Conversion of a Fixed Asset to Inventory

Hi Readers,

I have encountered instances where someone intends to re-classify an inventory item to a fixed asset item. This post will explore how we can do that in the system.

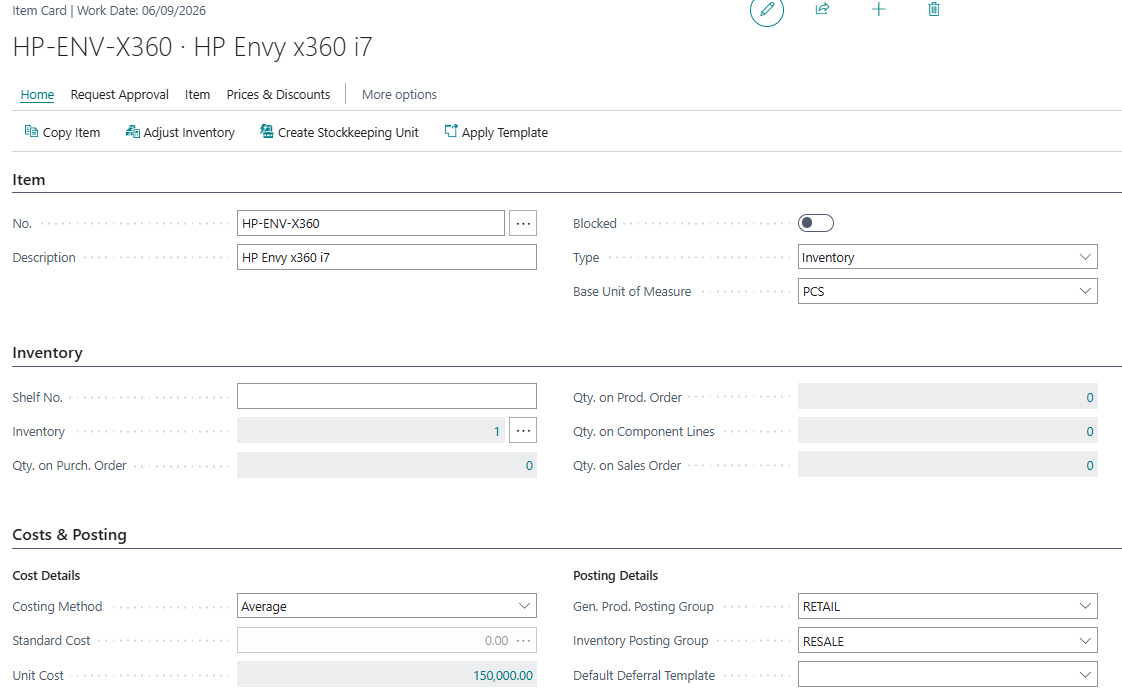

We will use the item below for the scenario. Assuming an organization which sells laptops has decided to take one of their stock HP Envy for internal use by their accountant and wish to convert it to a fixed asset.

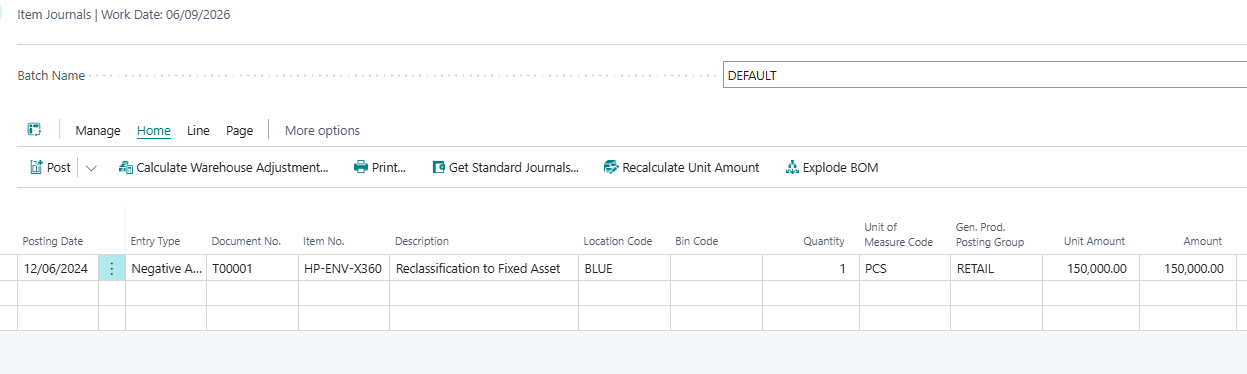

Step 1 : Adjusting out the item

A negative inventory adjustment allows us to reduce the stock in the system. Lets check which accounts are affected by the adjustment

| Account | Debit | Credit |

| Inventory Adjustment Account | XXX | |

| Inventory Account | XXX |

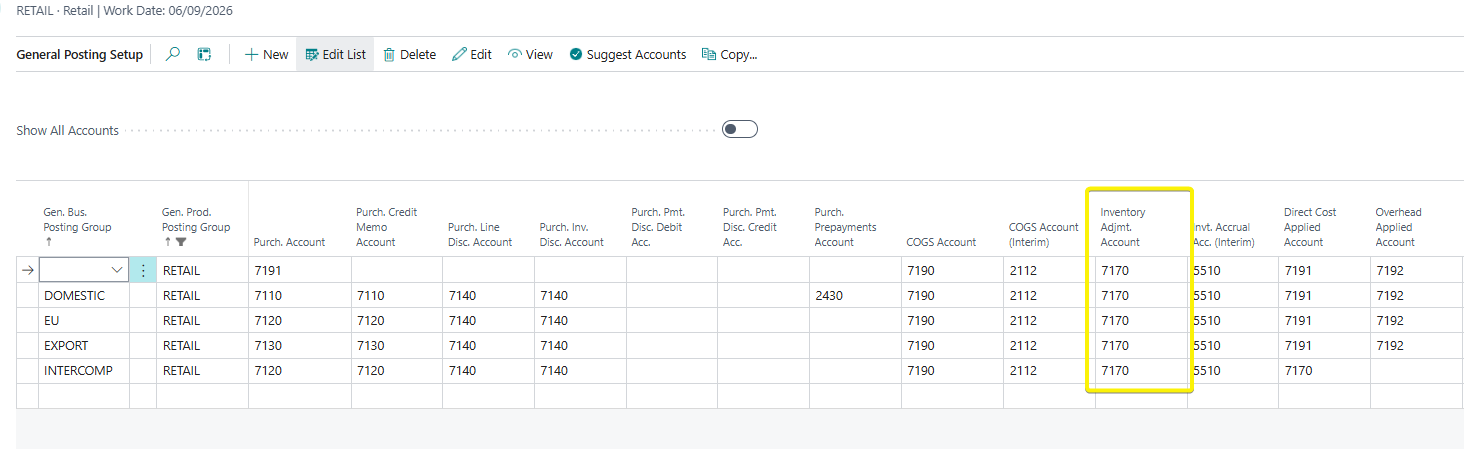

The inventory adjustment account is picked from the Gen. Prod Posting Group of the item

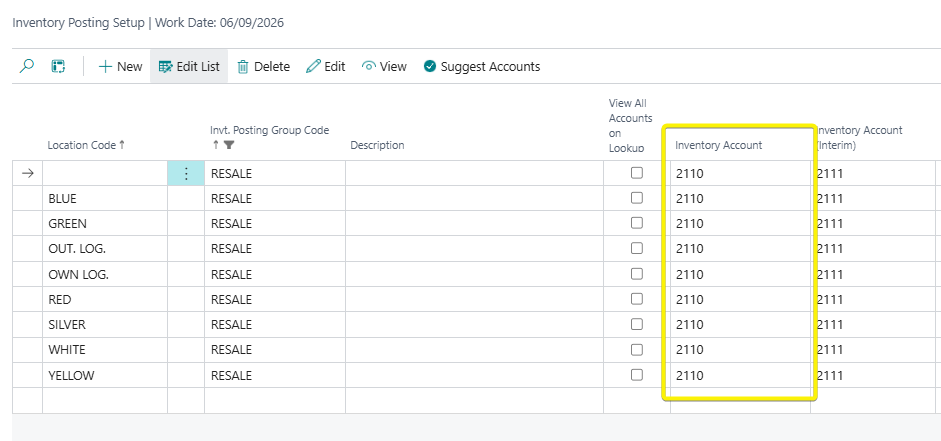

The inventory account is picked from the Inventory Posting Group of the item

Therefore, since we know that the Inventory Adjustment Account is debited with the cost of the item being adjusted, we can replace it with the Asset Acquisition Account.

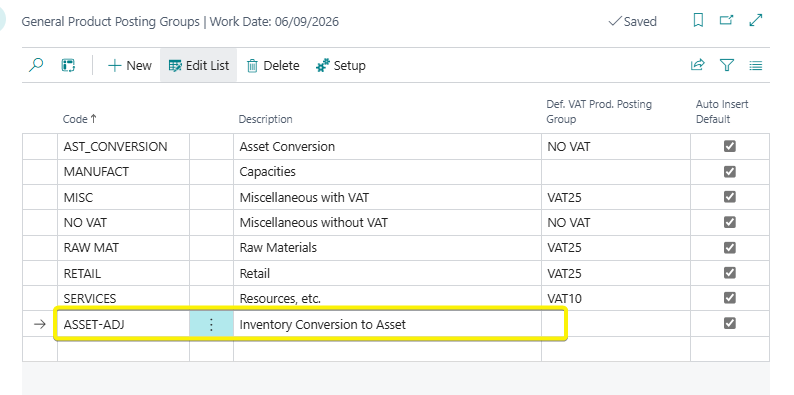

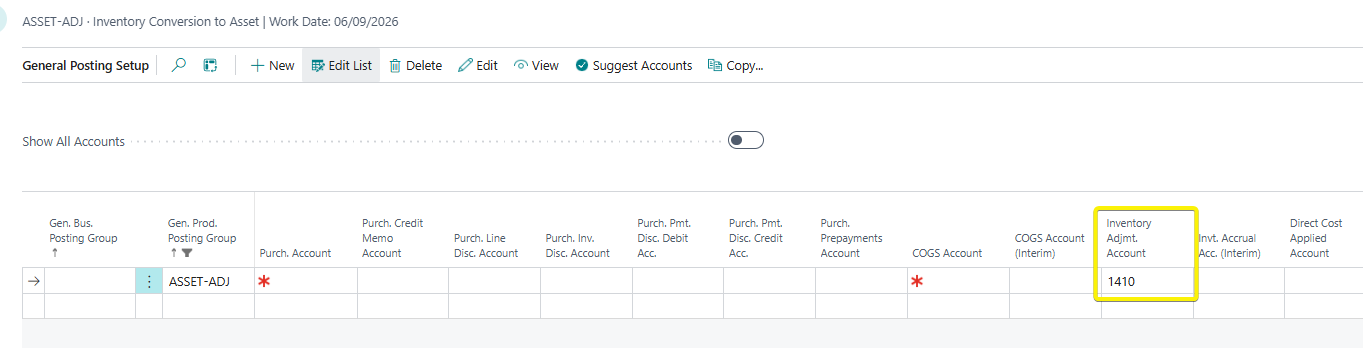

Create a new Gen. Prod Posting Group and called it ASSET-ADJ

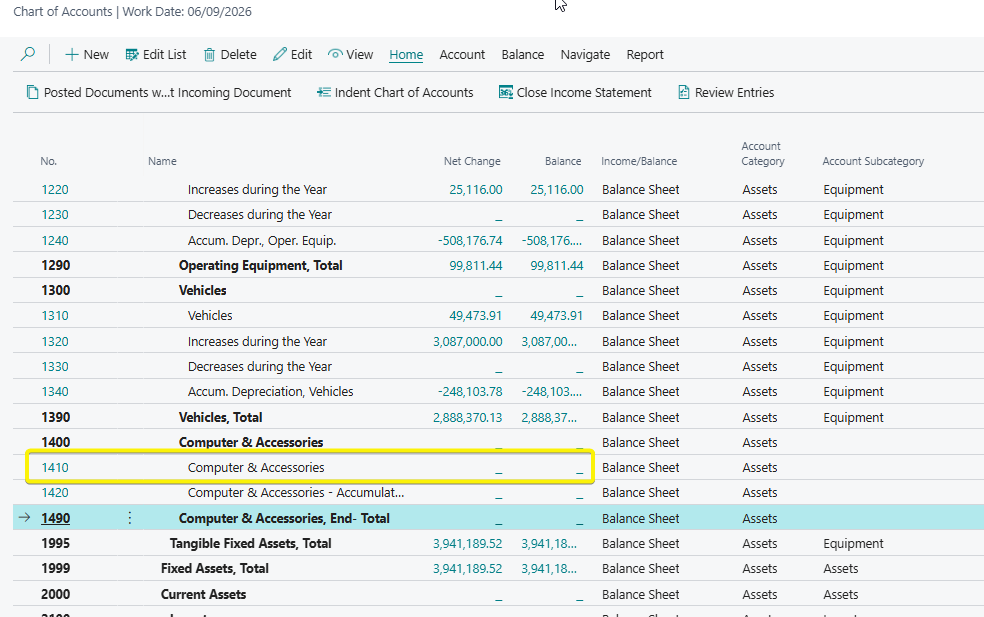

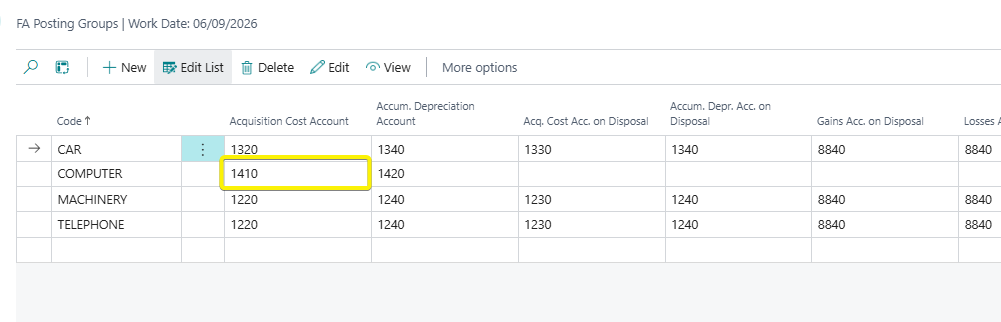

Then on the Gen. Posting Setup for the item, add the asset acquisition account of the fixed asset you wish to debit. In my case that would be Computer & Equipment, Cost as seen below

So now let me do the negative adjustment. Go to the item journals and add the details of the item.

Also expose the Gen. Prod Posting Group in the item journal

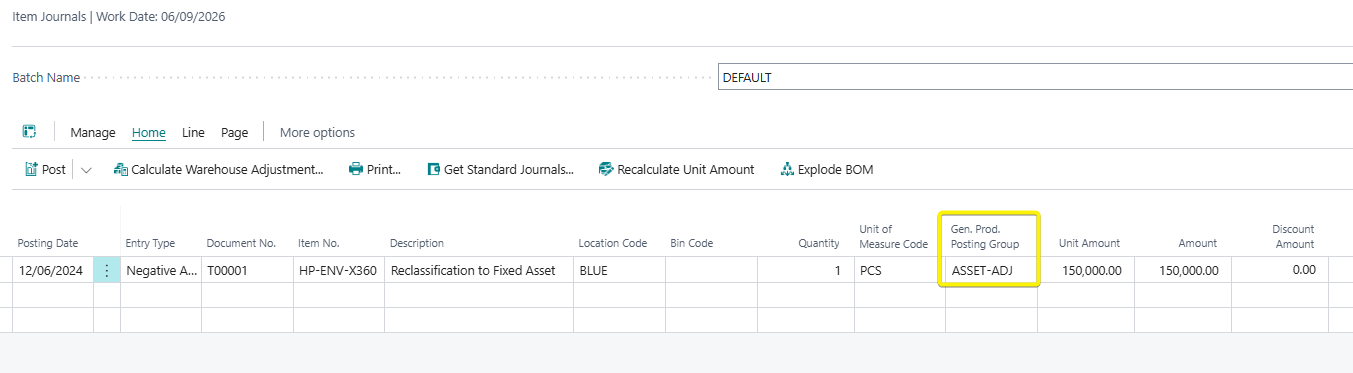

Now we change the Gen. Prod Posting Group from the default one in the item to the one we created

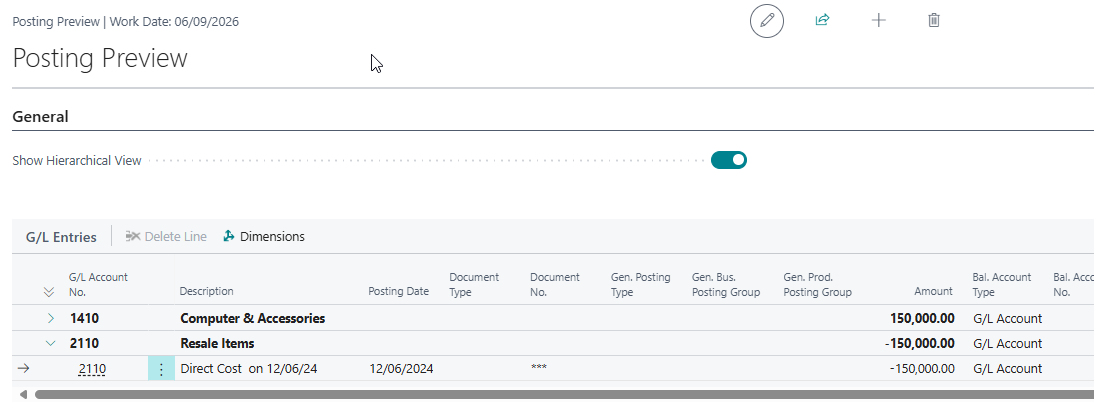

Run a preview post to see the expected output on the GL accounts

The posting should be okay now. Our asset acquisition account is posted and our inventory is credit. You can post.

Note down the amount in the acquisition account as it will be used later - 150,000 in my case.

You can run the adjust-item & post cost functions and confirm the amount in your acquisition account remains the same.

Step 2 : Creating the fixed asset and adding the acquisition amount

Now that we have our acquisition amount in the control account, we should now ensure the fixed asset subledger is also adjusted to maintain the balance.

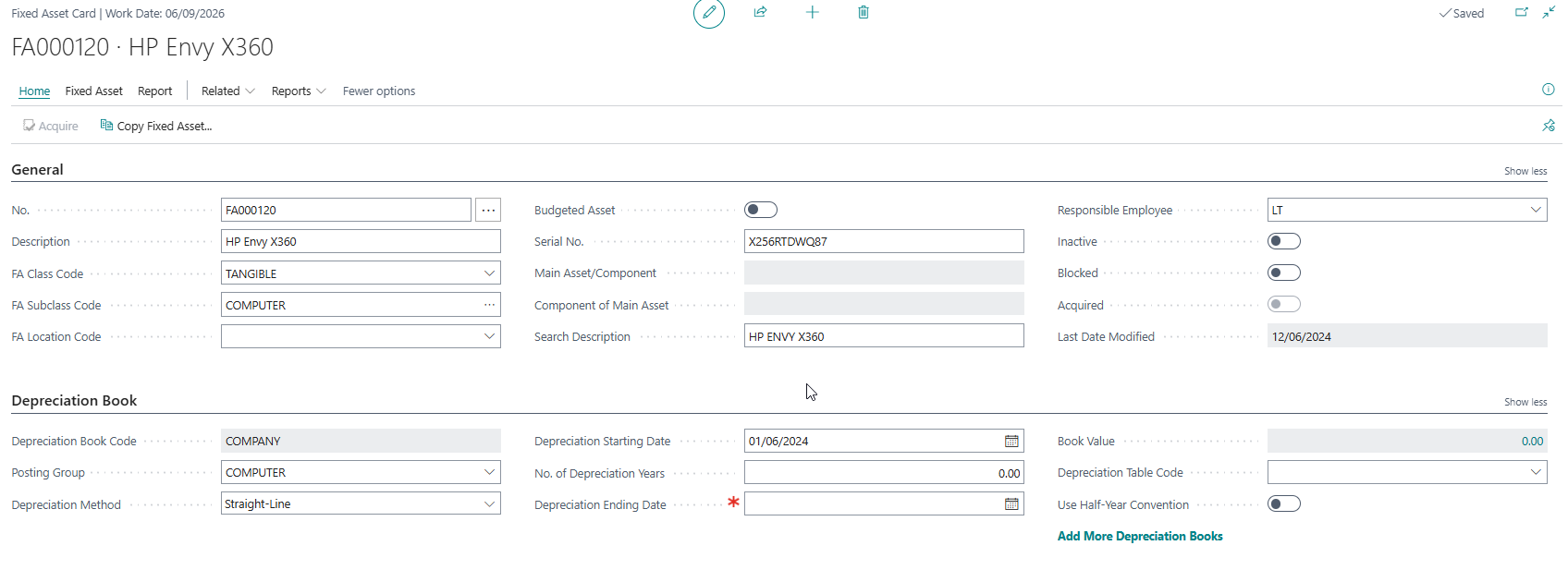

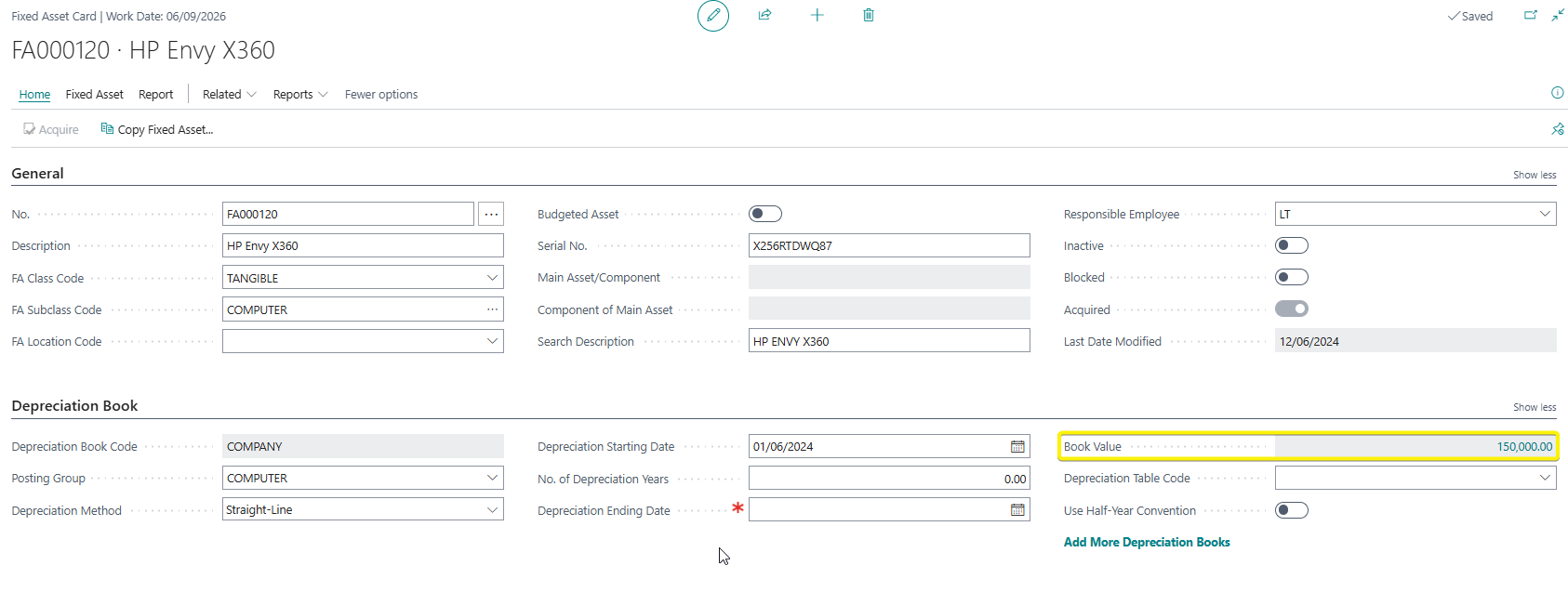

Create the fixed asset card for the item and add the necessary fields : FA Class, Sub Class, Posting Group

The FA Posting Group should have the same acquistion account as the account you placed in the Inventory Adjustment field.

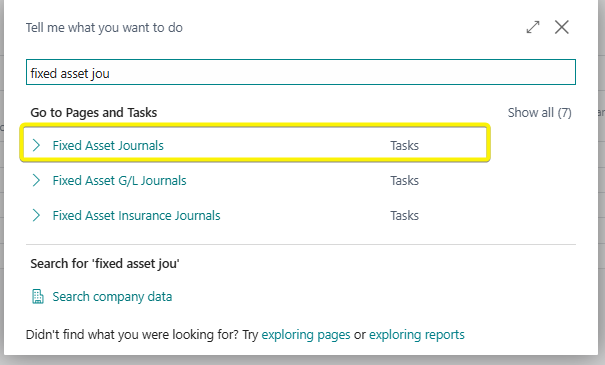

Search for Fixed Asset Journals. Ensure not to use Fixed Asset G/L Journals

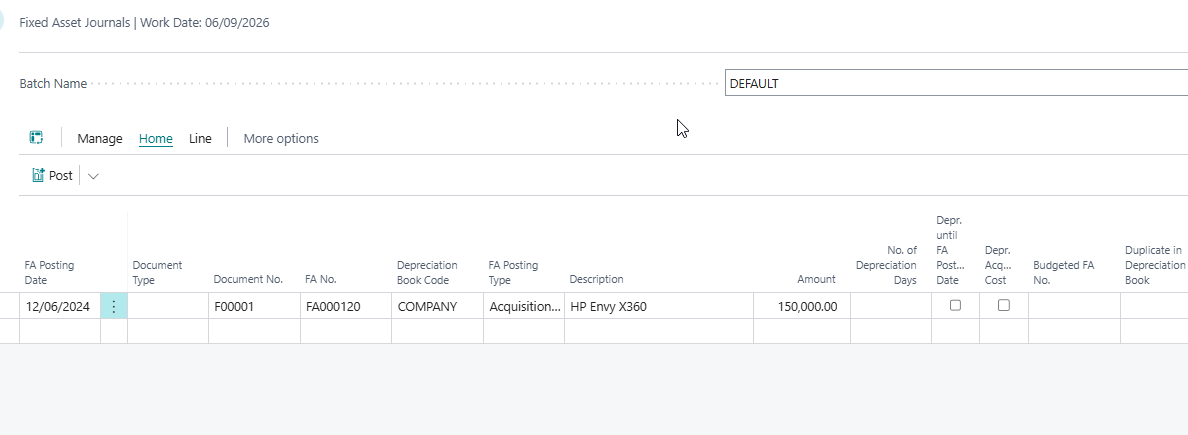

Add the details in the fixed asset journal as below:

| Field | Value |

| FA Posting Date | The date similar to the date that the item was adjusted out |

| FA No. | Pick the fixed asset number created |

| FA Posting Type | Acquisition Cost |

| Amount | Cost amount in the acquisition account after adjusting the item out. |

We cannot post because our journal will try to post to the sub-ledger (Fixed Asset Ledger Entries) and the main ledger control account(General Ledger Entries).

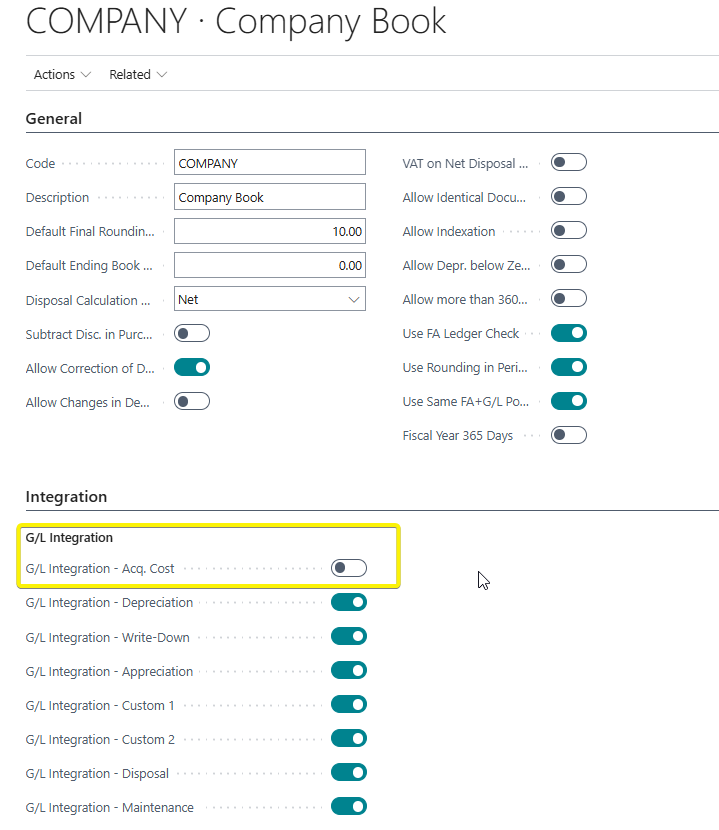

Therefore, we need to temporarily disable posting to the main ledger control account.

On your depreciation book, turn off G/L Integration - Acq. Cost checkbox. This should allows us to only post to the subledger.

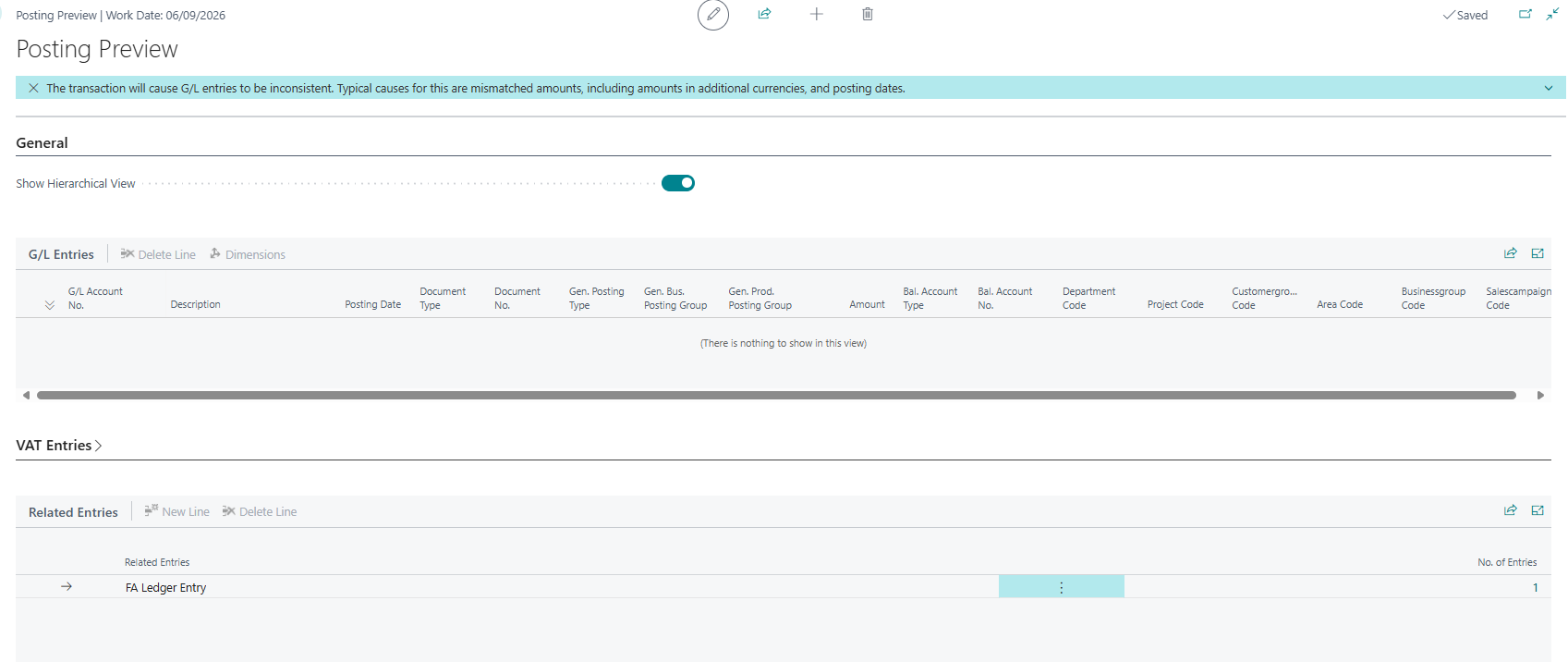

You can preview post to ascertain that entries are going okay.

The G/L Entries section should be blank indicating we are only hitting our subledger.

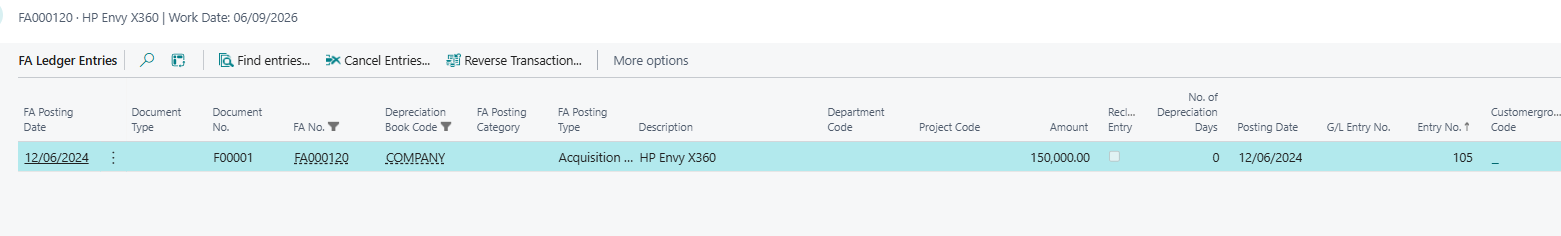

You can post the journal.

The net book value of the fixed asset should now be populated.

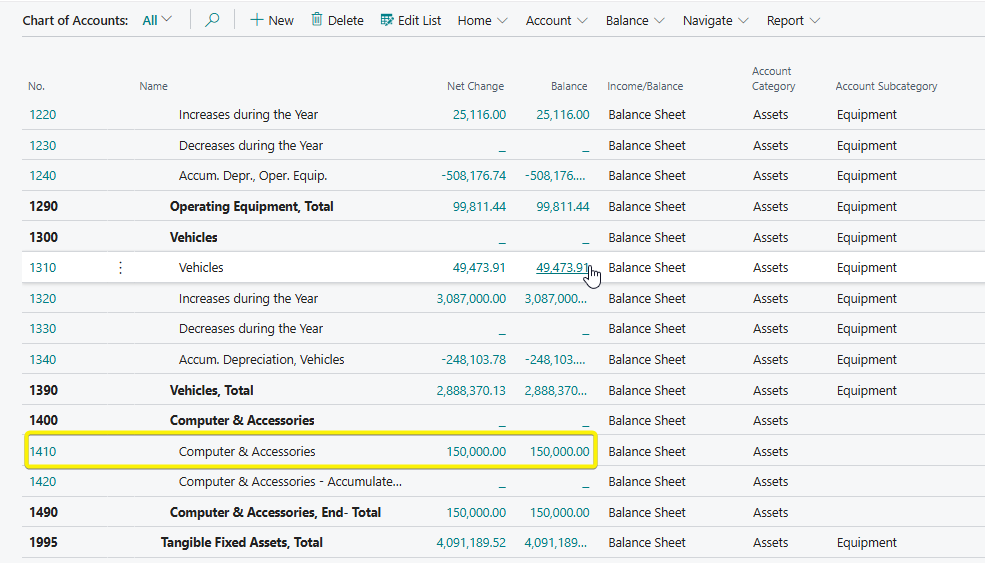

The sub-ledger (Fixed Asset Ledger Entries) and the main ledger control account(General Ledger Entries) should now be balanced : The fixed asset has a NBV of 150,000 and the Computer & Accessories Account has a debit value of 150,000.

PS: Remember to turn back on the G/L Integration - Acq. Cost checkbox in the depreciation book.