Reversal of a fixed asset disposal

Hi Readers,

We will look at how to reverse the financial entries and fixed asset ledger entries of a fixed asset disposal.

Scenario

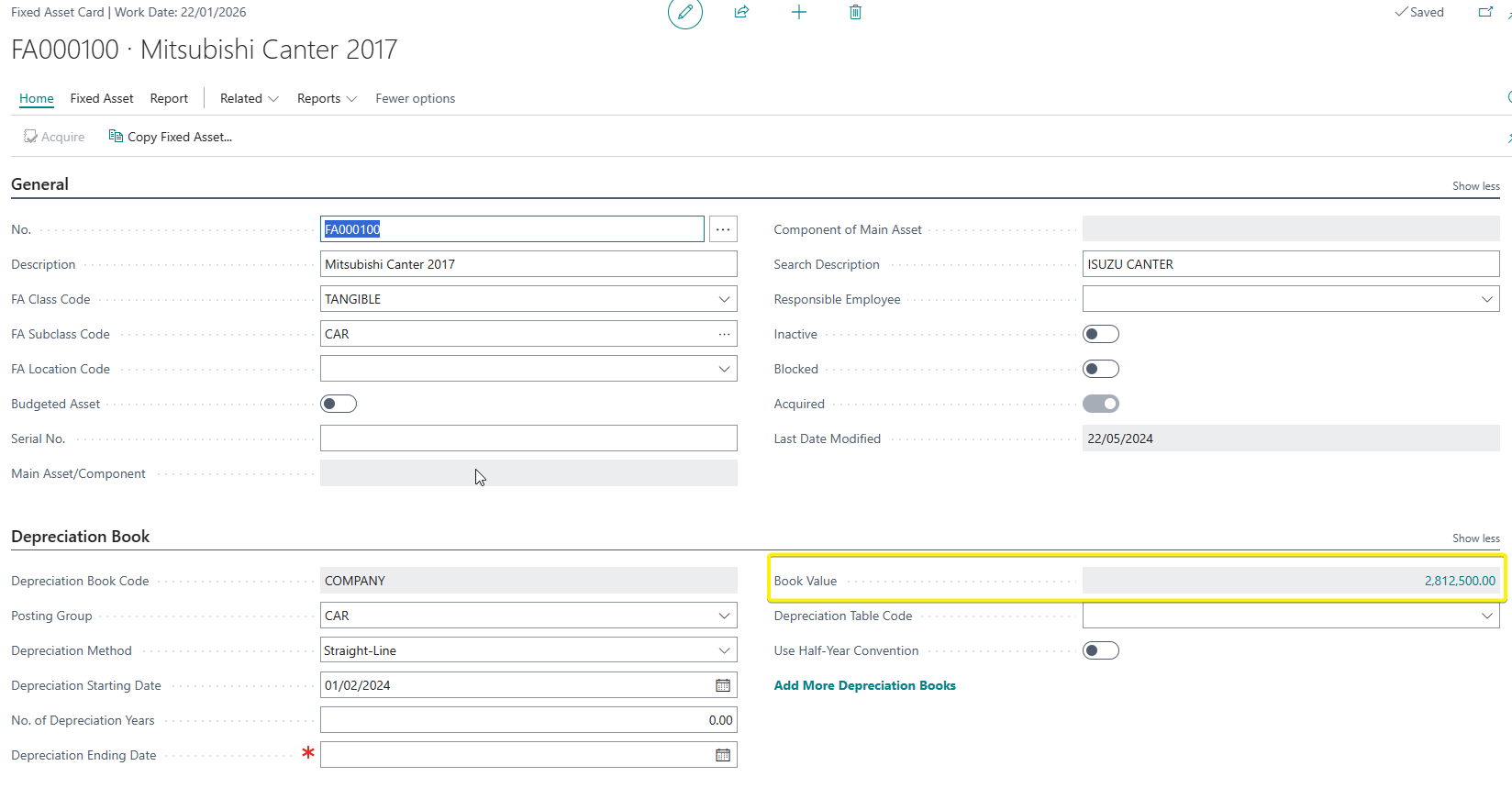

We have a fixed asset with a net book value of 2,812,500.

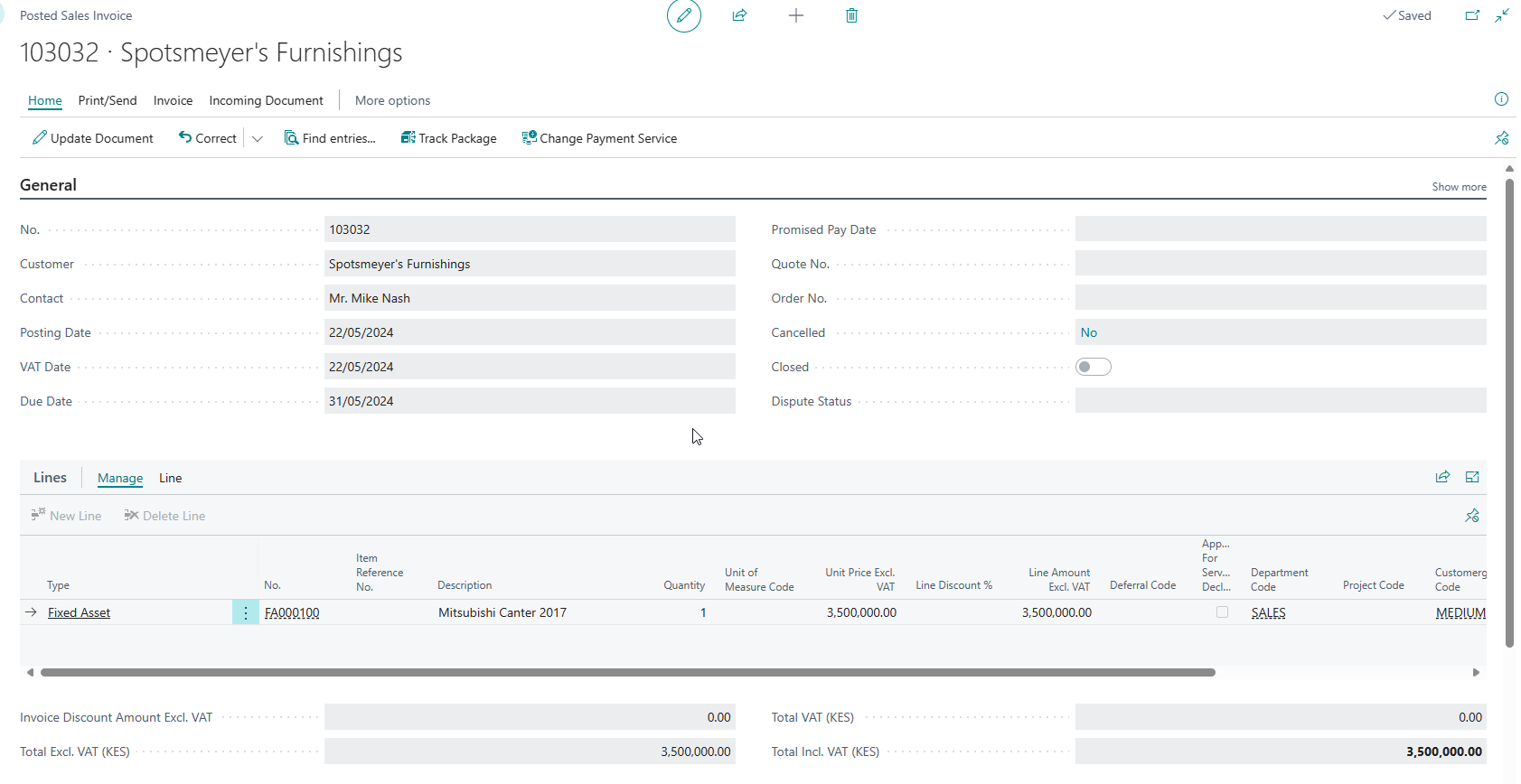

The asset has been disposed off for 3,500,000.

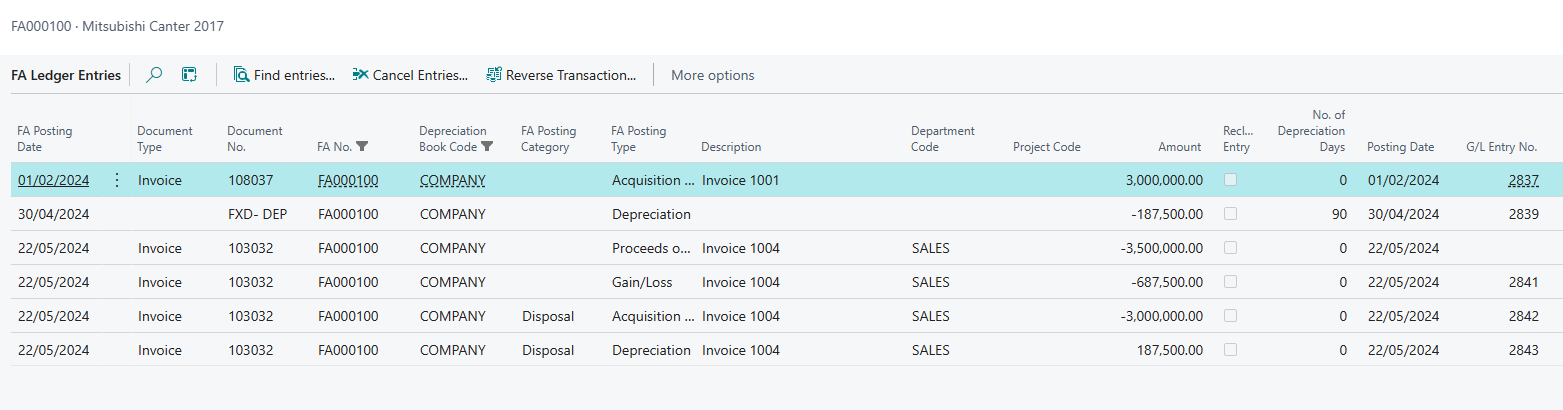

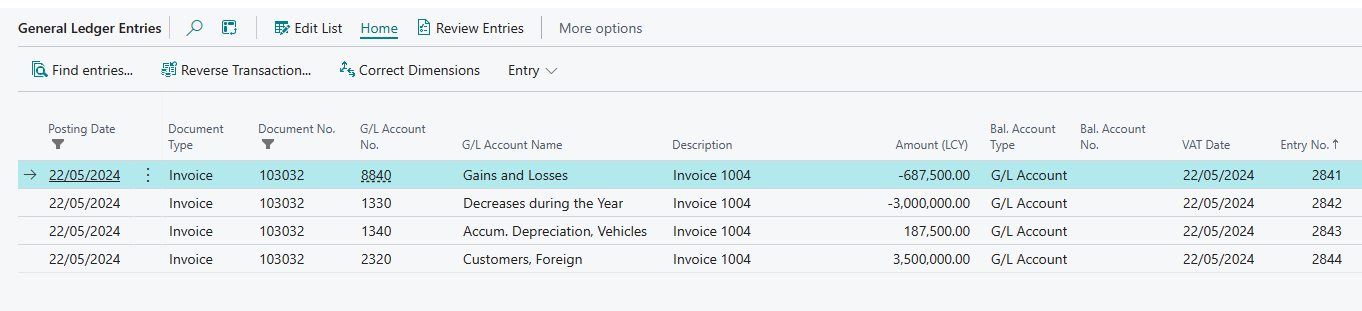

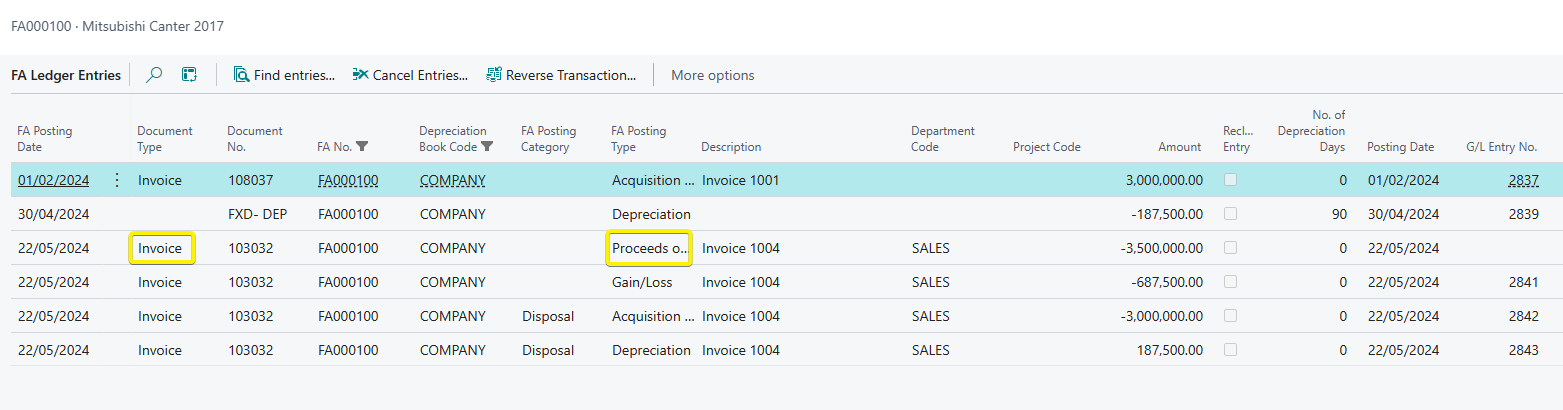

The disposal generates the following general ledger entries and fixed asset ledger entries.

| Account Name | Debit | Credit |

| Account Receivables | 3,500,000 | |

| Accumulated Depreciation (Total depreciation from the date of purchase to date of disposal - 22.05.24) | 187,500 | |

| Asset Acquisition Cost (The asset was acquired for 3,000,000 on 01.02.2024) | 3,000,000 | |

| Gain & Loss Account on Disposal | 687,500 |

Reversal of the disposal

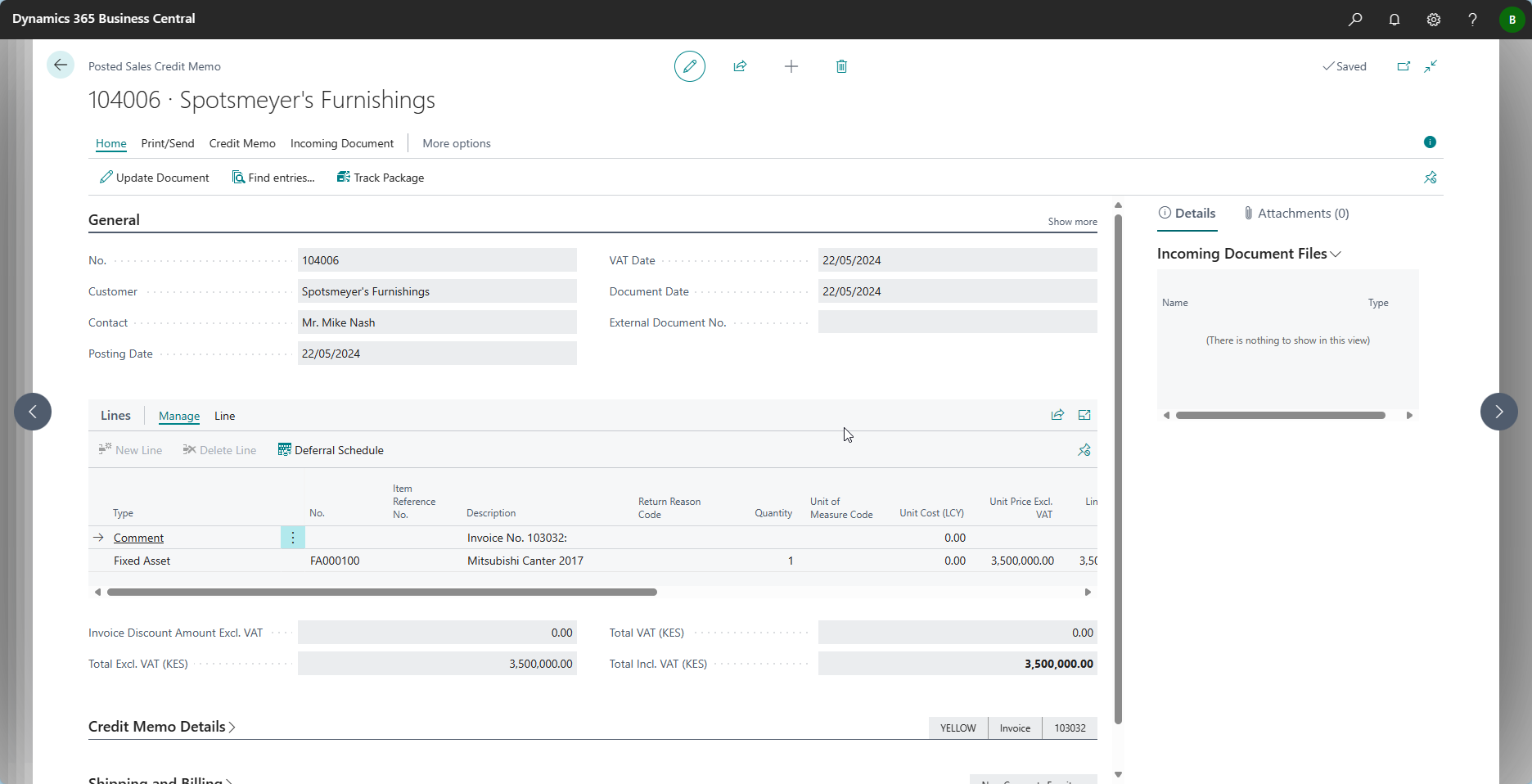

1.A credit memo is generated and posted.

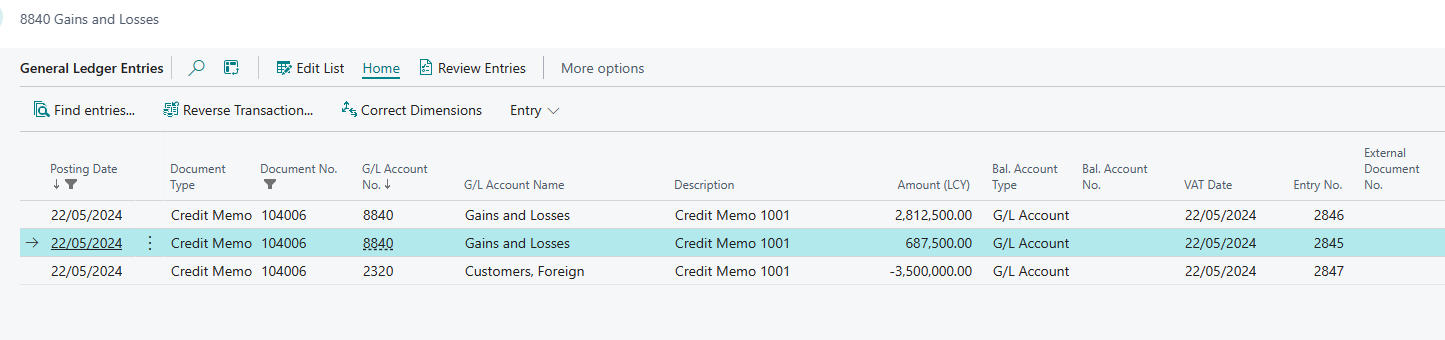

2. The credit memo posted generates the following entries:

| Account Name | Debit | Credit |

| Gain & Loss Account on Disposal | 3,500,000 | |

| Account Receivables | 3,500,000 |

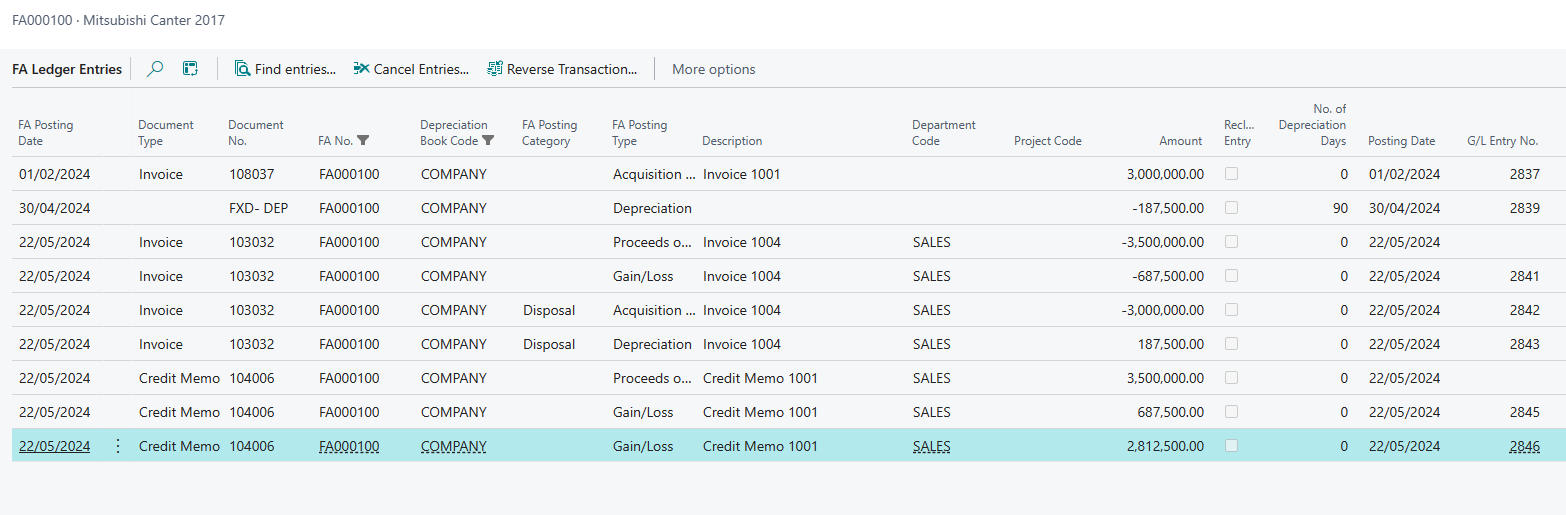

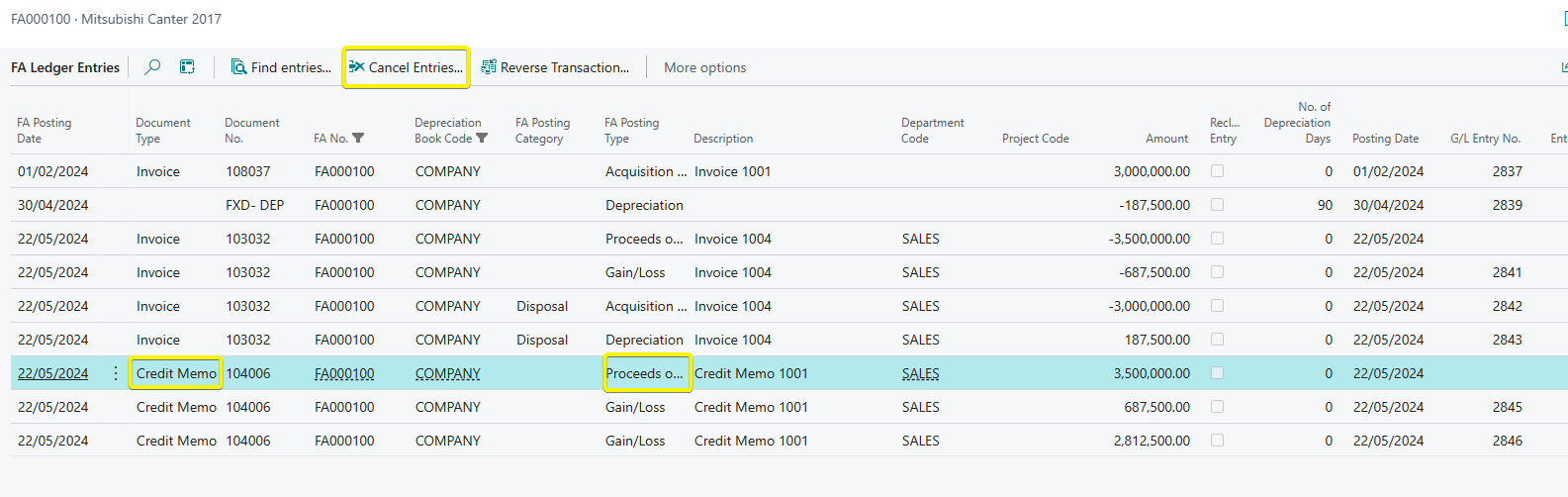

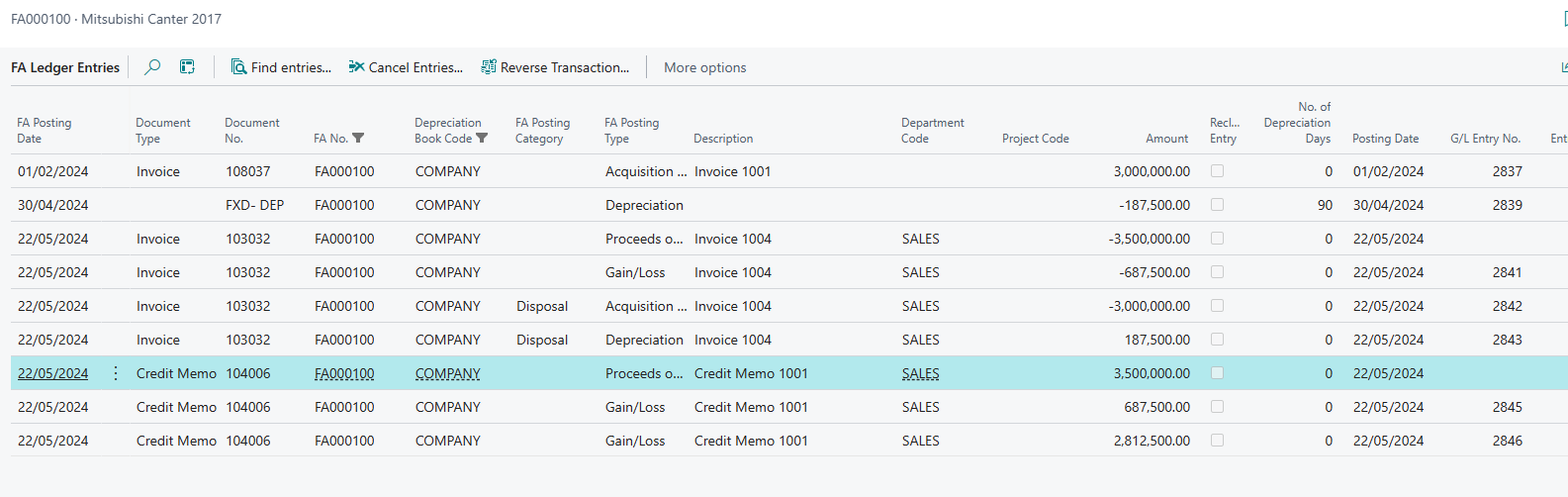

The fixed asset ledgers generated are as shown below.

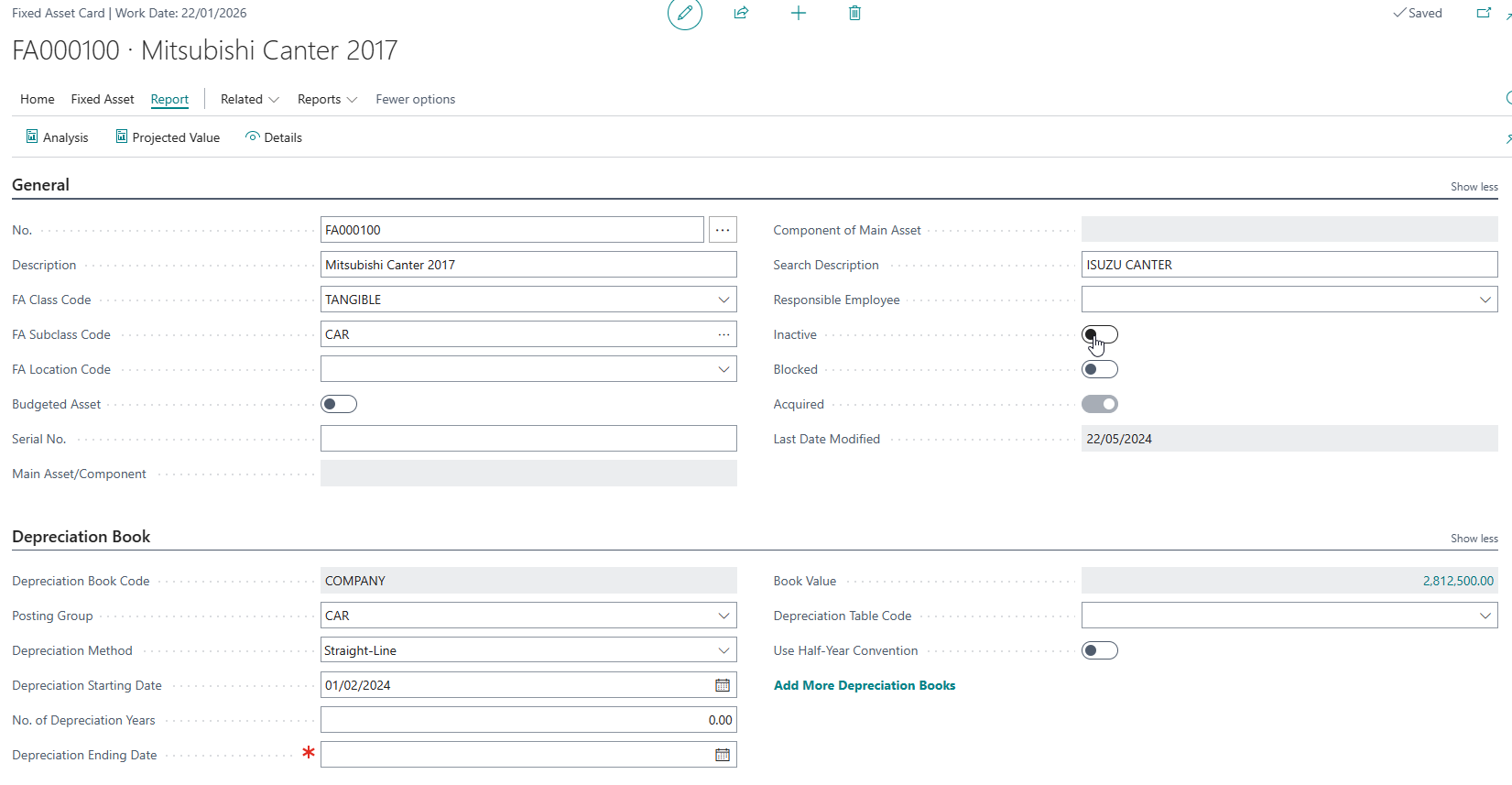

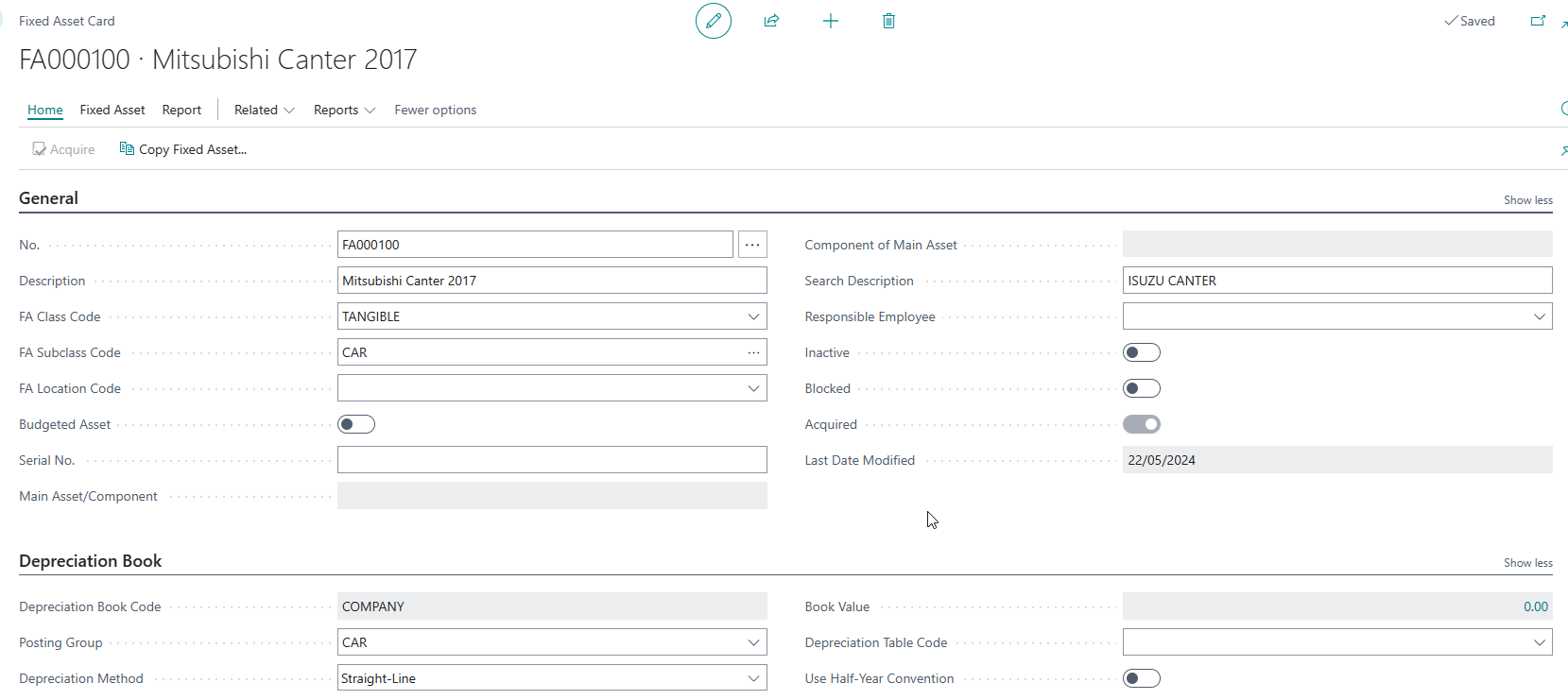

The fixed asset card is as below after reversal.

3. From the reversal entries, we can note we have 2 issues:

-

- The entries generated by the credit memo do not return the chart of accounts to their original position before disposal. The accumulated depreciation, asset acquisition and gain on disposal have not been reversed

-

- The book value of the asset on the fixed asset card remains zero despite the reversal.

So how do we resolve the issues above?

Resolving the entries.

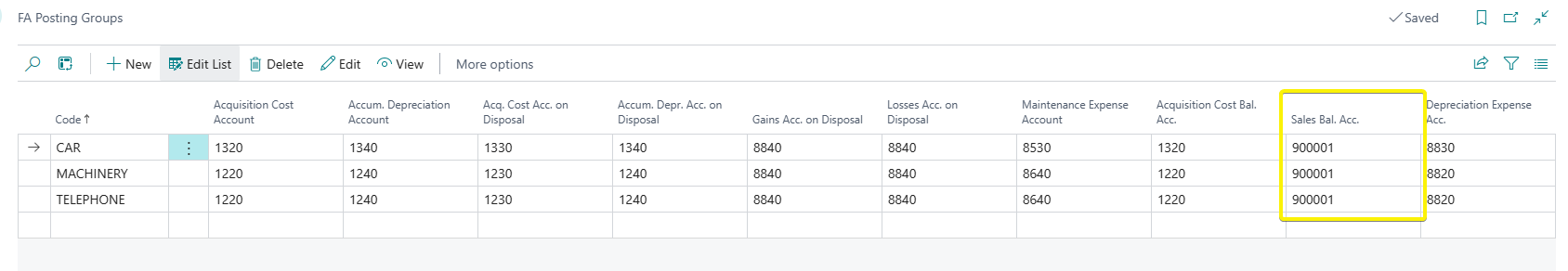

1.In the FA Posting Group, we have a contra account called Sales Bal. Account which allows us to complete the reversal. The field may require to be added on the page. Add an account to the column, you can use the Gain or Loss Account because the net effect on the account will be zero once we are done.

2. Open the fixed asset ledger entries of the asset and select the entry where the Document Type is Credit Memo and FA Posting Type is Proceeds from Disposal. Once selected, click on the Cancel Entries Function at the top.

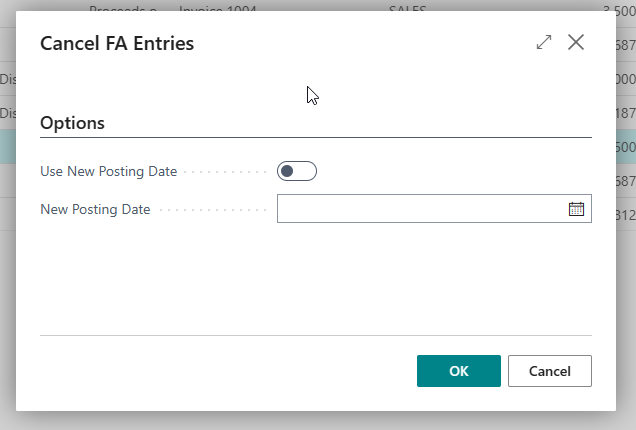

3. In the window that appears, click on OK.

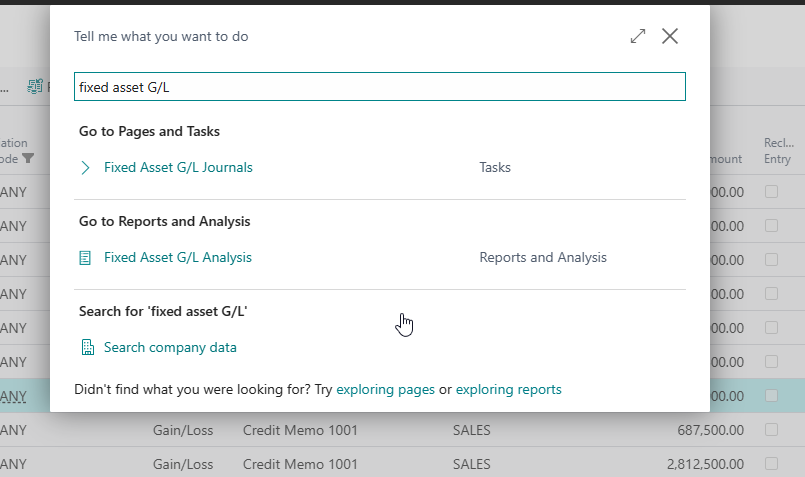

4. The system will generate an entry in the Fixed Asset G/L Journal. Search for Fixed Asset G/L Journal and open it.

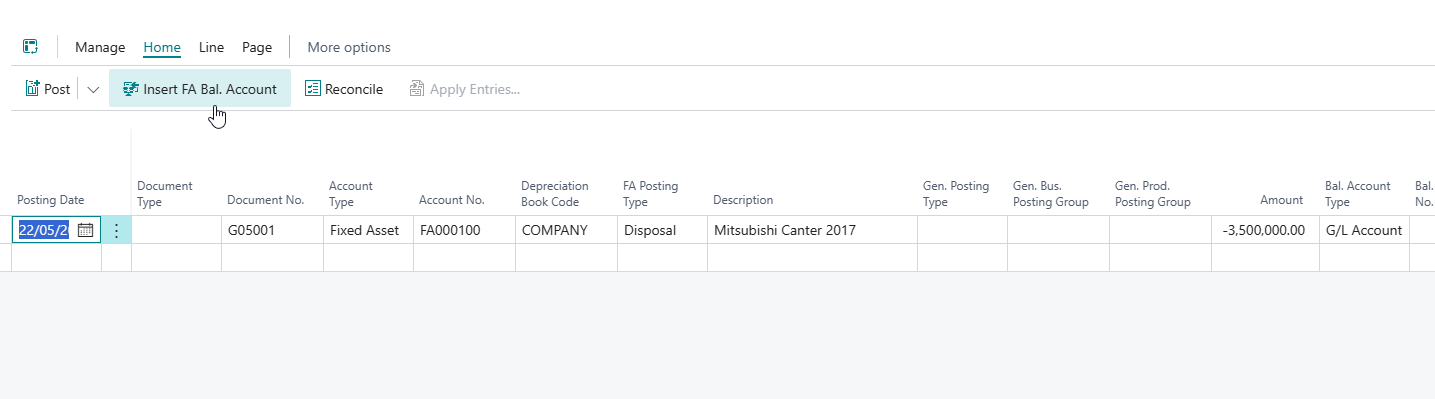

5. On the journal, the system generates one-half of the transaction. We require the balancing account to be able to post the transaction. Click on Insert FA Bal. Account. and this will populate the account you placed in the Sales Bal. Acc in the FA Posting Group.

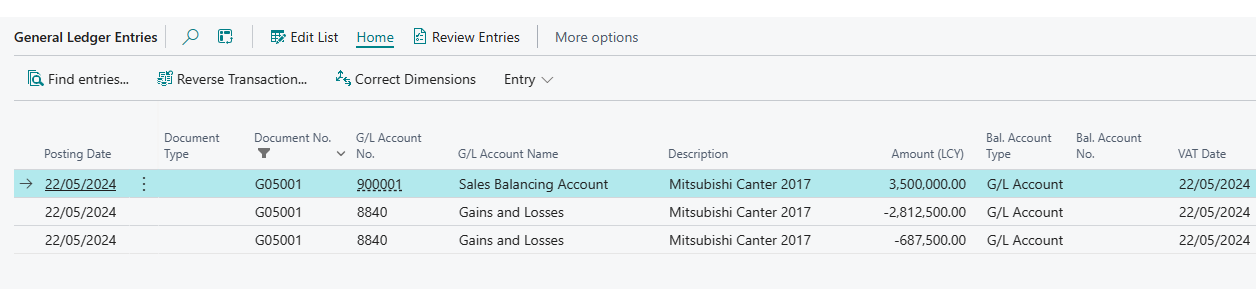

6. Click on Post. The following entries will be created by that posting:

| Account Name | Debit | Credit |

| Sales Bal. Account | 3,500,000 | |

| Gain & Loss Account on Disposal | 3,500,000 |

7. On the fixed asset ledger entries, the credit memo entries will also not be visible now.

8. Repeat the process by selecting the entry where the Document Type is Invoice and FA Posting Type is Proceeds from Disposal. Once selected, click on the Cancel Entries Function at the top.

9. Follow the process similar to point 3 - 5. On posting , the following entries will be generated

| Account Name | Debit | Credit |

| Gain & Loss Account on Disposal | 687,500 | |

| Asset Acquisition | 3,000,000 | |

| Accumulated Depreciation | 187,500 | |

| Sales Bal. Acc | 3,500,000 |

10. Our books should be reverted back to their original state before disposal. See all transactions combined below

| Account Name | Debit | Credit |

| Disposal Entries | ||

| Account Receivables | 3,500,000 | |

| Accumulated Depreciation (Total depreciation from the date of purchase to date of disposal - 22.05.24) | 187,500 | |

| Asset Acquisition Cost (The asset was acquired for 3,000,000 on 01.02.2024) | 3,000,000 | |

| Gain & Loss Account on Disposal | 687,500 | |

| Posting Credit memo entries | ||

| Gain & Loss Account on Disposal | 3,500,000 | |

| Account Receivables | 3,500,000 | |

| Posting cancellation of credit memo entries | ||

| Sales Bal. Account | 3,500,000 | |

| Gain & Loss Account on Disposal | 3,500,000 | |

| Posting cancellation of invoice entries | ||

| Gain & Loss Account on Disposal | 687,500 | |

| Asset Acquisition | 3,000,000 | |

| Accumulated Depreciation | 187,500 | |

| Sales Bal. Acc | 3,500,000 |

11. The book value on the asset should also now be okay.