Unrealized and Realized Gain and Losses in Foreign Exchange

Hi Readers,

In this post, we will look at the functionality of unrealized/realized gains and losses within Business Central. I will use the receivable module to go through this topic.

Unrealized gains and losses

The following transactions happen :

| Date | Description | Transaction |

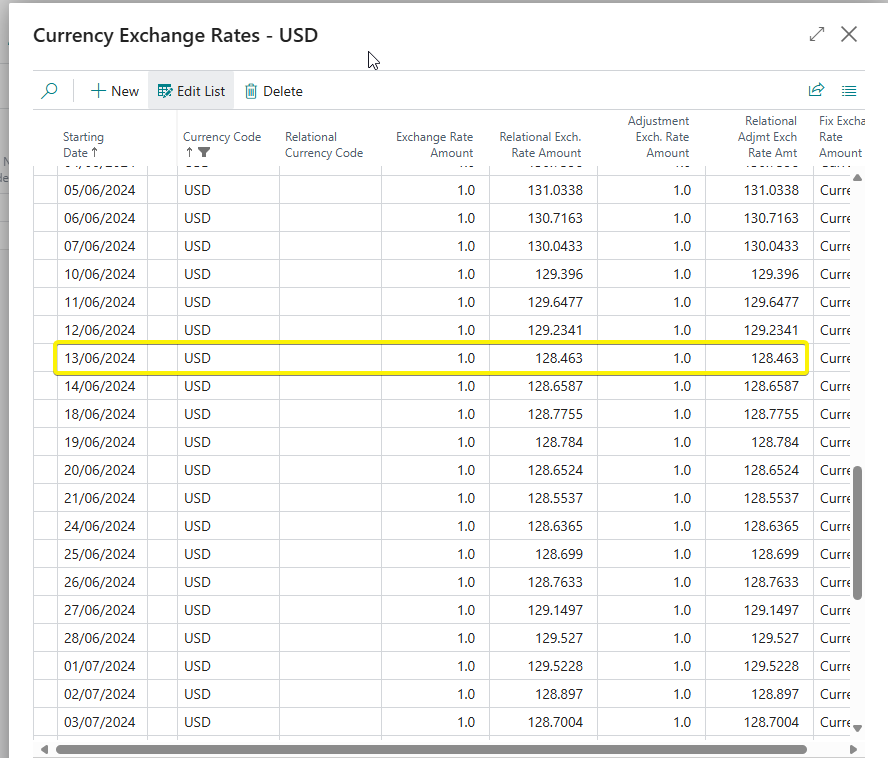

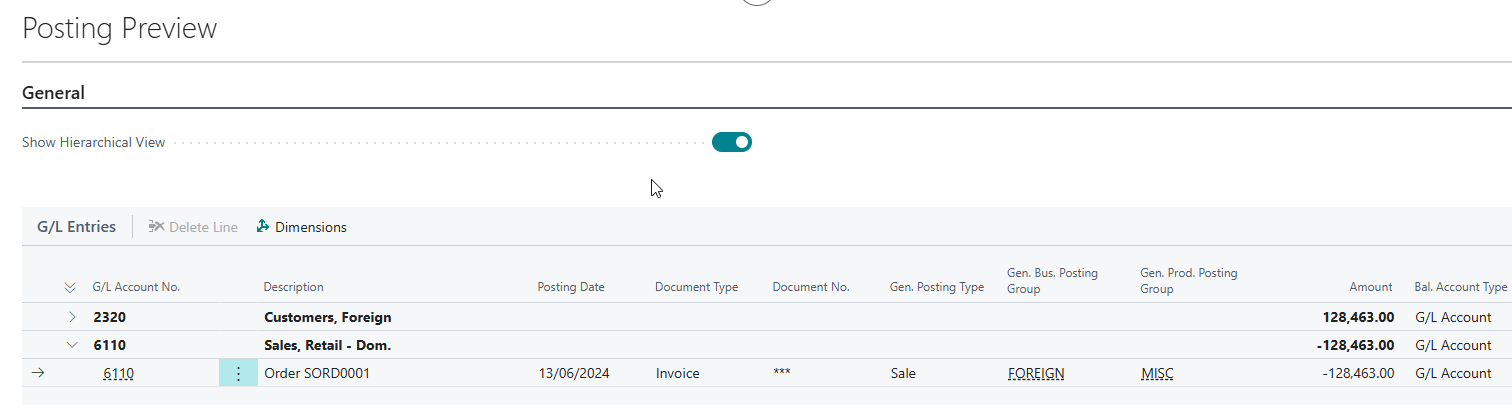

| 13.06.2024 |

An invoice of USD 1000 is raised to a customer. The exchange rate used is 128.463 to KES currency. |

The customer balance will be KES 128,463.00 |

| Date | Description | Transaction |

| 30.06.24 |

When closing the reporting period of June, the accountant ran the Adjust Exchange Rates report to update the receivables. The rates as at 30/06/24 was 129.527 |

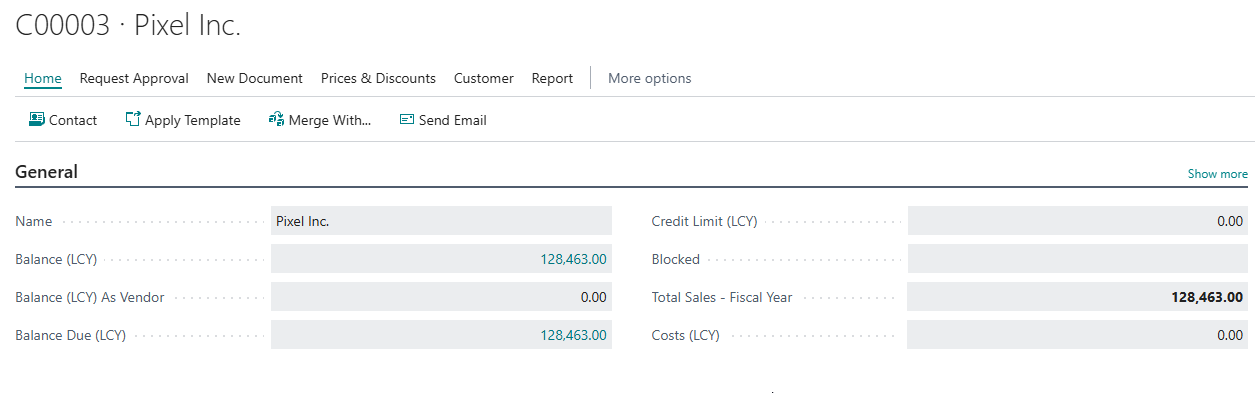

The customer balance will now be KES 129,527.00 |

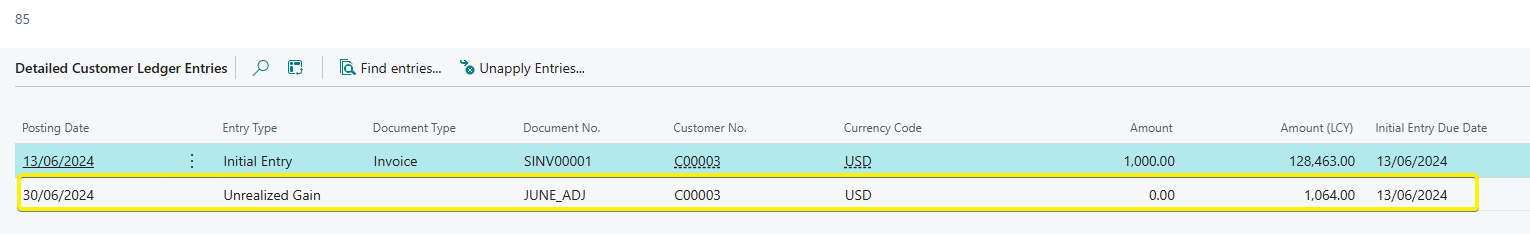

After running the adjust exchange rate, the invoice balance will be 'revalued' to KES 129,567 ( USD 1,000 * 129.527). The difference between KES 129,527 - KES 128,463.00 = KES 1,064 is the difference in value.

This increase in value is termed as an unrealized gain.

Unrealized gains or losses are the gains or losses on transactions that have not been completed (without payment) as of the reporting date. This would mean that the payment has not been made or received prior to the close of the accounting period.

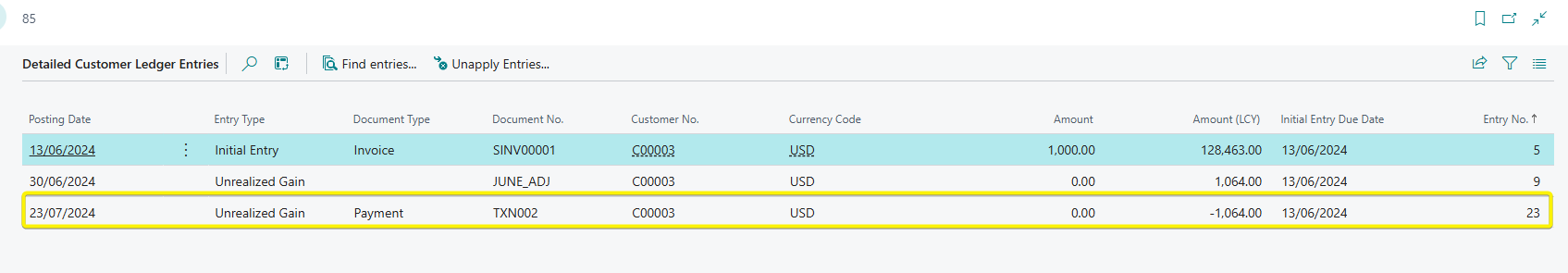

The following unrealized gain entry will be added on the detailed customer ledger entries for that specific invoice to add the value of the receivable.

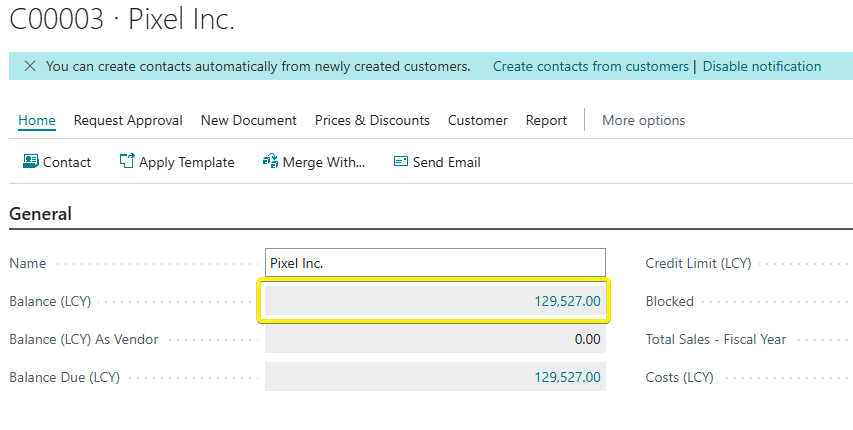

Our new customer balance would read as below:

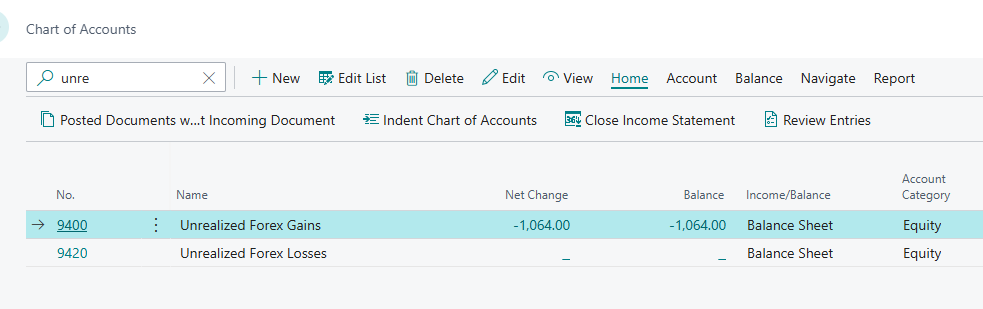

An entry will be made in the unrealized gain account.

| Account | Debit | Credit |

| Receivables Account |

1,064 |

|

| Unrealized Gain Account |

|

1,064 |

For an unrealized loss, the transaction would be vice versa.

Realized gains and losses

The following transaction happens

| Date | Description | Transaction |

| 23.07.24 |

The customer made the payment of USD 1,000. |

The payment is posted in the journal and applied to the customer. |

On posting and applying the payment to the invoice, the unrealized gain is reversed by the payment because the transaction is now completed.

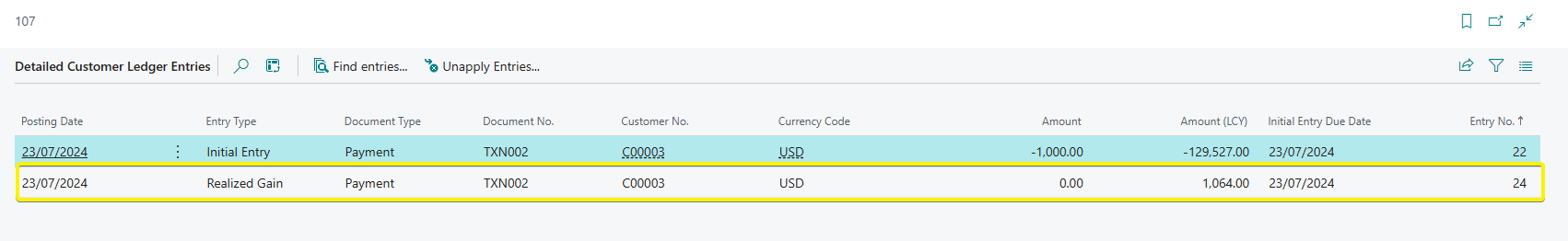

Now that our transaction is completed, the unrealized gain is now converted to a realized gain. On the detailed customer ledger entries of the payment entry, we can find an entry showing the realized gain.

Therefore, realized gains or losses are the gains or losses on transactions that have been completed. It means that the customer has already settled the invoice prior to the preparation of the books.

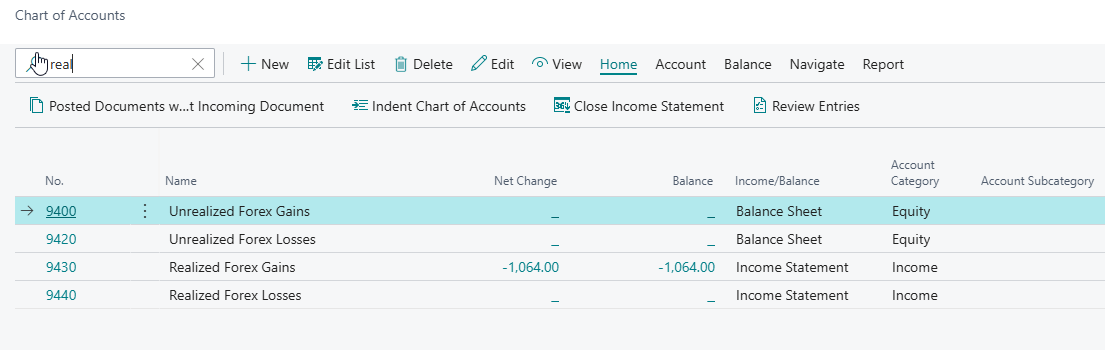

On the chart of account, the realized forex gains accounts is also populated.

| Account | Debit | Credit |

| Unrealized Gain Account |

1,064 |

|

| Bank |

129,527 |

|

| Customers |

|

129,527 |

| Realized Gain Account |

|

1,064 |

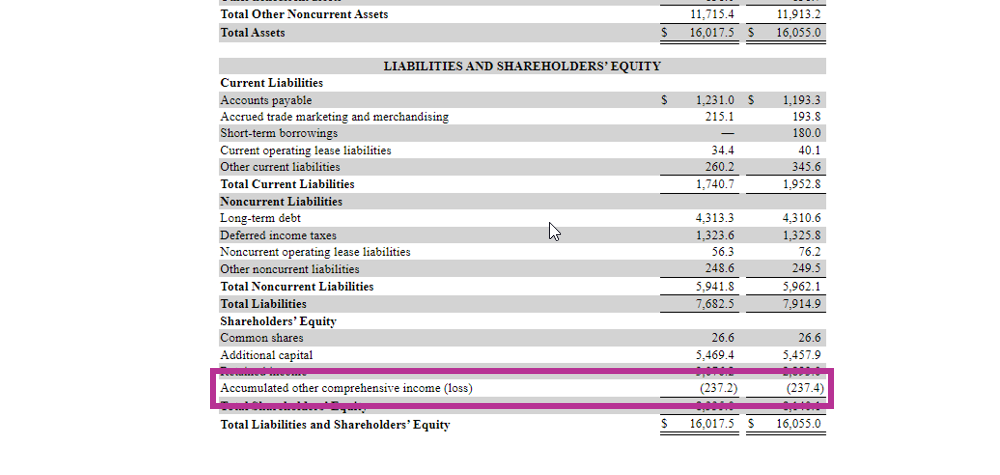

PS: Unrealized gain/losses are not recorded in the income statement until they are realized. They are recorded in the Equity section of the balance sheet under Accumulated Other Comprehensive Income (AOCI).

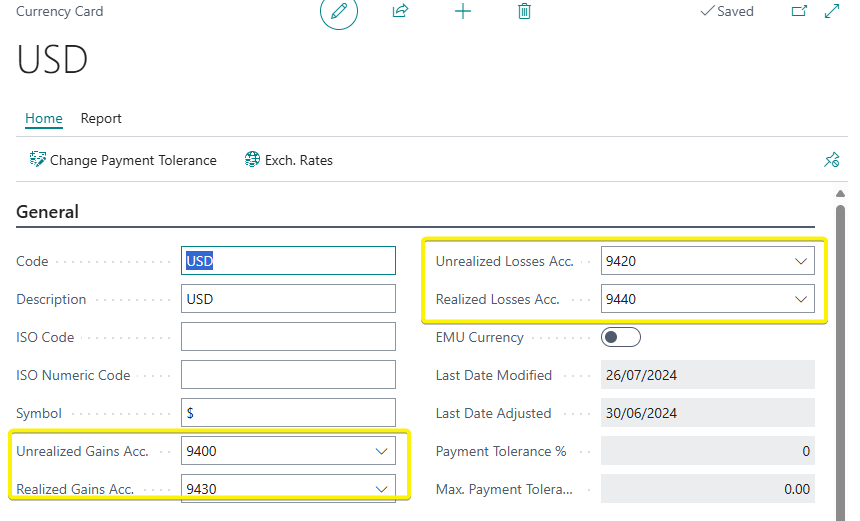

The realized/unrealized gain & loss accounts are defined on the currency card.

ENDS.