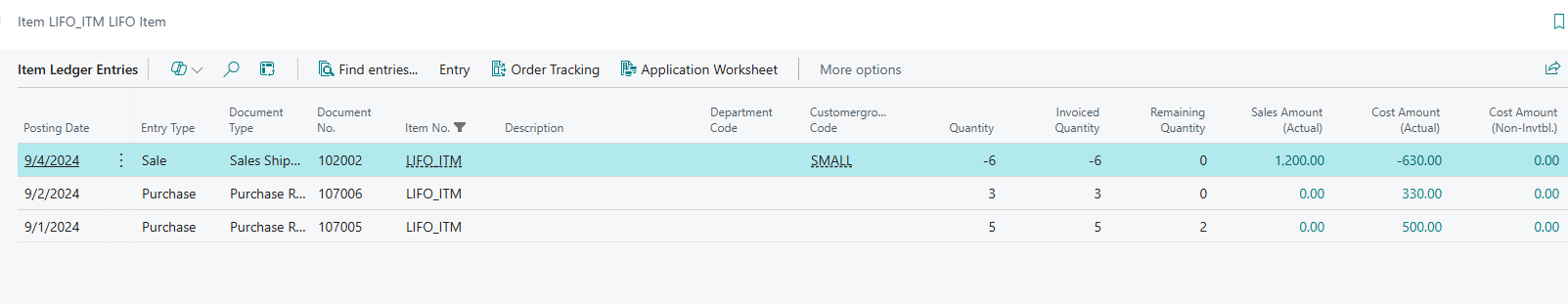

On posting, see the item ledger entries below.

| Date | Transaction Type | Transaction Details | System Entries |

| 01/09/2024 | Purchase | 5 Pieces at cost of 100 |

We will have a purchase receipt item ledger of 5 items with a Cost Amount (Actual) of 500 ( 5 * 100). You will note the remaining qty is two. Because we sold six unit, the system picked the latest available entry first and picked 3 of them, then picked three units from this entry. Thus we are left with two units in this entry.

|

| 02/09/2024 | Purchase | 3 Pieces at a cost of 110 |

We will have a purchase receipt item ledger of 3 items with a Cost Amount (Actual) of 330 ( 3 * 110). You will note the remaining qty is zero. Because we sold six unit, the system picked the latest available entry first and picked 3 of them. |

| 04/09/2024 | Sale | 6 pieces at a price of 200 |

We will have a sale shipment item ledger of 6 items with a Cost Amount (Actual) of 630 calculated as below: 3 units of 100 cost = 300 3 unit of 110 cost = 330 Total cost = 500+110 = 630 Sales cost is 1200. |

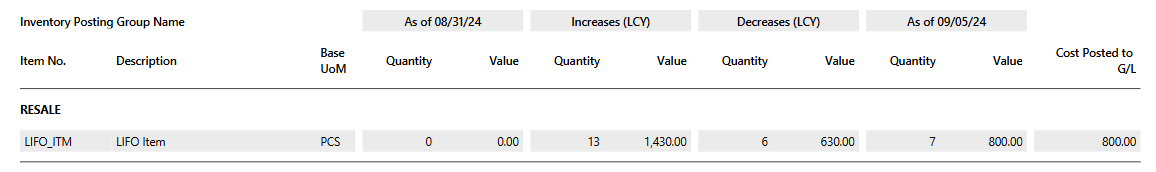

Valuation

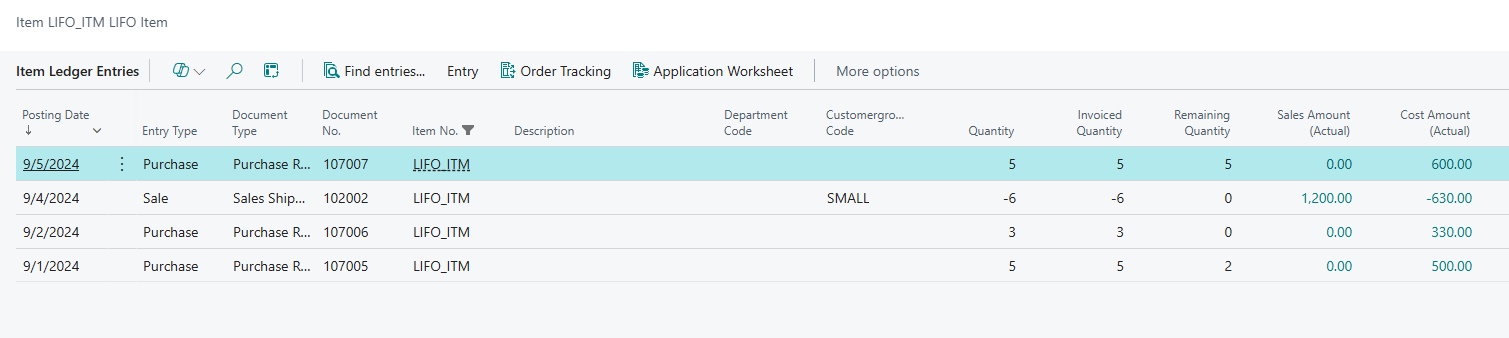

I will add an extra transaction to check how LIFO valuation is done

| Date | Transaction Type | Transaction Details |

| 05/09/2024 | Purchase | 5 Pieces at cost of 120 |

The item ledgers are updated with the newer entry.

On running the valuation , the total cost is given as 820.

The breakdown is as below:

| Transaction Details |

|

5 units at cost of 120 = 600 2 units at cost of 100 = 200 Total cost = 600 + 200 = 800 |

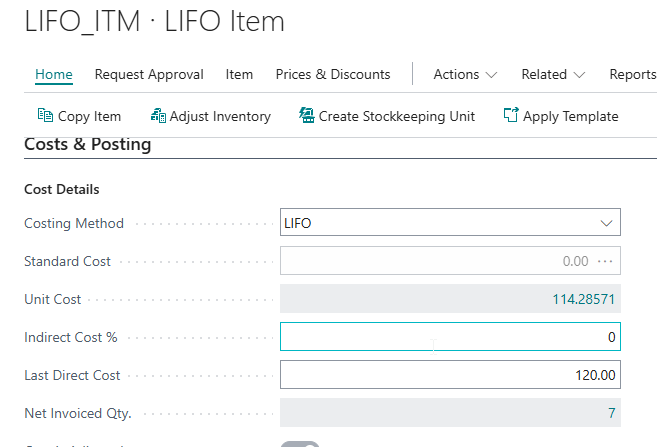

On the item card, the field unit cost has a value of 114.28571. This should be the total cost 800 divided by 7 units to give you that figure.

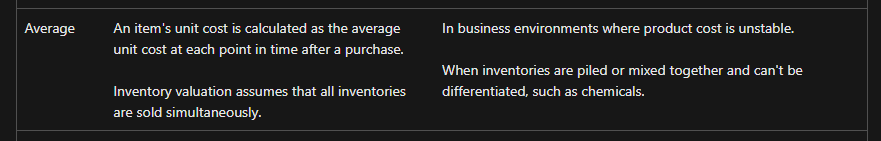

AVERAGE

From Microsoft website, Average description and application is as below:

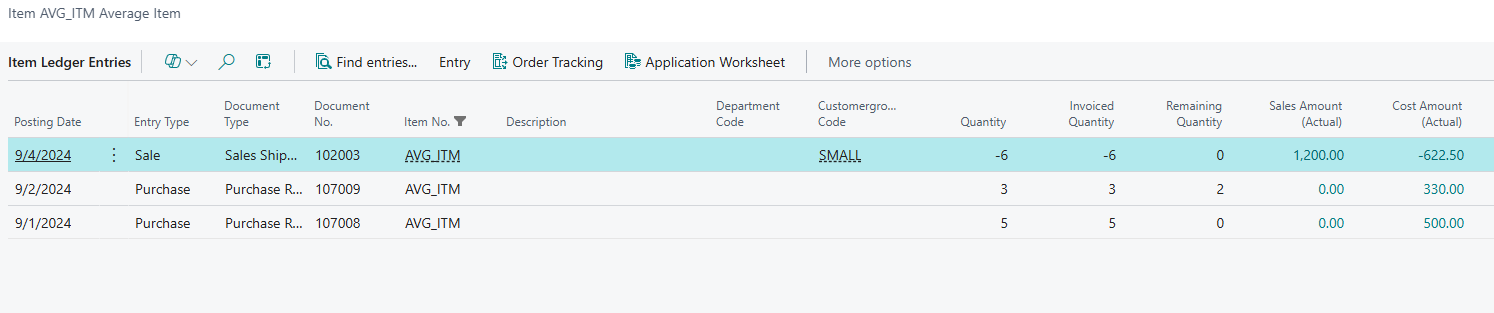

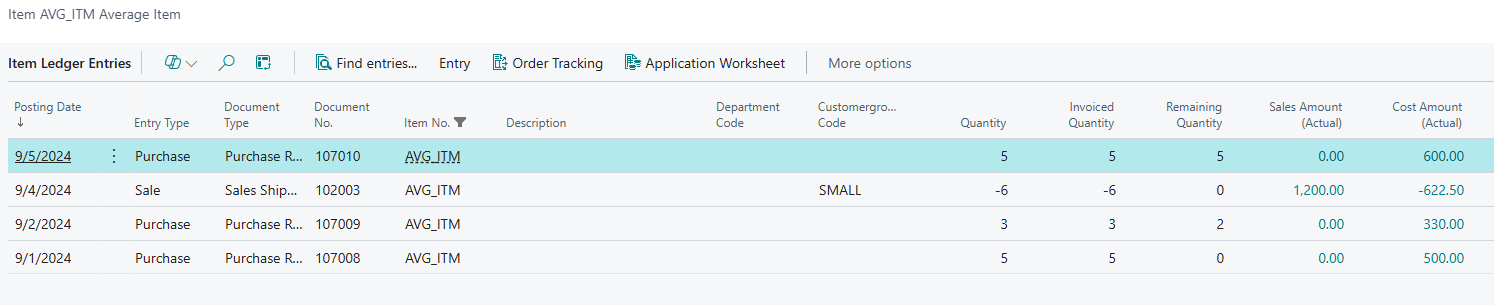

On posting, see the item ledger entries below.

| Date | Transaction Type | Transaction Details | System Entries |

| 01/09/2024 | Purchase | 5 Pieces at cost of 100 |

We will have a purchase receipt item ledger of 5 items with a Cost Amount (Actual) of 500 ( 5 * 100). You will note the remaining qty is zero. Because we sold six unit, the system picked the first available entry and picked 5 of them |

| 02/09/2024 | Purchase | 3 Pieces at a cost of 110 |

We will have a purchase receipt item ledger of 3 items with a Cost Amount (Actual) of 330 ( 3 * 110). You will note the remaining qty is two. Because we sold six unit, the system picked the first available entry and picked 5 of them, then pick one unit from the next earlier entry. Thus we are left with two units in this entry.

|

| 04/09/2024 | Sale | 6 pieces at a price of 200 |

We will have a sale shipment item ledger of 6 items with a Cost Amount (Actual) of 622.5 calculated as below: After 1st Purchase -> 5 units at 100 cost = 500 After 2nd Purchase -> 3 units at 110 cost = 330 Total of 8 units at total cost of 830 = 830 / 8 = 103.75 Therefore total COGs for sales will be 103.75 * 6 = 622.5 Sales cost is 1200. |

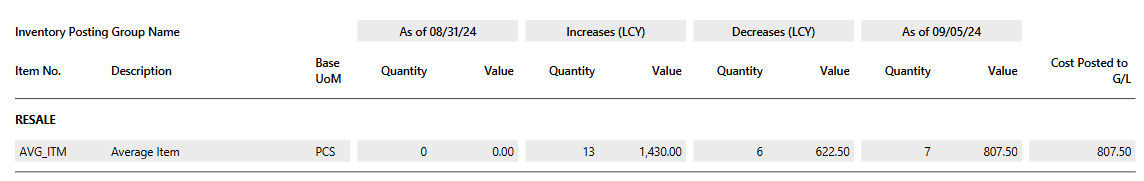

Valuation

I will add an extra transaction to check how average valuation is done

| Date | Transaction Type | Transaction Details |

| 05/09/2024 | Purchase | 5 Pieces at cost of 120 |

The item ledgers are updated with the newer entry.

On running the valuation , the total cost is given as 807.5

The breakdown is as below:

| Transaction Details |

|

After 1st Purchase -> 5 units at 100 cost = 500 After 2nd Purchase -> 3 units at 110 cost = 330 Total of 8 units sold at total cost of 830 = 830 / 8 = 103.75 After 3rd Purchase -> 5 units at 120 cost = 600 Total units available =7 (5[new] + 2 [old]) at total cost of 807.5 ((103.75[average cost of old] * 2) + 600 [new total cost]))

|

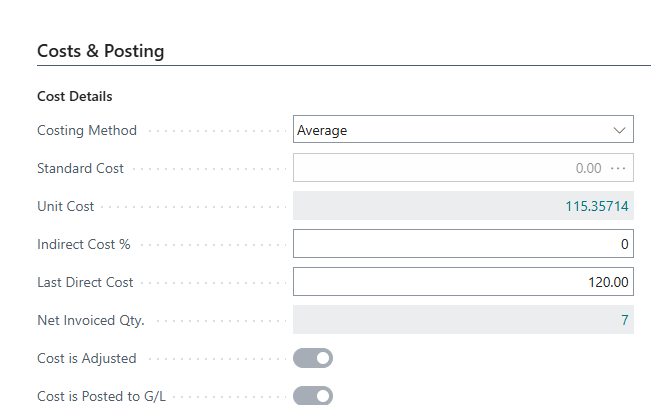

On the item card, the field unit cost has a value of 115.35714. This should be the total cost 807.5 divided by 7 units to give you that figure.

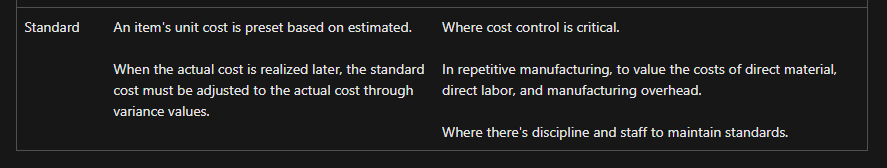

STANDARD

From Microsoft website, Standard description and application is as below:

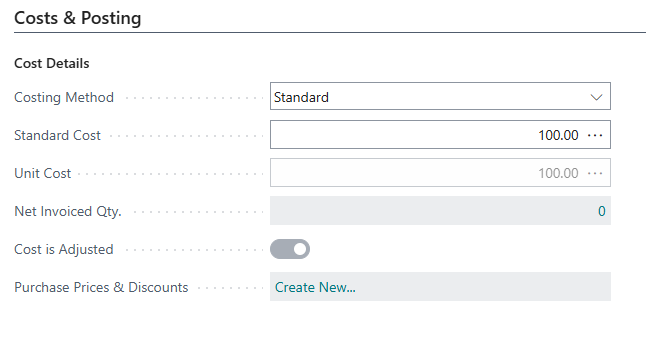

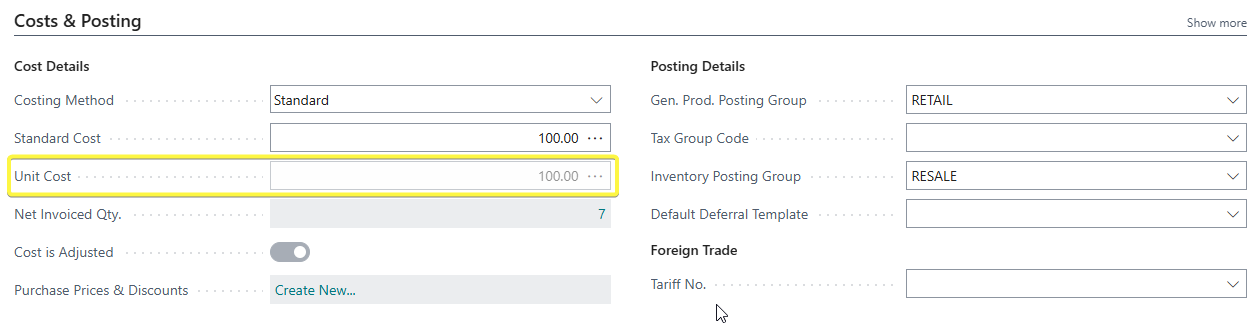

As per above the standard cost has to be preset on the item card before any purchases are done. My standard cost will be 100.

I will do the postings.

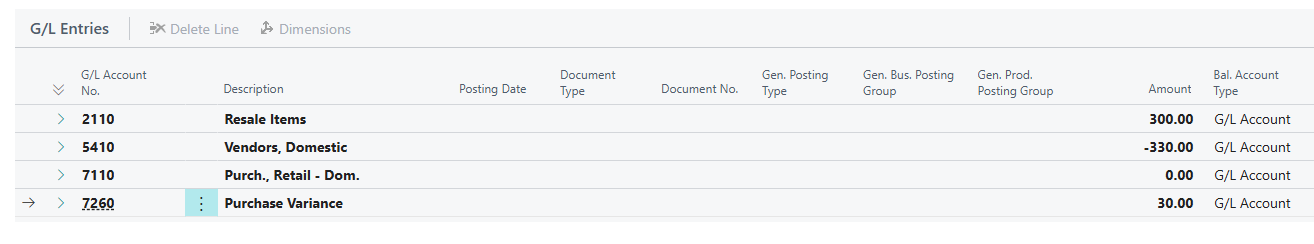

Note: For standard costing method, any difference between the standard cost and the purchase cost is posted to the Purchase Variance Account in the Gen Posting Setup.

Example -> 3 units bought at 330, Standard Cost is 3 units at 100 = 300 , 330 - 300 = purchase variance of 30. See below.

| Date | Transaction Type | Transaction Details | System Entries |

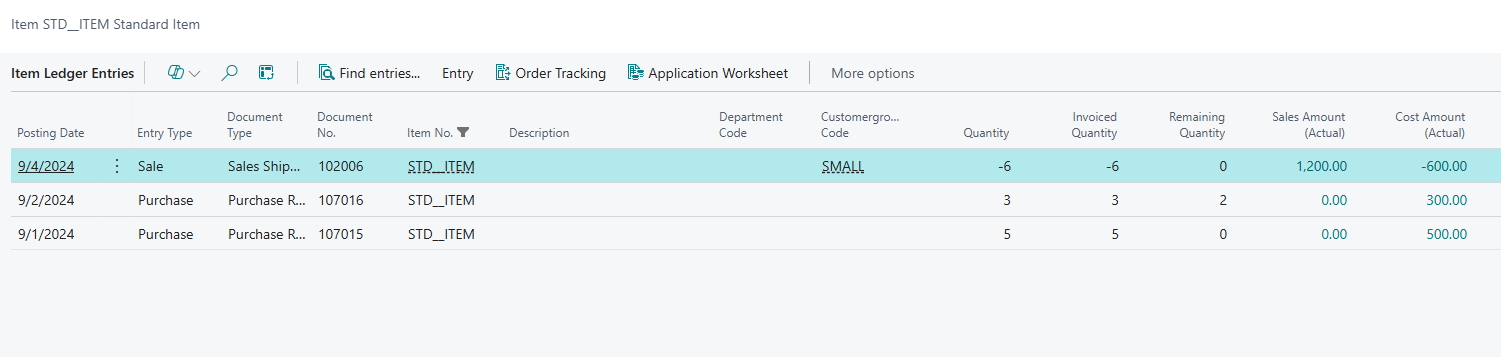

| 01/09/2024 | Purchase | 5 Pieces at cost of 100 |

We will have a purchase receipt item ledger of 5 items with a Cost Amount (Actual) of 500 ( 5 * 100). You will note the remaining qty is zero. Because we sold six unit, the system picked the first available entry and picked 5 of them |

| 02/09/2024 | Purchase | 3 Pieces at a cost of 110 |

We will have a purchase receipt item ledger of 3 items with a Cost Amount (Actual) of 300 ( 3 * 100) - the standard cost , any cost difference transferred to variance accounts. You will note the remaining qty is two. Because we sold six unit, the system picked the first available entry and picked 5 of them, then pick one unit from the next earlier entry. Thus we are left with two units in this entry.

|

| 04/09/2024 | Sale | 6 pieces at a price of 200 |

We will have a sale shipment item ledger of 6 items with a Cost Amount (Actual) of 600 calculated as below: 6 units with a standard cost of 100 = 600 Sales cost is 1200. |

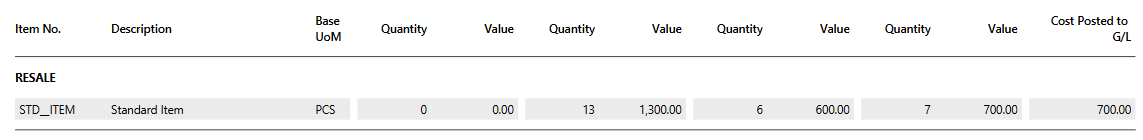

Valuation

I will add an extra transaction to check how standard valuation is done

| Date | Transaction Type | Transaction Details |

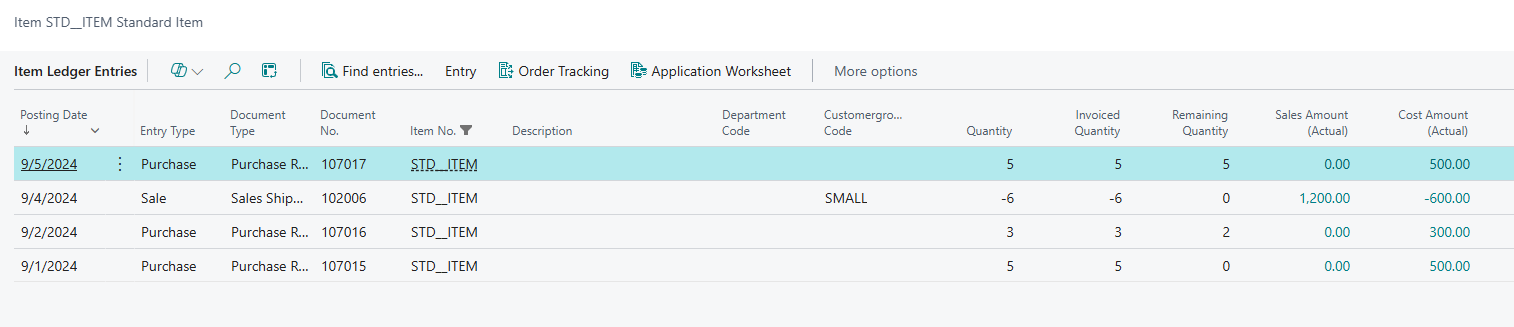

| 05/09/2024 | Purchase | 5 Pieces at cost of 120 |

The item ledgers are updated with the newer entry.

On running the valuation , the total cost is given as 700

The breakdown is as below:

| Transaction Details |

|

5 units at cost of 100 = 500 2 units at cost of 100 = 200 Total cost = 500 + 200 = 700 |

The unit cost is not applicable for this costing method and 'grayed' out as seen below.

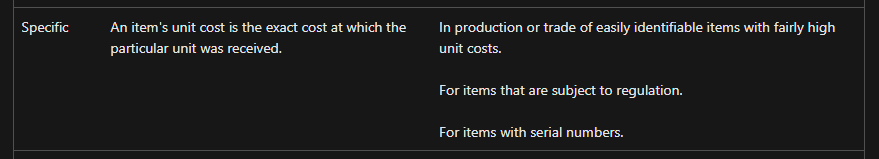

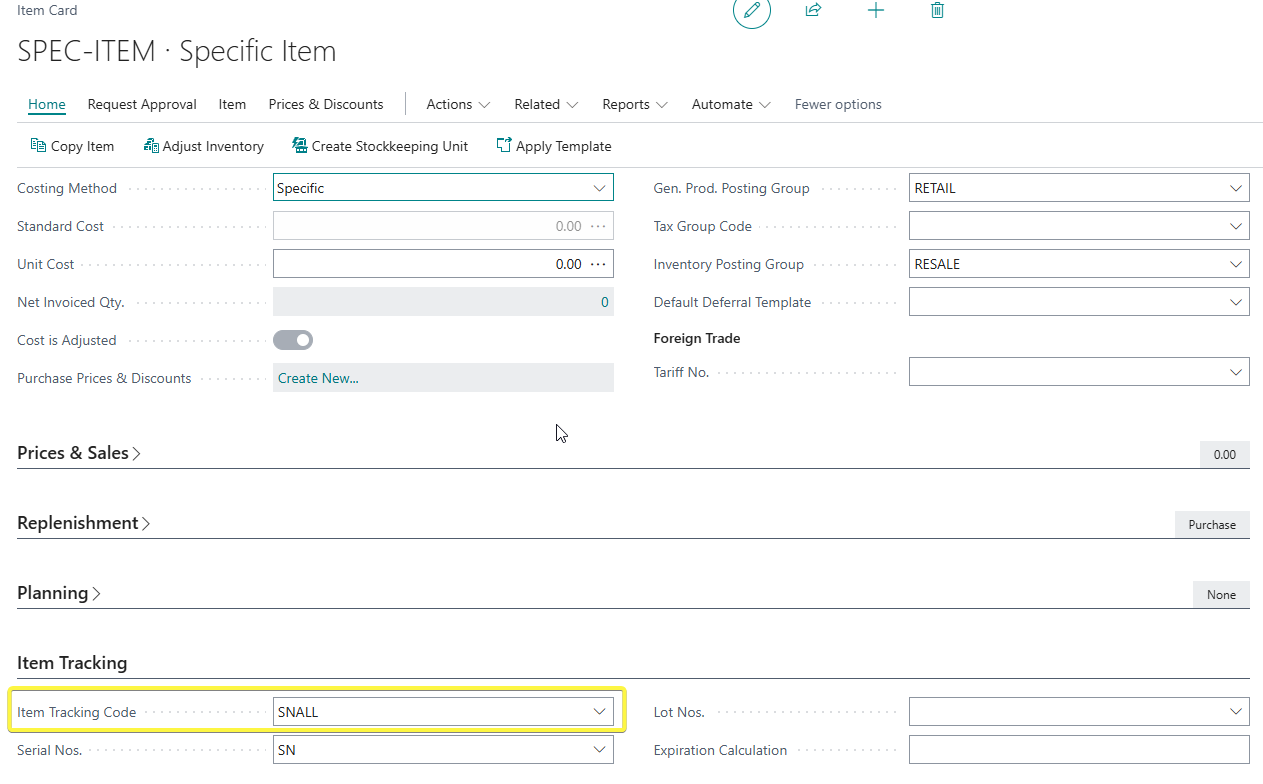

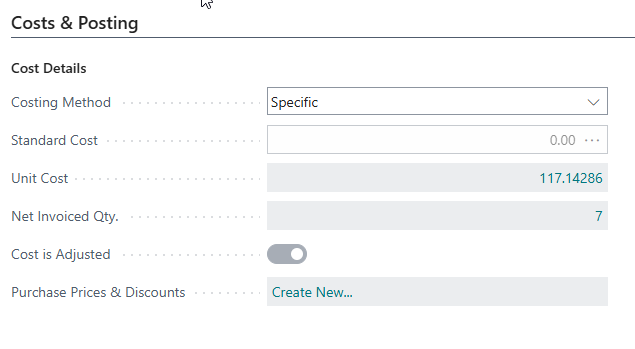

SPECIFIC

From Microsoft website, Specific description and application is as below:

For specific costing method to be used, item tracking must be used - either tracking by lot, serial, package or combined. This will mean that each item purchased must be assigned a lot, serial or package. On selling, the user should pick which item lot, serial or package they are selling too.

I will do my postings.

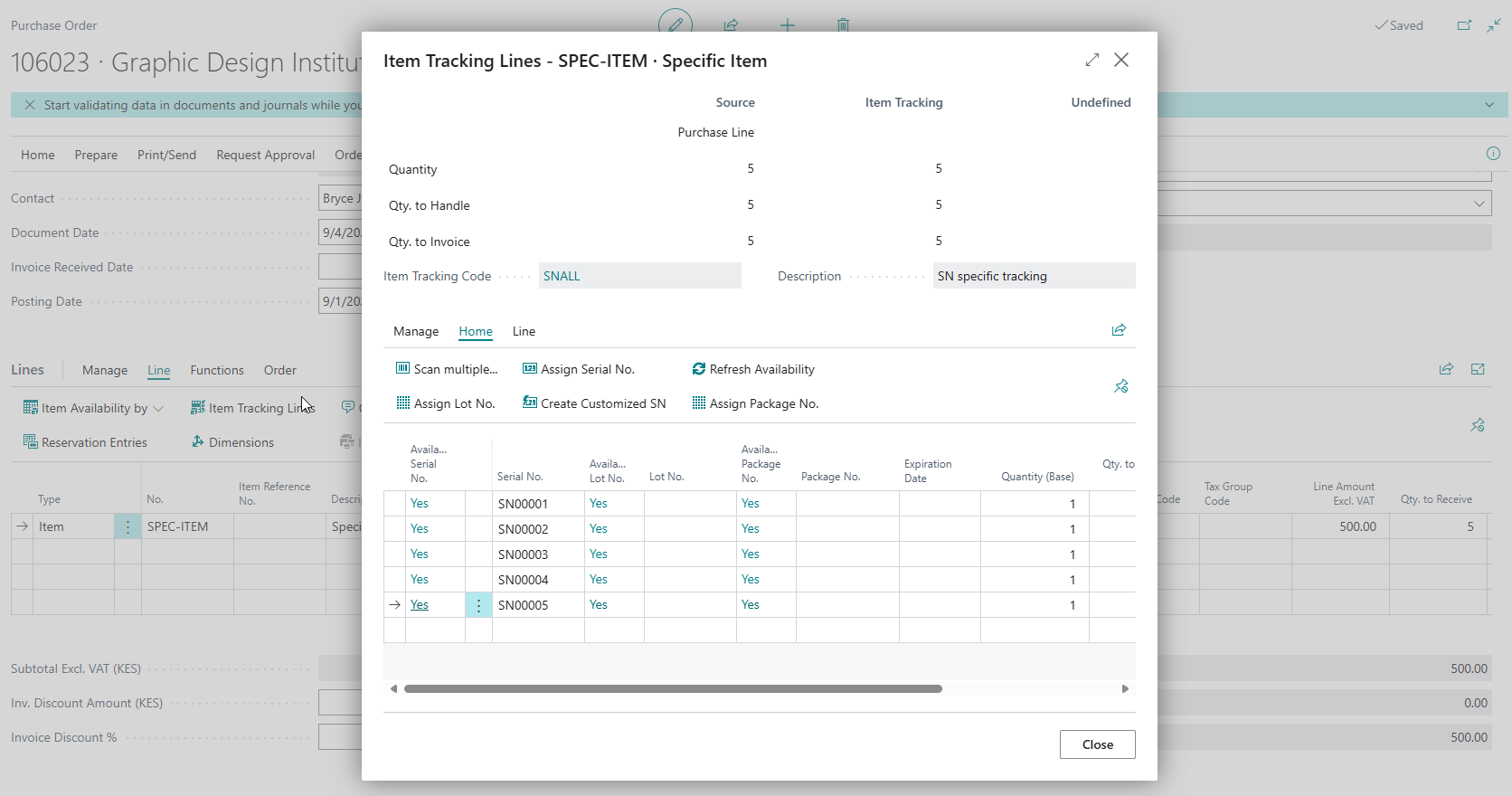

Sample below as i assign 5 serial numbers for the first purchase of 5 items.

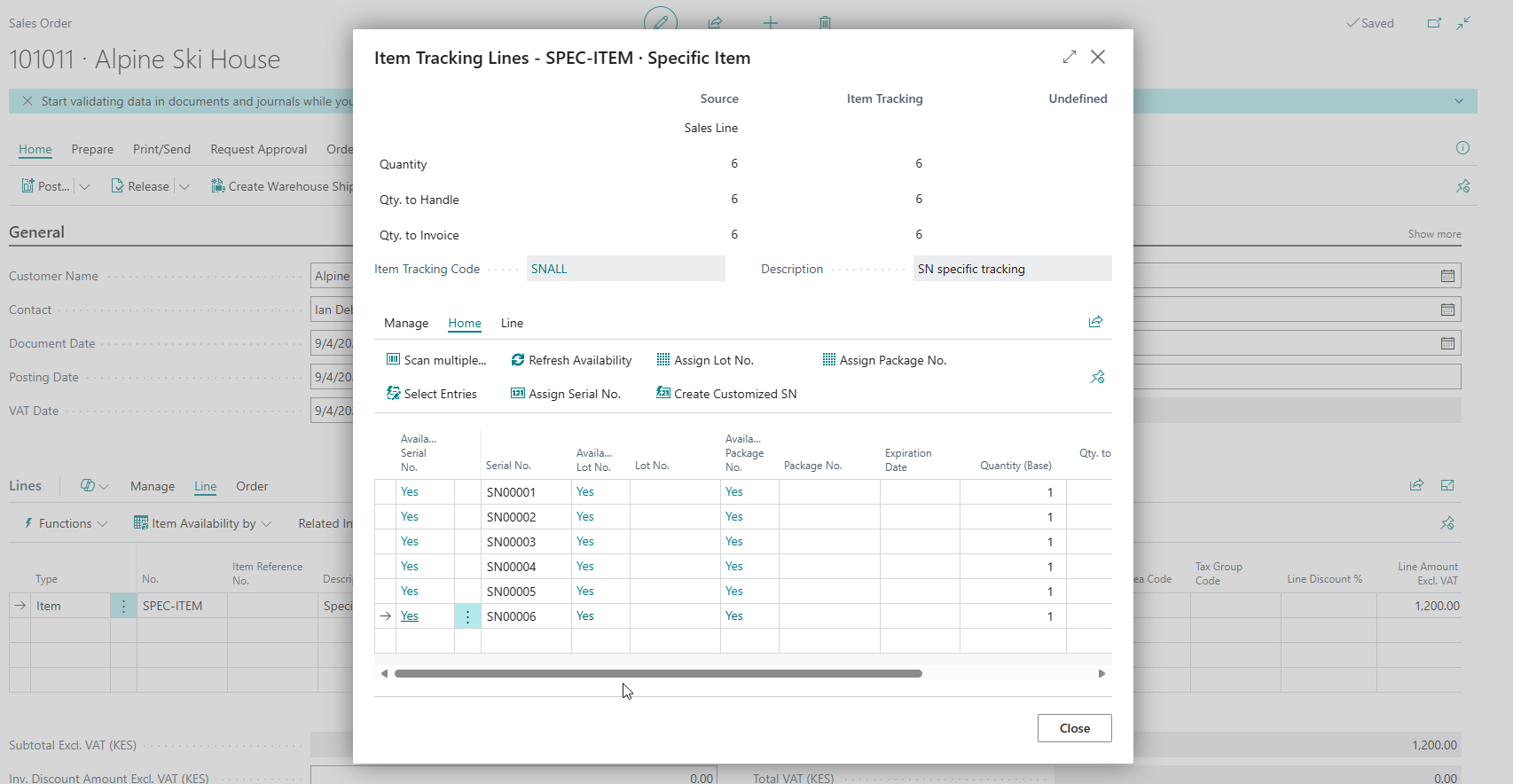

On selling, I have to picked the serials to be sold.

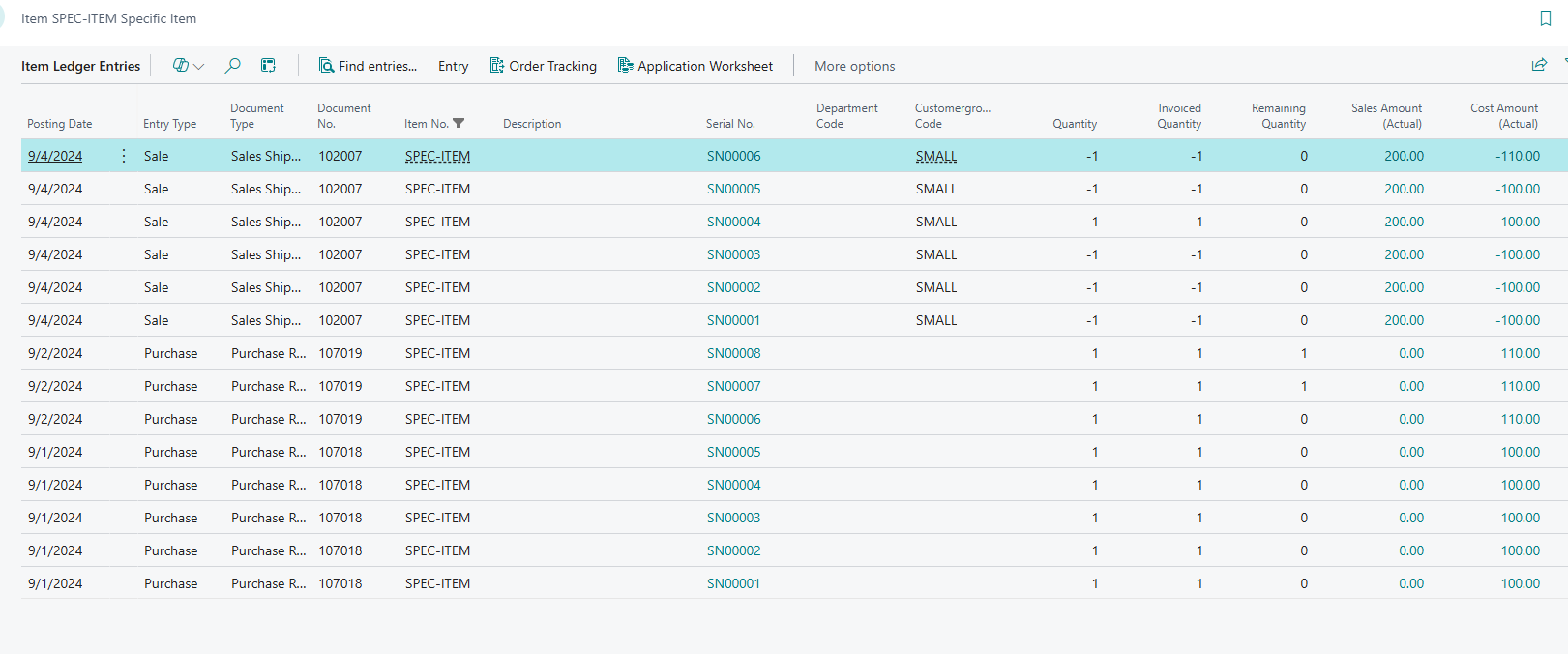

The entries will be generated as follows:

Each single item purchase & sale will have its own item ledger entry and the specific serial number.

Therefore, the COGs is matched to the purchase of that specific serial. For example, you can note the first entry has a cost of goods sold of 110. Therefore, serial number SN00006 had a purchase cost of 110.

Valuation

I will add an extra transaction to check how standard valuation is done

| Date | Transaction Type | Transaction Details |

| 05/09/2024 | Purchase | 5 Pieces at cost of 120 |

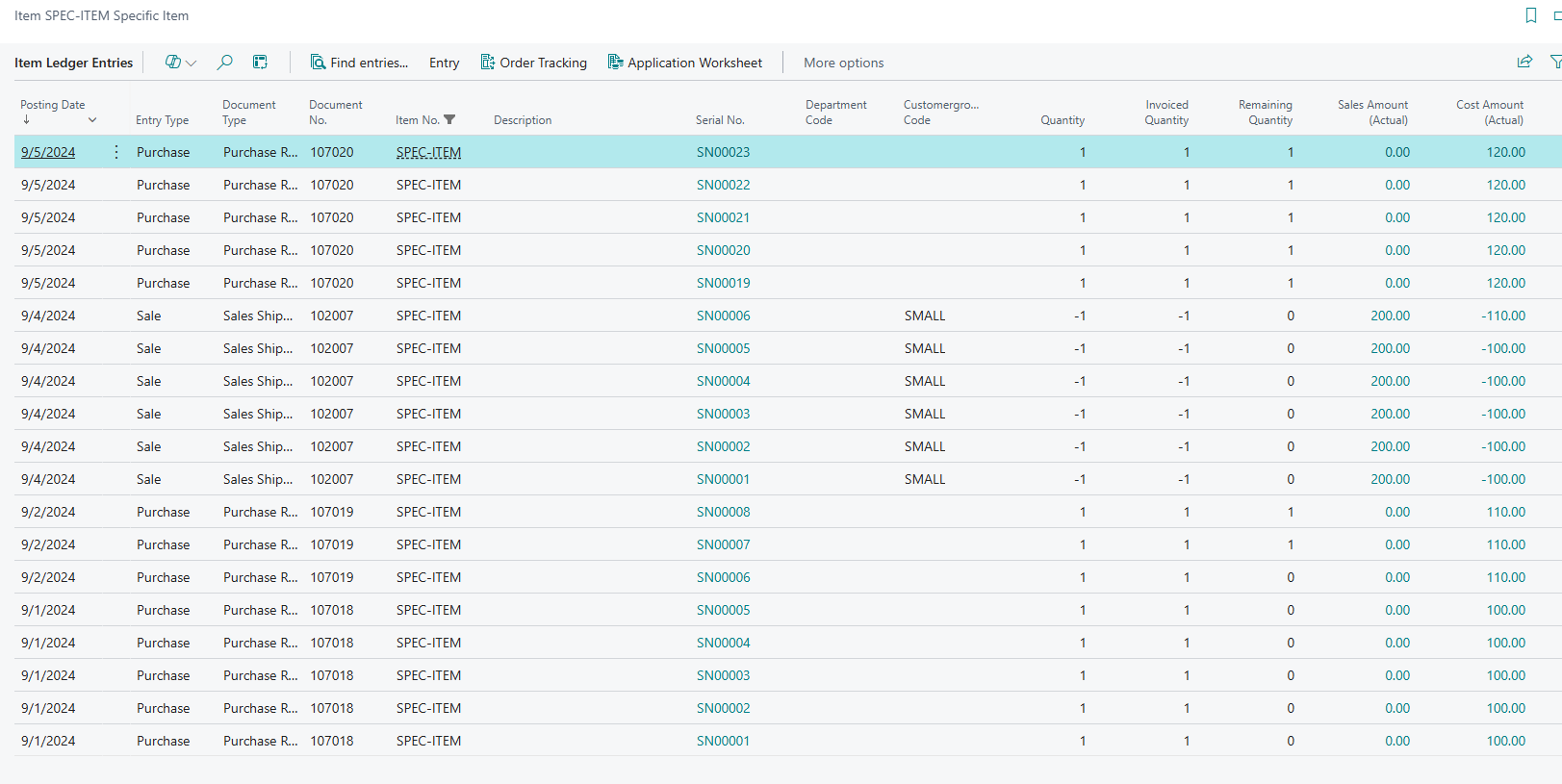

The entry will be updated as

On running the valuation , the total cost is given as 820.

The breakdown is as below:

| Transaction Details |

|

The valuation will the purchase cost of each serial available added up. 5 units at cost of 120 = 600 2 units at cost of 110 = 220 Total cost = 600 + 220 = 820 |

On the item card, the field unit cost has a value of 117.14286. This should be the total cost 820 divided by 7 units to give you that figure.

We can have a comparison table to see the COGS, valuation per item costing.

| Item Costing Method | COGS Value | Final Units Count | Final Units Cost Valuation | Unit Cost on Card |

| FIFO | 610 | 7 | 820 | 117.14286 |

| LIFO | 630 | 7 | 800 | 114.28571 |

| Average | 622.5 | 7 | 807.5 | 115.35714 |

| Standard | 600 | 7 | 700 | N/A |

| Specific | Unique to the serial number selected | 7 | 820 | 117.14286 |

ENDS.